- United States

- /

- Food

- /

- NYSE:TSN

Tyson Foods (NYSE:TSN) Expands Wright Brand With Bold New Premium Sausage Links

Reviewed by Simply Wall St

Tyson Foods (NYSE:TSN) recently announced the launch of a new product line under its Wright Brand, featuring premium sausage links with flavors such as applewood, white cheddar & bacon, and bacon, cheddar & jalapeno. This launch underscores the company's commitment to quality and innovation. During the same week, concerns over global trade tensions influenced broader market sentiment, with the S&P 500 slipping amid China-U.S. tensions despite the index's strong performance in May. Tyson's shares moved in line with the market's 1.7% climb, suggesting its product announcements added weight to the broader market movement.

The launch of Tyson Foods' Wright Brand premium sausage line highlights its dedication to product innovation, aligning with efforts to enhance operational efficiency and diversify its offerings. This innovation may bolster the company’s revenue growth in its Prepared Foods segment, especially as it aims to capitalize on consumer trends favoring quality and unique flavors. The recent market movements, partly influenced by this product launch, saw Tyson's shares align with broader market gains yet remain below the consensus analyst price target of US$66.10 by approximately 17.7% as of June 2025. This suggests a potential for share price appreciation should the market recognize these operational improvements.

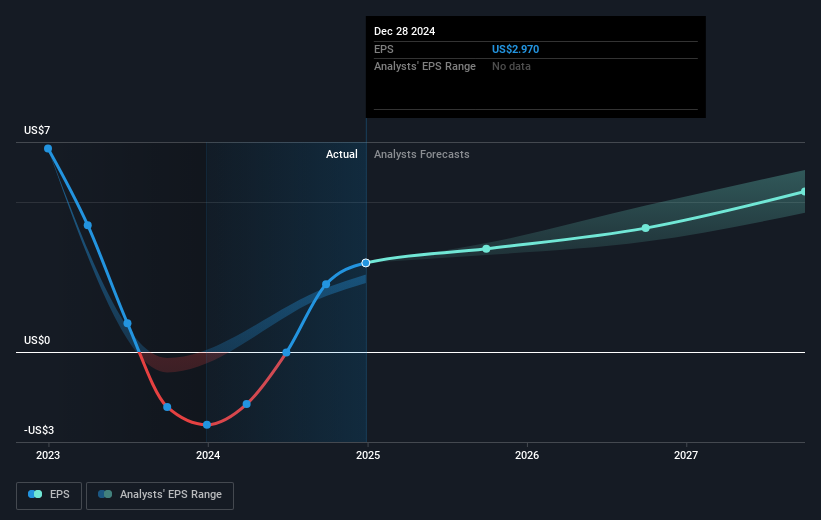

Over a longer timeframe, the company's total return, including share price gains and dividends, was 1.75% over the past year. This performance places Tyson Foods behind the broader US Market return of 11.5% for the same period, indicating challenges in realizing value from its strategic initiatives against industry or market benchmarks. Analysts expect Tyson's revenue and earnings to benefit from enhanced operational strategies, projecting revenue growth to US$56.10 billion and earnings reaching US$2.10 billion by May 2028, although future revenue growth is expected to be slower than the market average. This projection, if achieved, could narrow the gap between Tyson’s current share price and the analyst price target, contingent upon improved profit margins and operational execution.

Evaluate Tyson Foods' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives