- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

The 12% return this week takes Axogen's (NASDAQ:AXGN) shareholders three-year gains to 122%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For instance the Axogen, Inc. (NASDAQ:AXGN) share price is 122% higher than it was three years ago. That sort of return is as solid as granite. Also pleasing for shareholders was the 43% gain in the last three months. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Axogen

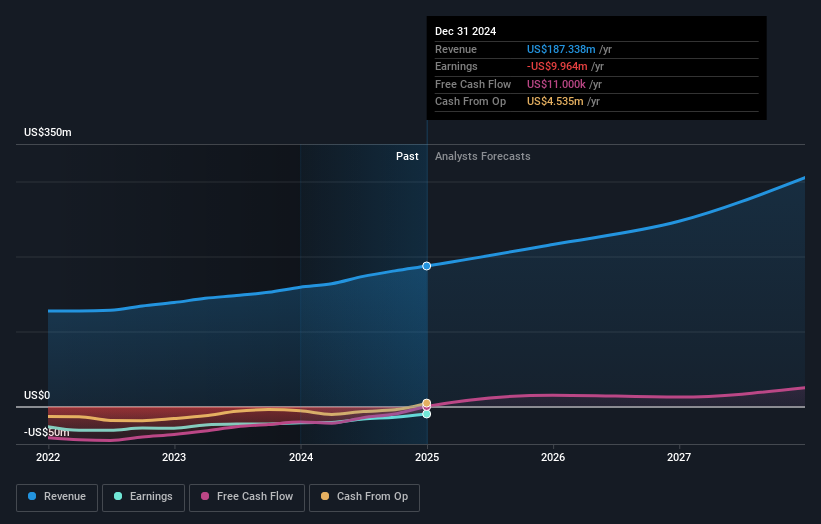

Because Axogen made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Axogen's revenue trended up 14% each year over three years. That's a very respectable growth rate. It's fair to say that the market has acknowledged the growth by pushing the share price up 30% per year. It's hard to value pre-profit businesses, but it seems like the market has become a lot more optimistic about this one! It would be worth thinking about when profits will flow, since that milestone will attract more attention.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Axogen's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Axogen shareholders have received a total shareholder return of 88% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 11% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before spending more time on Axogen it might be wise to click here to see if insiders have been buying or selling shares.

But note: Axogen may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AXGN

Axogen

Develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives