- United States

- /

- Healthcare Services

- /

- NasdaqGS:AMED

It Looks Like Shareholders Would Probably Approve Amedisys, Inc.'s (NASDAQ:AMED) CEO Compensation Package

We have been pretty impressed with the performance at Amedisys, Inc. (NASDAQ:AMED) recently and CEO Paul Kusserow deserves a mention for their role in it. Coming up to the next AGM on 08 June 2021, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

Check out our latest analysis for Amedisys

Comparing Amedisys, Inc.'s CEO Compensation With the industry

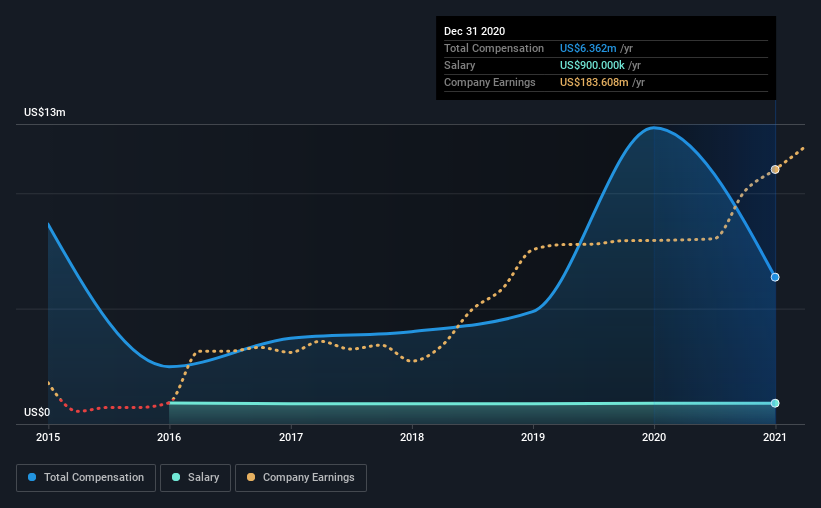

Our data indicates that Amedisys, Inc. has a market capitalization of US$8.4b, and total annual CEO compensation was reported as US$6.4m for the year to December 2020. Notably, that's a decrease of 50% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$900k.

On comparing similar companies from the same industry with market caps ranging from US$4.0b to US$12b, we found that the median CEO total compensation was US$6.5m. This suggests that Amedisys remunerates its CEO largely in line with the industry average. What's more, Paul Kusserow holds US$98m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$900k | US$899k | 14% |

| Other | US$5.5m | US$12m | 86% |

| Total Compensation | US$6.4m | US$13m | 100% |

Speaking on an industry level, nearly 19% of total compensation represents salary, while the remainder of 81% is other remuneration. Amedisys pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Amedisys, Inc.'s Growth

Over the past three years, Amedisys, Inc. has seen its earnings per share (EPS) grow by 70% per year. In the last year, its revenue is up 6.9%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Amedisys, Inc. Been A Good Investment?

We think that the total shareholder return of 220%, over three years, would leave most Amedisys, Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Amedisys that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Amedisys, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:AMED

Flawless balance sheet and fair value.