- United States

- /

- Healthcare Services

- /

- NasdaqCM:AHCO

Market Might Still Lack Some Conviction On AdaptHealth Corp. (NASDAQ:AHCO) Even After 50% Share Price Boost

AdaptHealth Corp. (NASDAQ:AHCO) shareholders would be excited to see that the share price has had a great month, posting a 50% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

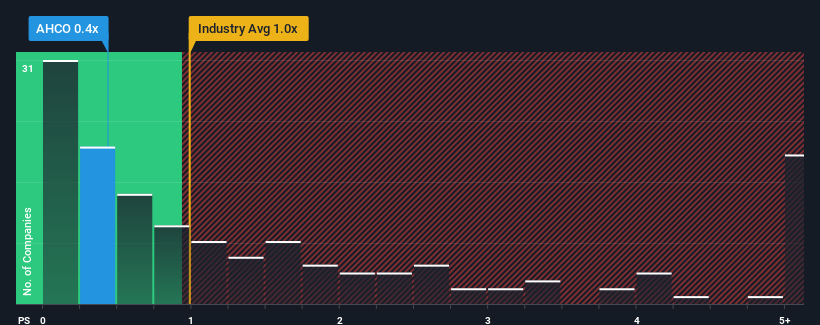

In spite of the firm bounce in price, AdaptHealth's price-to-sales (or "P/S") ratio of 0.4x might still make it look like a buy right now compared to the Healthcare industry in the United States, where around half of the companies have P/S ratios above 1x and even P/S above 3x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for AdaptHealth

What Does AdaptHealth's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, AdaptHealth has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think AdaptHealth's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For AdaptHealth?

AdaptHealth's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.7%. This was backed up an excellent period prior to see revenue up by 199% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 6.0% per year during the coming three years according to the ten analysts following the company. With the industry predicted to deliver 7.7% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that AdaptHealth's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On AdaptHealth's P/S

The latest share price surge wasn't enough to lift AdaptHealth's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that AdaptHealth currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

You always need to take note of risks, for example - AdaptHealth has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AHCO

AdaptHealth

Sells home medical equipment (HME), medical supplies, and home and related services in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives