- United States

- /

- Food

- /

- NYSEAM:SEB

Seaboard (SEB): Evaluating Valuation After Recent Share Price Strength

Reviewed by Kshitija Bhandaru

Seaboard (SEB) has been catching the interest of investors after its shares edged up nearly 1% in the latest trading session. With a year-to-date return of 46%, the stock’s movement hints at shifting sentiment among market participants.

See our latest analysis for Seaboard.

The roughly 46% share price return for Seaboard so far this year stands out against a modest 13.6% total shareholder return over the past year. This hints at growing optimism despite some recent volatility, and momentum seems to be building as the market response shifts in the company's favor.

If you're curious about what else is capturing renewed investor interest lately, this is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The key question now is whether Seaboard’s impressive rally signals an undervalued stock with room to climb further, or if investors have already priced in every bit of potential growth, leaving little upside from this point.

Price-to-Earnings of 24.4x: Is it justified?

Seaboard’s price-to-earnings ratio stands high at 24.4x, notably above both its industry peers and the broader US Food sector, given its last close price of $3,536.60 per share.

The price-to-earnings (P/E) ratio compares a company’s current share price to its earnings per share, offering insight into how much investors are willing to pay for each dollar of profit. In the food industry, it serves as a quick gauge of expected growth versus current performance.

In Seaboard’s case, the market seems to be pricing in significant future earnings growth or a premium for stability, yet the reality does not appear to align. SEB’s earnings have actually declined by 18.2% per year over the past five years and are not projected to grow rapidly in the near term based on current trends. This level is sharply above the US Food industry average of 17.7x and even above the peer average of 22.7x, highlighting that the stock trades at a premium without the supporting fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 24.4x (OVERVALUED)

However, company fundamentals may weigh on momentum if declining earnings continue or if investor sentiment shifts away from premium valuations.

Find out about the key risks to this Seaboard narrative.

Another Perspective: Discounted Cash Flow Tells a Different Story

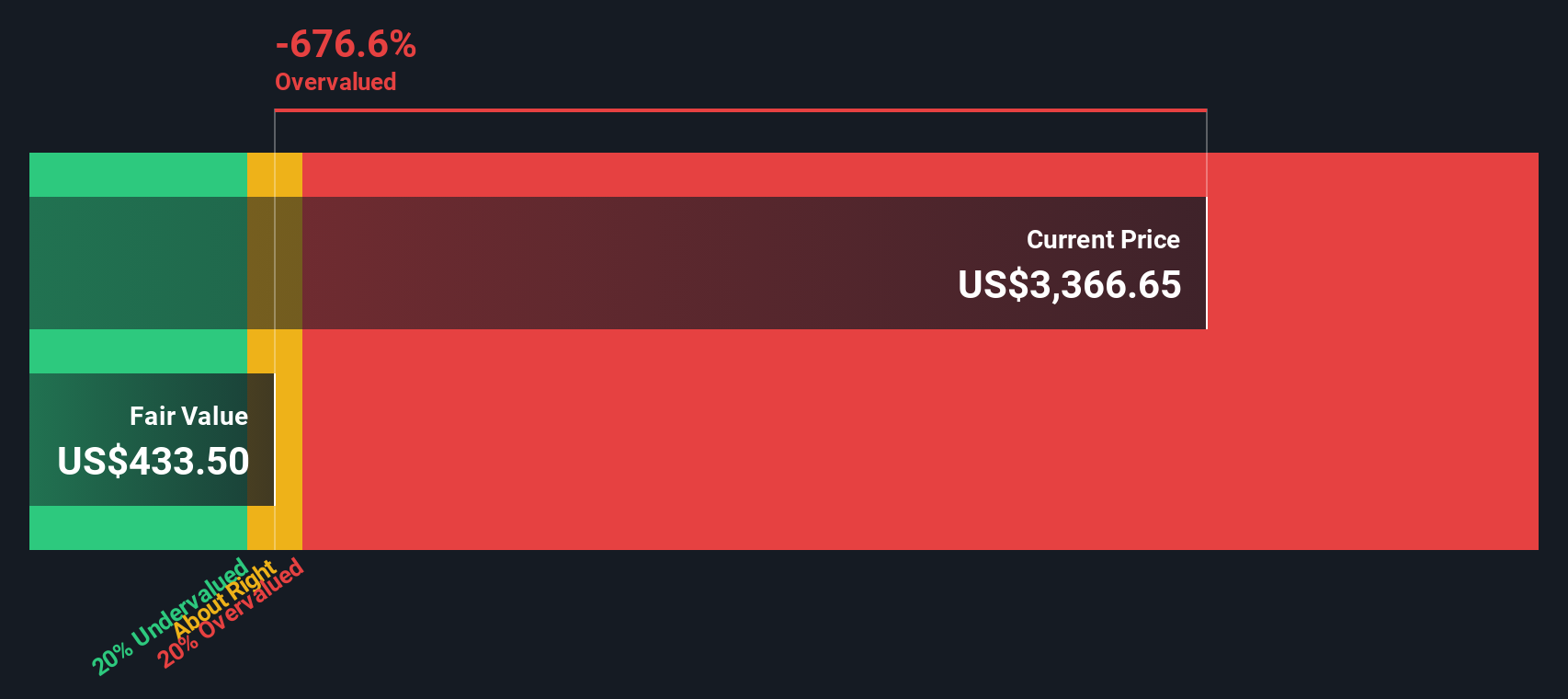

While Seaboard’s high price-to-earnings ratio signals a stretched valuation, the SWS DCF model presents an even starker picture. According to this approach, the stock trades well above its estimated fair value, indicating potential overvaluation from a cash flow perspective. Should investors trust the market's optimism or look closer at the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Seaboard for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Seaboard Narrative

If you see things differently or want to dig into the numbers on your own terms, you can easily build your own take in just a few minutes, too, with Do it your way

A great starting point for your Seaboard research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors look beyond one story. Pinpoint promising stocks with strong financials, groundbreaking innovation, or exceptional cash flow potential using these powerful tools today.

- Tap into game-changing healthcare breakthroughs by researching these 32 healthcare AI stocks, which are poised to transform the medical landscape and improve patient outcomes.

- Maximize your income potential by targeting these 19 dividend stocks with yields > 3%, which consistently deliver superior yields and reliable cash returns.

- Ride the wave of blockchain innovation by reviewing these 78 cryptocurrency and blockchain stocks, offering exposure to next-generation digital assets and secure technology growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:SEB

Seaboard

Operates in agricultural, energy, and ocean transportation business worldwide.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives