- United States

- /

- Machinery

- /

- NasdaqCM:HYFM

3 US Penny Stocks With Market Caps Over $30M To Consider

Reviewed by Simply Wall St

As the U.S. stock market rally continues, with major indices like the Dow Jones Industrial Average and S&P 500 reaching new highs, investors are increasingly exploring diverse investment opportunities. While penny stocks may seem like a term from a bygone era, they remain relevant for those seeking affordable entry points into smaller or newer companies with growth potential. By focusing on financial strength and growth prospects, these investments can offer unique opportunities in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.79 | $6.1M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.83 | $2.29B | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2376 | $8.57M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.40 | $557.36M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.55 | $51.15M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8999 | $80.04M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $4.08 | $445.26M | ★★★★☆☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Hydrofarm Holdings Group (NasdaqCM:HYFM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hydrofarm Holdings Group, Inc. manufactures and distributes controlled environment agriculture equipment and supplies in the United States and Canada, with a market cap of $33.49 million.

Operations: The company generates revenue of $200.16 million from its distribution and manufacturing operations focused on controlled environment agriculture equipment and supplies.

Market Cap: $33.49M

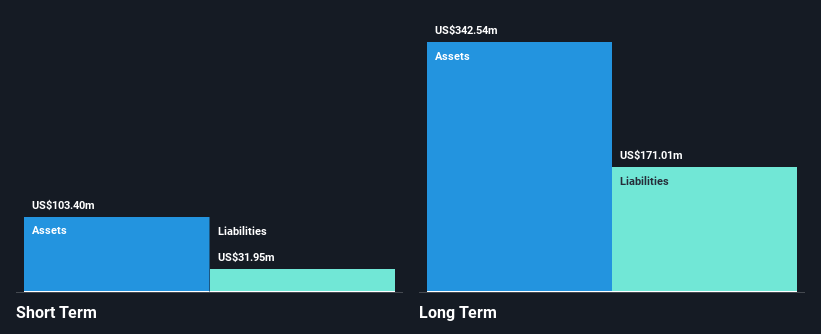

Hydrofarm Holdings Group, with a market cap of US$33.49 million, is navigating challenges typical of penny stocks, including high volatility and ongoing unprofitability. Despite generating US$200.16 million in revenue from its controlled environment agriculture equipment operations, the company faces significant hurdles such as non-compliance with Nasdaq's minimum bid price requirement and plans for a reverse stock split to address this issue. Leadership changes are underway with John Lindeman set to become CEO in January 2025, which may influence strategic direction as the firm seeks profitability amidst declining sales and net losses reported in recent earnings announcements.

- Click to explore a detailed breakdown of our findings in Hydrofarm Holdings Group's financial health report.

- Assess Hydrofarm Holdings Group's future earnings estimates with our detailed growth reports.

ALX Oncology Holdings (NasdaqGS:ALXO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ALX Oncology Holdings Inc. is a clinical-stage immuno-oncology company developing cancer therapies in the United States, with a market cap of $74.37 million.

Operations: ALX Oncology Holdings Inc. currently does not report any revenue segments, as it is in the clinical-stage of developing cancer therapies.

