- United States

- /

- Healthcare Services

- /

- NasdaqGM:BDSX

Biodesix (NASDAQ:BDSX) adds US$20m to market cap in the past 7 days, though investors from a year ago are still down 39%

It is a pleasure to report that the Biodesix, Inc. (NASDAQ:BDSX) is up 44% in the last quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 39% in the last year, significantly under-performing the market.

On a more encouraging note the company has added US$20m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for Biodesix

Given that Biodesix didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year Biodesix saw its revenue fall by 52%. If you think that's a particularly bad result, you're statistically on the money Meanwhile, the share price dropped by 39%. It's always work digging deeper, but we'd probably need to see a strong balance sheet and bottom line improvements to get interested in this one.

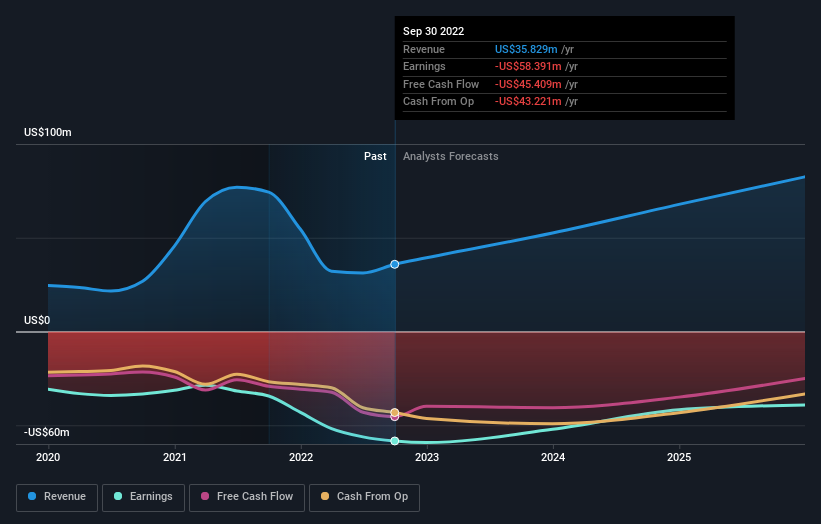

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling Biodesix stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We doubt Biodesix shareholders are happy with the loss of 39% over twelve months. That falls short of the market, which lost 5.9%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 44%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Biodesix (including 3 which are a bit unpleasant) .

Biodesix is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade Biodesix, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Biodesix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:BDSX

Very undervalued moderate.

Similar Companies

Market Insights

Community Narratives