- United States

- /

- Healthcare Services

- /

- OTCPK:BIMI

With A 60% Price Drop For BIMI Holdings Inc. (NASDAQ:BIMI) You'll Still Get What You Pay For

BIMI Holdings Inc. (NASDAQ:BIMI) shares have had a horrible month, losing 60% after a relatively good period beforehand. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 178% in the last twelve months.

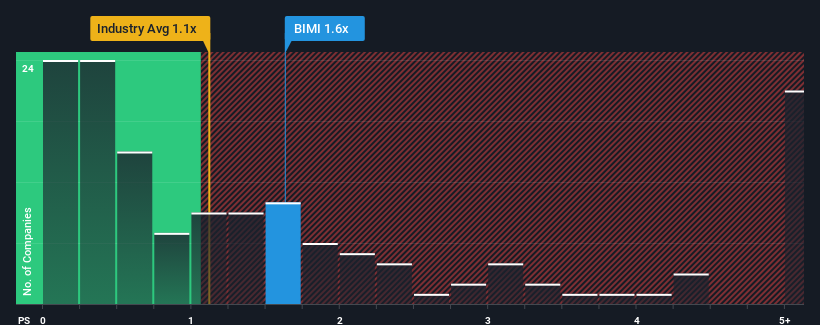

Although its price has dipped substantially, given close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider BIMI Holdings as a stock to potentially avoid with its 1.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for BIMI Holdings

How BIMI Holdings Has Been Performing

Recent times have been quite advantageous for BIMI Holdings as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for BIMI Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is BIMI Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, BIMI Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 92%. The latest three year period has also seen an excellent 104% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 8.1% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that BIMI Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

BIMI Holdings' P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that BIMI Holdings maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for BIMI Holdings (3 are potentially serious!) that you need to take into consideration.

If you're unsure about the strength of BIMI Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if BIMI Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:BIMI

BIMI Holdings

Engages in the retail and wholesale distribution of medical devices, and pharmaceutical and other healthcare products in the People’s Republic of China.

Adequate balance sheet low.

Market Insights

Community Narratives