Market Cap: $74.37M

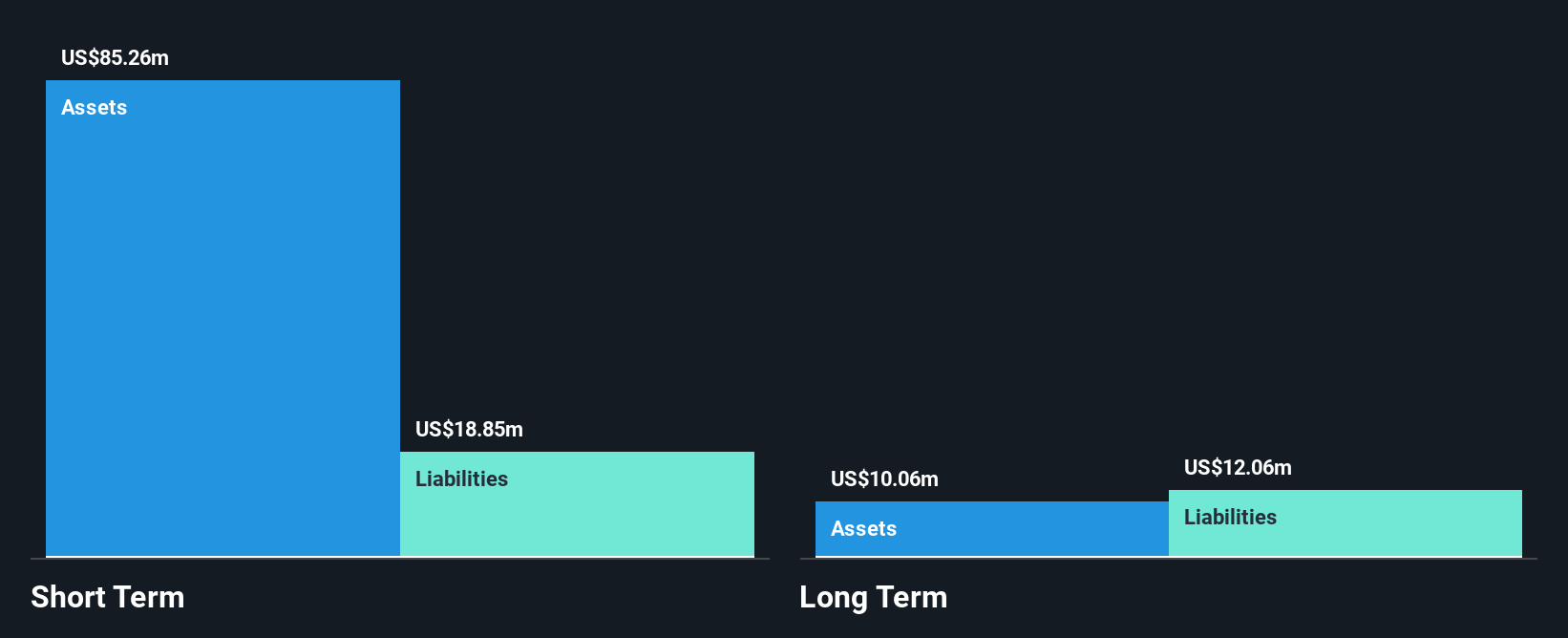

ALX Oncology Holdings, with a market cap of US$74.37 million, is a pre-revenue biotech firm focused on cancer therapies. The company remains unprofitable, reporting reduced net losses for the third quarter of 2024 compared to the previous year. While its share price has been volatile and shareholders experienced dilution over the past year, ALX maintains a solid cash runway exceeding one year and has significantly reduced its debt-to-equity ratio over five years. Recent leadership changes include appointing Dr. Alan Sandler as Chief Medical Officer, bringing extensive oncology expertise to support ongoing clinical trials in collaboration with Sanofi.

- Unlock comprehensive insights into our analysis of ALX Oncology Holdings stock in this financial health report.

- Learn about ALX Oncology Holdings' future growth trajectory here.

Zevia PBC (NYSE:ZVIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zevia PBC is a beverage company that develops, markets, sells, and distributes various carbonated beverages in the United States and Canada, with a market cap of $131.21 million.

Operations: The company's revenue from its non-alcoholic beverages segment is $153.39 million.

