- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

AtriCure (ATRC): Exploring Valuation Insights as Analyst Targets Signal Potential Upside

Reviewed by Kshitija Bhandaru

AtriCure (ATRC) shares have seen modest movement lately, catching the attention of investors interested in the healthcare sector. The stock’s performance over the past month and year provides some insight into current market sentiment.

See our latest analysis for AtriCure.

While AtriCure’s recent share price has moved sideways, the more notable story is its small but positive 1-year total shareholder return of 0.28%. Some clinical and regulatory milestones have kept healthcare investors alert. Momentum has been modest rather than runaway, suggesting that the market is still weighing AtriCure’s long-term growth prospects and risk profile.

If you’re tracking trends in the healthcare sector, this could be the perfect chance to discover fresh opportunities with our See the full list for free.

With shares trading near 34 dollars, well below analysts’ 50 dollar target, and strong recent net income growth, investors have to ask: is this a hidden bargain, or is the market wisely factoring in all future potential?

Most Popular Narrative: 30.5% Undervalued

With the consensus fair value pegged at $50 and the latest closing price at $34.73, the narrative suggests significant room for upside if projections hold. But what are the fundamental business drivers behind this optimism?

Rapid revenue growth is supported by accelerated adoption of AtriCure's innovative, minimally invasive devices like the AtriClip FLEX Mini and cryoSPHERE MAX. These products directly benefit from the global trend toward minimally invasive cardiac procedures and hospital prioritization of advanced surgical solutions. This increases both volumes and average selling prices, driving top-line expansion.

Want to know what propelled this ambitious valuation target? There is one bold bet hidden in the narrative: future profits. How do projected earnings, revenue growth, and a headline-grabbing profit multiple stack up in the analysts’ math? Uncover the key assumptions that could send this stock surging or stalling.

Result: Fair Value of $50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, clinical trial delays or intensifying competition in ablation technologies could challenge AtriCure’s growth story and put pressure on its long-term earnings potential.

Find out about the key risks to this AtriCure narrative.

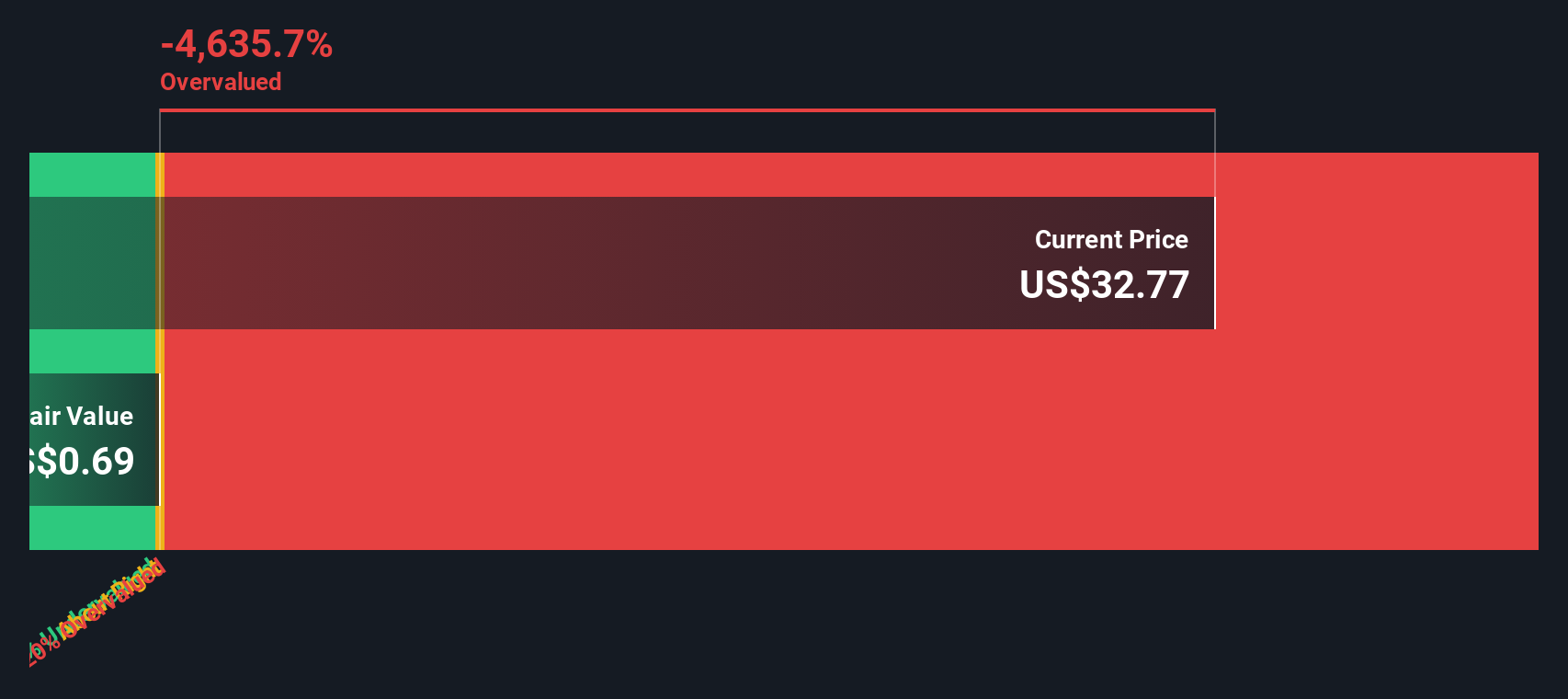

Another View: Discounted Cash Flow Basics

Looking at the SWS DCF model, AtriCure’s shares are actually trading above its intrinsic value estimate. While analyst targets focus on potential earnings growth, the DCF approach is more cautious and questions whether cash flows will ever justify current prices. Which story will win out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AtriCure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AtriCure Narrative

If you want a different take or wish to dig deeper on your own, you can piece together your own outlook in just a few minutes. Do it your way

A great starting point for your AtriCure research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your search to just one opportunity. Seize your advantage with unique investment themes now. Missing out could mean missing the next breakout performer.

- Tap into reliable income opportunities and get ahead of market swings by checking out these 19 dividend stocks with yields > 3% with yields above 3%.

- Stay on the cutting edge by targeting innovation with these 25 AI penny stocks set to transform how businesses operate worldwide.

- Capitalize on value by finding these 894 undervalued stocks based on cash flows trading below their intrinsic worth judged by cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives