- United States

- /

- Food

- /

- NYSE:SJM

Unpleasant Surprises Could Be In Store For The J. M. Smucker Company's (NYSE:SJM) Shares

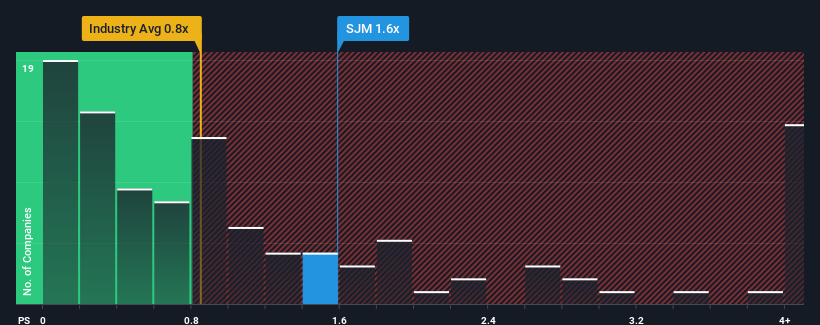

When you see that almost half of the companies in the Food industry in the United States have price-to-sales ratios (or "P/S") below 0.8x, The J. M. Smucker Company (NYSE:SJM) looks to be giving off some sell signals with its 1.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for J. M. Smucker

How J. M. Smucker Has Been Performing

J. M. Smucker could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on J. M. Smucker will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For J. M. Smucker?

J. M. Smucker's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 1.4% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 4.8% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 2.8% per annum, which is not materially different.

With this in consideration, we find it intriguing that J. M. Smucker's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From J. M. Smucker's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given J. M. Smucker's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for J. M. Smucker (1 doesn't sit too well with us!) that we have uncovered.

If you're unsure about the strength of J. M. Smucker's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Established dividend payer and fair value.