Market Cap: $131.21M

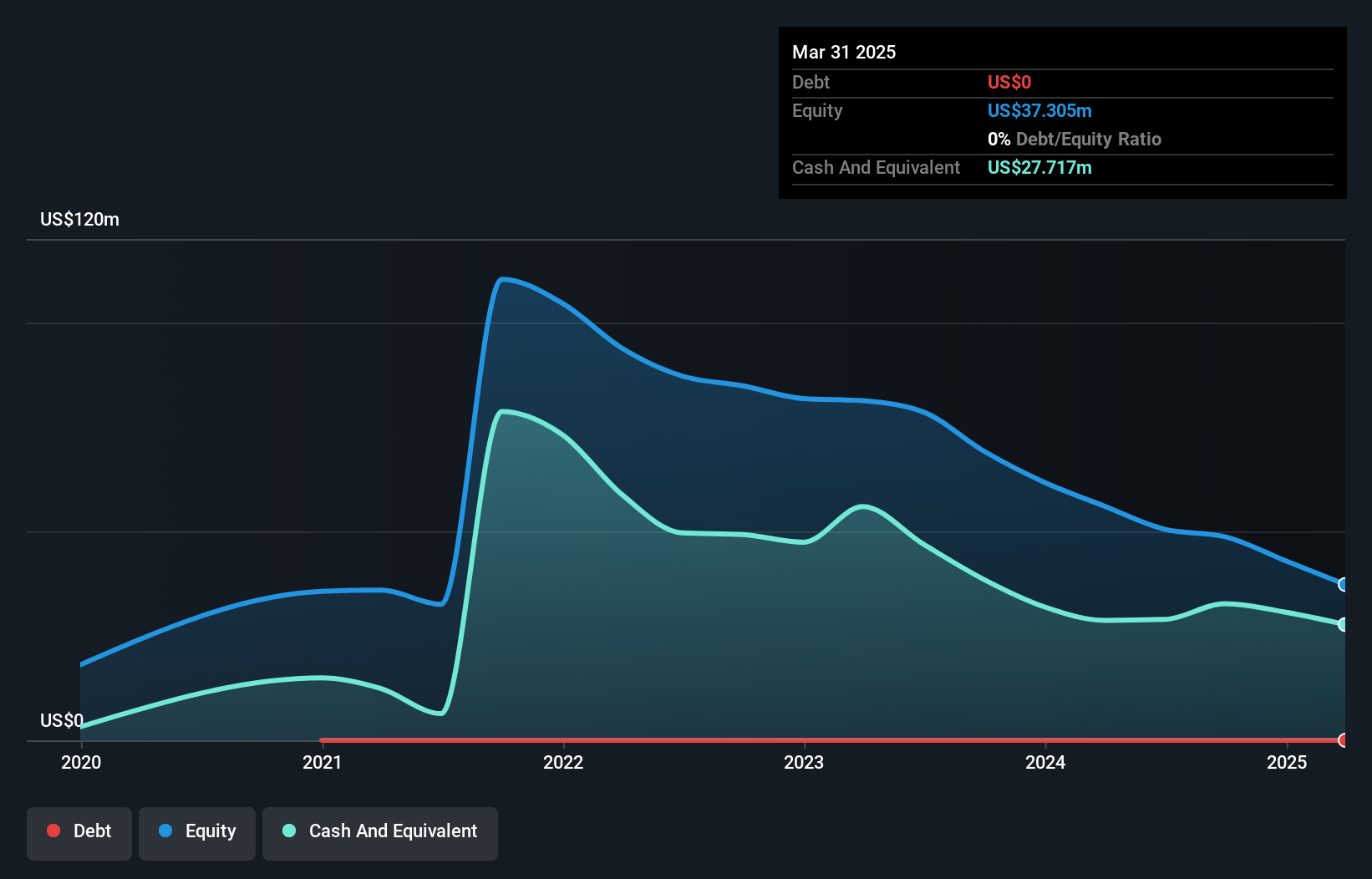

Zevia PBC, with a market cap of US$131.21 million, has faced challenges with declining sales and ongoing unprofitability, reporting a net loss of US$2.53 million for Q3 2024. Despite this, the company maintains a strong cash position with sufficient runway for over three years and remains debt-free. Recent updates include launching a new Salted Caramel Soda flavor to capture consumer interest in non-alcoholic beverages and providing guidance for Q4 sales between US$38 million to US$40 million. The board recently experienced changes but retains experienced leadership overall.

- Click here to discover the nuances of Zevia PBC with our detailed analytical financial health report.

- Understand Zevia PBC's earnings outlook by examining our growth report.

Summing It All Up

- Discover the full array of 720 US Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hydrofarm Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HYFM

Hydrofarm Holdings Group

Manufactures and distributes hydroponics equipment and supplies for controlled environment agriculture (CEA) in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives