- United States

- /

- Medical Equipment

- /

- NasdaqGS:ATRI

Atrion's (NASDAQ:ATRI) Upcoming Dividend Will Be Larger Than Last Year's

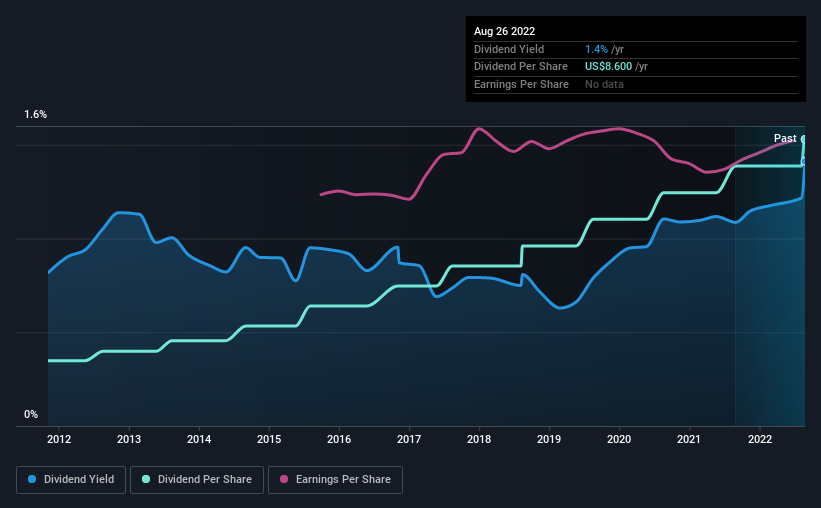

The board of Atrion Corporation (NASDAQ:ATRI) has announced that it will be paying its dividend of $2.15 on the 30th of September, an increased payment from last year's comparable dividend. The payment will take the dividend yield to 1.4%, which is in line with the average for the industry.

Check out our latest analysis for Atrion

Atrion's Dividend Is Well Covered By Earnings

Unless the payments are sustainable, the dividend yield doesn't mean too much. Atrion was earning enough to cover the previous dividend, but it was paying out quite a large proportion of its free cash flows. By paying out so much of its cash flows, this could indicate that the company has limited opportunities for investment and growth.

Looking forward, earnings per share could rise by 1.2% over the next year if the trend from the last few years continues. Assuming the dividend continues along recent trends, we think the payout ratio could be 47% by next year, which is in a pretty sustainable range.

Atrion Has A Solid Track Record

The company has an extended history of paying stable dividends. The annual payment during the last 10 years was $1.96 in 2012, and the most recent fiscal year payment was $8.60. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend's Growth Prospects Are Limited

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Atrion hasn't seen much change in its earnings per share over the last five years. The company has been growing at a pretty soft 1.2% per annum, and is paying out quite a lot of its earnings to shareholders. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While Atrion is earning enough to cover the dividend, we are generally unimpressed with its future prospects. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Atrion that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ATRI

Atrion

Develops, manufactures, and sells products for fluid delivery, cardiovascular, and ophthalmic applications in the United States, Canada, Europe, and internationally.

Flawless balance sheet average dividend payer.