- United States

- /

- Beverage

- /

- NYSE:STZ

Constellation Brands (STZ): Revisiting Valuation After Guidance Cut and New Tariff Risks

Reviewed by Kshitija Bhandaru

If you’re wondering what just happened with Constellation Brands (STZ), you’re not alone. The company recently lowered its outlook for fiscal 2026, citing softer beer demand and new risks around Mexican import tariffs. Combined with choppy inventory moves, this guidance cut served as a wake-up call for anyone following the stock’s trajectory. It is the kind of event that makes investors pause to rethink where the value might really be.

This is hardly a blip. Over the past year, Constellation Brands’ shares have fallen about 45%, with most of that drop accelerating in 2025 as the warning signs stacked up. Earlier challenges were already pressuring the beer business, but this new guidance, along with the heightened focus on tariffs, has increased uncertainty and reversed short-term market momentum.

So with all this in mind, is the market overreacting and making room for a bargain, or is Constellation Brands just catching up to a new reality that is already priced in?

Most Popular Narrative: 26.1% Undervalued

The most widely followed narrative argues that Constellation Brands is trading far below its fair value, despite recent guidance cuts and industry challenges. This view is based on a discounted cash flow estimate and substantial anticipated improvement in the company’s long-term financial outlook.

Constellation Brands anticipates significant improvements in its Wine & Spirits business post-2025 following the divestiture of mainstream wine brands and related restructuring actions. These actions are expected to yield over $200 million in net annualized cost savings across the enterprise by fiscal '28, which will positively impact operating margins and earnings.

Is this the bargain Wall Street is missing? Could a massive business overhaul, new cash flow strategies, and a transformative cost structure reset the growth clock? The real question is what assumptions are fueling this bullish outlook and just how optimistic analysts are about future profitability. Want the full story? The underlying math and projections might surprise you.

Result: Fair Value of $179.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent U.S. beer demand weakness and new tariffs impacting margins could quickly shift the outlook and undermine this undervalued narrative.

Find out about the key risks to this Constellation Brands narrative.Another View: Market Pricing Tells a Different Story

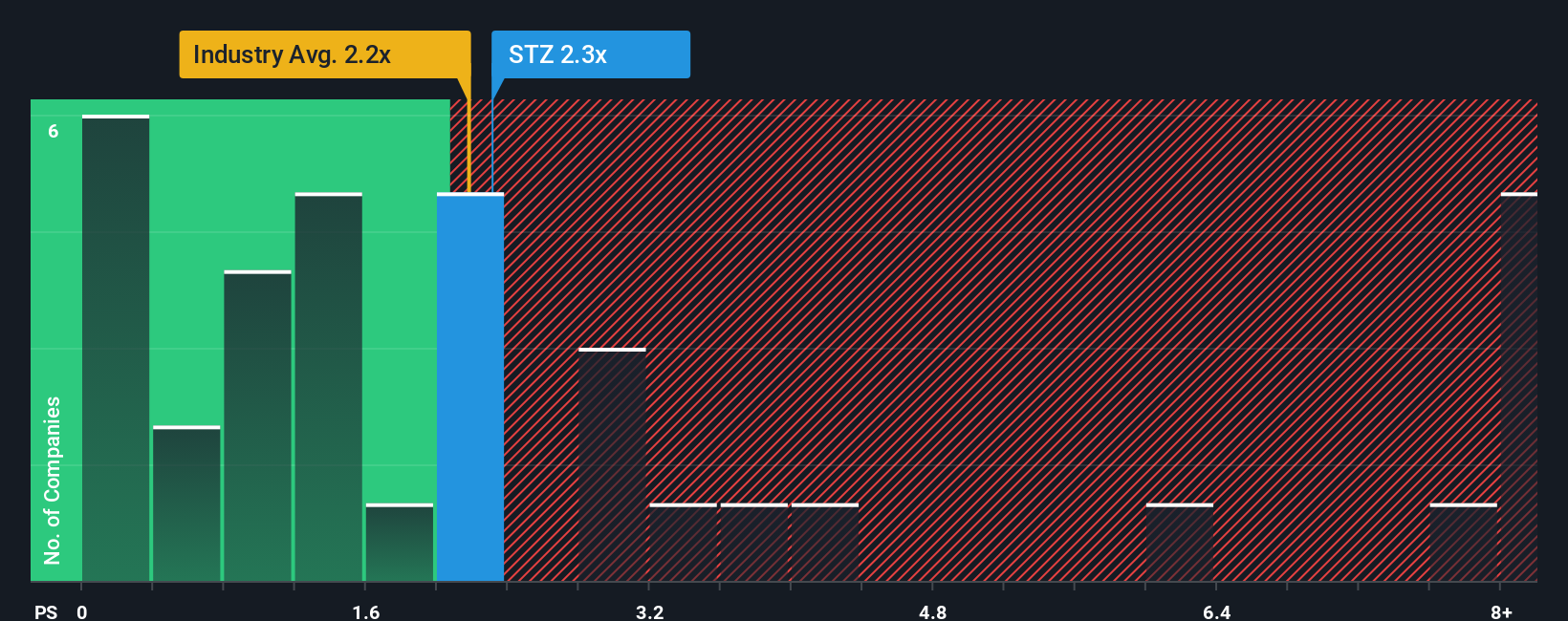

When we compare Constellation Brands to the rest of the US Beverage industry using sales-based valuation, the numbers suggest it is actually slightly more expensive than average. Does this put the bullish outlook in doubt?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Constellation Brands to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Constellation Brands Narrative

If you see things differently or want to dig deeper on your own terms, you can build your own view in just a few minutes. Do it your way.

A great starting point for your Constellation Brands research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turn this moment into an opportunity by checking out other stocks with big upside through the Simply Wall Street Screener. Don’t let great opportunities pass you by; your next standout investment could be just one smart move away.

- Start generating potential double-digit yields by checking out high-income opportunities through our dividend stocks with yields > 3%.

- Tap into revolutionary breakthroughs and growth potential in computing by exploring the world of quantum computing stocks.

- Find your edge in markets with undervalued gems by using our insider access to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives