- United States

- /

- Medical Equipment

- /

- NasdaqCM:BMRA

Here's Why We're Watching Biomerica's (NASDAQ:BMRA) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Biomerica (NASDAQ:BMRA) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Biomerica

When Might Biomerica Run Out Of Money?

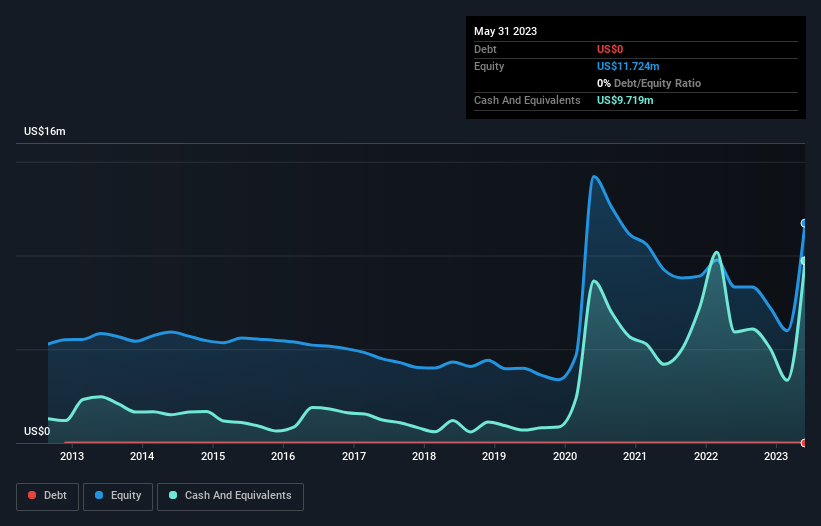

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at May 2023, Biomerica had cash of US$9.7m and no debt. In the last year, its cash burn was US$5.6m. That means it had a cash runway of around 21 months as of May 2023. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is Biomerica Growing?

One thing for shareholders to keep front in mind is that Biomerica increased its cash burn by 755% in the last twelve months. That's pretty alarming given that operating revenue dropped 72% over the last year, though the business is likely attempting a strategic pivot. In light of the above-mentioned, we're pretty wary of the trajectory the company seems to be on. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Biomerica is building its business over time.

Can Biomerica Raise More Cash Easily?

Biomerica revenue is declining and its cash burn is increasing, so many may be considering its need to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Biomerica's cash burn of US$5.6m is about 26% of its US$21m market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

So, Should We Worry About Biomerica's Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Biomerica's cash runway was relatively promising. After looking at that range of measures, we think shareholders should be extremely attentive to how the company is using its cash, as the cash burn makes us uncomfortable. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Biomerica (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if Biomerica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BMRA

Biomerica

A biomedical technology company, engages in developing, patenting, manufacturing, and marketing diagnostic and therapeutic products for the detection and treatment of medical conditions and diseases worldwide.

Adequate balance sheet slight.