- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

How the Potential Drug-Pricing Deal and Conference Updates Could Shape BrightSpring Health (BTSG) Strategy

Reviewed by Sasha Jovanovic

- BrightSpring Health Services recently presented at the Jefferies 2025 Healthcare Services Conference in Nashville, Tennessee, on September 29, 2025, providing updates on company initiatives and industry perspectives.

- Investor sentiment across the healthcare sector was buoyed by news of a potential drug-pricing agreement between the White House and pharmaceutical companies, easing some regulatory uncertainty for industry players like BrightSpring.

- We'll examine how renewed optimism around regulatory policy from the industry-wide drug-pricing agreement could influence BrightSpring’s investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

BrightSpring Health Services Investment Narrative Recap

To be a shareholder in BrightSpring Health Services, one needs to believe in the company’s potential to capitalize on specialty pharmacy growth and demographic trends driving demand for home care, while managing pressures from high government reimbursement reliance and significant leverage. The recent drug-pricing agreement news reduces some regulatory uncertainty, easing the sector’s biggest near-term risk, but labor cost pressures still remain the most pressing catalyst to watch. At present, the market optimism stemming from policy clarity appears beneficial but does not fundamentally shift the risk profile tied to staffing and wage inflation. Among recent company updates, BrightSpring’s earnings release for the second quarter stands out. The results revealed strong year-over-year revenue growth and a swing to profitability, reflecting operational scale and increased demand across service lines. While these financial improvements are encouraging, how well BrightSpring can sustain this momentum amidst labor cost pressures and reimbursement dynamics will be central to its near-term trajectory. In contrast, investors should be aware that continued wage and staffing cost escalation could still pose significant headwinds for BrightSpring if...

Read the full narrative on BrightSpring Health Services (it's free!)

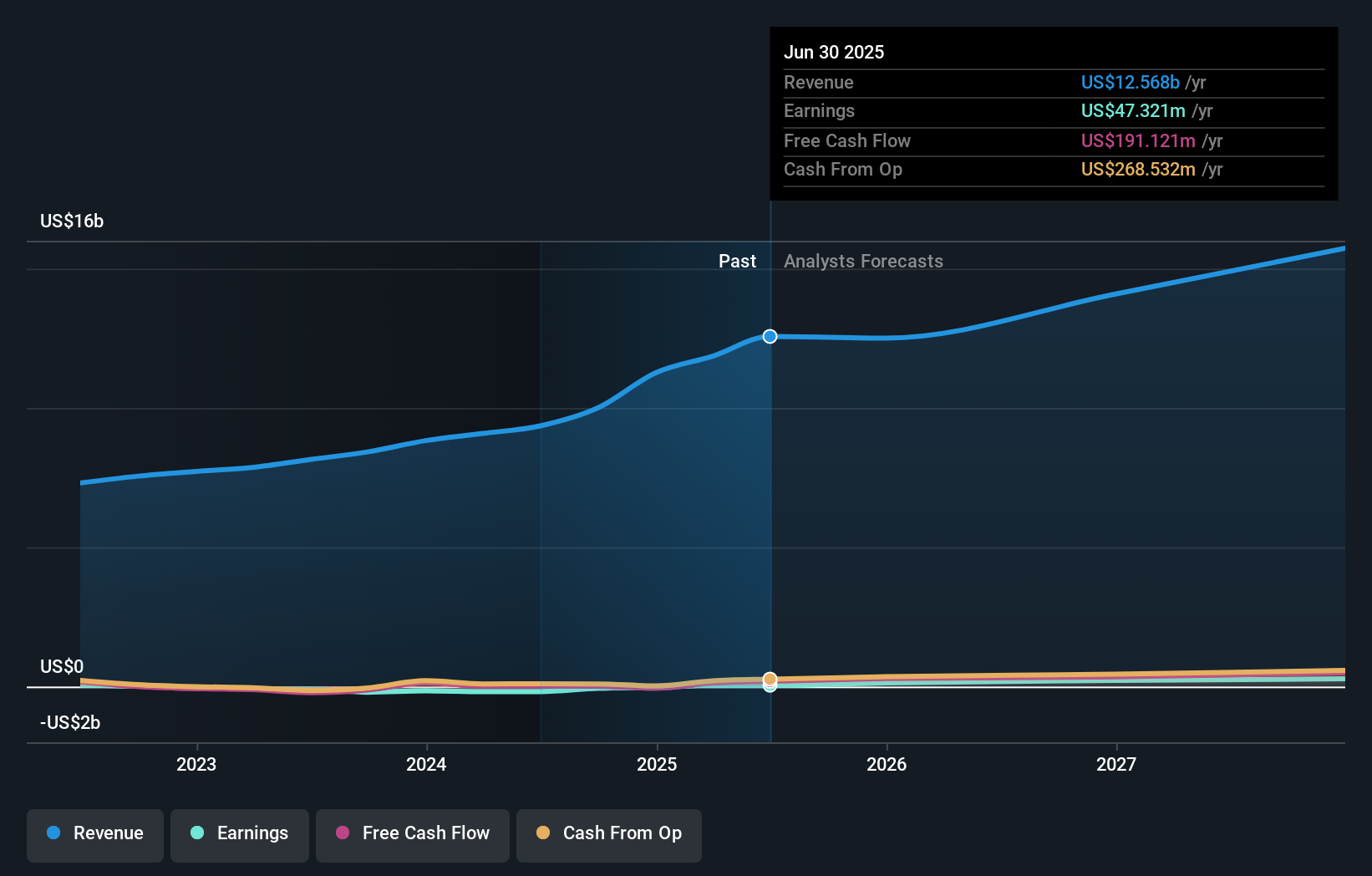

BrightSpring Health Services is projected to reach $16.8 billion in revenue and $361.8 million in earnings by 2028. This outlook assumes a 10.1% annual revenue growth rate and an earnings increase of $314.5 million from the current $47.3 million.

Uncover how BrightSpring Health Services' forecasts yield a $29.12 fair value, a 3% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community contributed three fair value estimates for BrightSpring, spanning from US$29.13 to US$128.33, reflecting a wide spectrum of views. Many are focused on reimbursement policy shifts, a key area that could have lasting impact on future revenue stability and investor confidence.

Explore 3 other fair value estimates on BrightSpring Health Services - why the stock might be worth just $29.12!

Build Your Own BrightSpring Health Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BrightSpring Health Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BrightSpring Health Services' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives