Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that AtriCure, Inc. (NASDAQ:ATRC) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for AtriCure

What Is AtriCure's Net Debt?

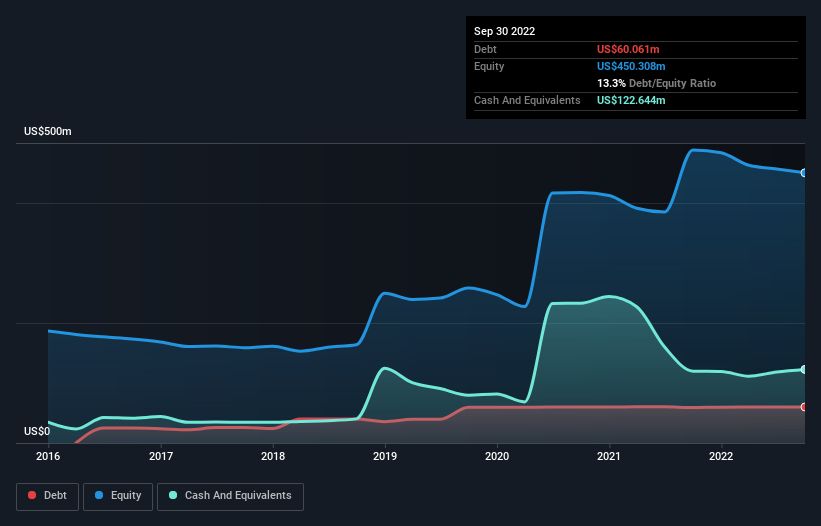

The chart below, which you can click on for greater detail, shows that AtriCure had US$60.1m in debt in September 2022; about the same as the year before. But on the other hand it also has US$122.6m in cash, leading to a US$62.6m net cash position.

How Healthy Is AtriCure's Balance Sheet?

According to the last reported balance sheet, AtriCure had liabilities of US$57.6m due within 12 months, and liabilities of US$74.0m due beyond 12 months. Offsetting this, it had US$122.6m in cash and US$41.5m in receivables that were due within 12 months. So it actually has US$32.5m more liquid assets than total liabilities.

This state of affairs indicates that AtriCure's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$1.98b company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that AtriCure has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if AtriCure can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, AtriCure reported revenue of US$316m, which is a gain of 22%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is AtriCure?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that AtriCure had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of US$37m and booked a US$56m accounting loss. However, it has net cash of US$62.6m, so it has a bit of time before it will need more capital. With very solid revenue growth in the last year, AtriCure may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for AtriCure you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026