- United States

- /

- Food

- /

- NYSE:TSN

Tyson Foods (NYSE:TSN) Sees Q2 Earnings Drop Despite Stable Sales

Reviewed by Simply Wall St

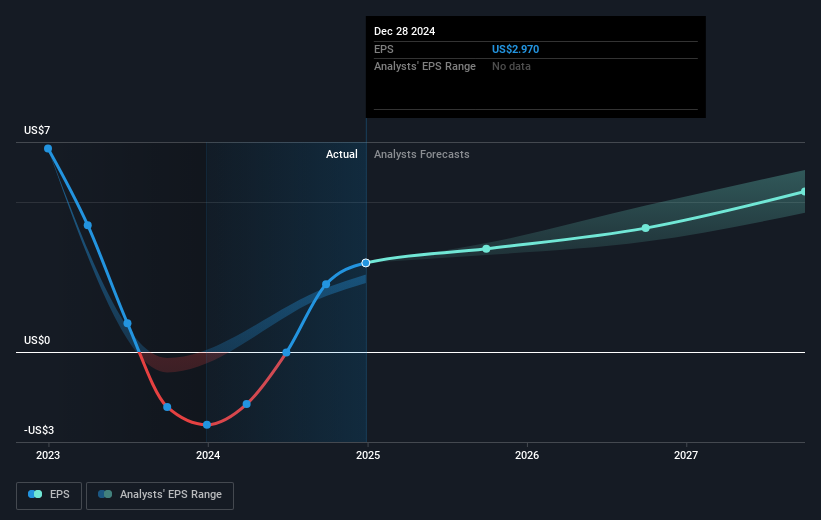

Tyson Foods (NYSE:TSN) recently released its second quarter earnings revealing a minor sales increase, yet a stark drop in net income, which saw a decline from $145 million to $7 million. This period coincided with a 6.63% rise in Tyson's share price over the past quarter, despite broader market fluctuations amid economic uncertainties. Positive six-month results with net income growth may have cushioned the stock, while legal settlements and dividend affirmations also likely influenced investor outlook. As the broader market rose 2.8% recently, Tyson’s performance was largely in line, with mixed sector impacts adding complexity to its overall return analysis.

Buy, Hold or Sell Tyson Foods? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent earnings announcement by Tyson Foods, illustrating a decrease in net income from US$145 million to US$7 million, adds a complex layer to the company's growth narrative. While the short-term share price has risen by 6.63%, signaling temporary investor confidence, the dip in earnings could cast doubts on projected revenue and earnings targets. This suggests a reliance on future operational improvements and digital initiatives to counteract current profit challenges, especially amidst pressures from input cost inflation and cattle supply constraints.

Over a more extended period, Tyson Foods has delivered a total return, including dividends, of 15.64% over five years. This performance provides context to its recent share price gain, reflecting a longer-term resilience that contrasts with a broader U.S. Food Industry decrease over the past year. Moreover, Tyson Foods outperformed the food industry, which saw a 9.1% decline over the same period. The analyst consensus sets a price target of US$67.34, placing the current share price at a 10% discount. This highlights a cautious optimism among analysts, factoring in anticipated margin improvements and earnings growth.

The earnings update and subsequent developments could either bolster investor confidence in Tyson’s operational strategies or amplify concerns depending on future economic conditions. As Tyson Foods aims to bridge the gap to its target price, sustained execution on earnings and revenue forecasts remains critical. This context underscores the potential impact of operational and market dynamics on its future valuation.

Our valuation report here indicates Tyson Foods may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives