- United States

- /

- Medical Equipment

- /

- NasdaqCM:AWH

Shareholders in Aspira Women's Health (NASDAQ:AWH) have lost 88%, as stock drops 11% this past week

Even the best investor on earth makes unsuccessful investments. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. So we hope that those who held Aspira Women's Health Inc. (NASDAQ:AWH) during the last year don't lose the lesson, in addition to the 88% hit to the value of their shares. A loss like this is a stark reminder that portfolio diversification is important. Even if you look out three years, the returns are still disappointing, with the share price down30% in that time. Shareholders have had an even rougher run lately, with the share price down 43% in the last 90 days. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Aspira Women's Health

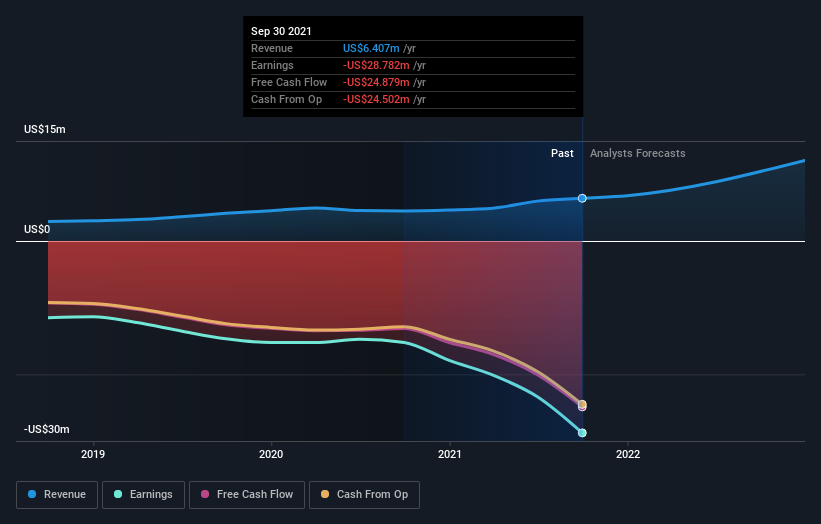

Given that Aspira Women's Health didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Aspira Women's Health saw its revenue grow by 42%. That's definitely a respectable growth rate. Unfortunately, the market wanted something better, given it sent the share price 88% lower during the year. One fear might be that the company might be losing too much money and will need to raise more. We'd posit that the future looks challenging, given the disconnect between revenue growth and the share price.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that Aspira Women's Health shareholders are down 88% for the year. Unfortunately, that's worse than the broader market decline of 1.3%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Aspira Women's Health (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

But note: Aspira Women's Health may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AWH

Aspira Women's Health

Aspira Women's Health Inc., together with its subsidiaries, discovers, develops, and commercializes of noninvasive AI-powered diagnostic tests for gynecologic diseases in the United States.

Moderate and fair value.