- United States

- /

- Beverage

- /

- NYSE:SAM

Exploring Boston Beer Company (SAM) Valuation as Shares Show Recent Weakness

Reviewed by Simply Wall St

See our latest analysis for Boston Beer Company.

Boston Beer Company's share price has seen renewed pressure in recent months, with a year-to-date share price return of -27.3% highlighting lingering investor caution despite some pockets of short-term recovery. The total shareholder return over the past year stands at -25.91%, while longer-term investors have faced steeper declines. Three- and five-year total returns are still deep in negative territory. Overall, short-term momentum appears sluggish, with the longer-term picture reinforcing a cautious outlook as Boston Beer continues to reassess its growth story and valuation in a challenging market.

If you’re keeping an eye out for other opportunities as the beverage sector evolves, now’s a perfect time to widen your search and discover fast growing stocks with high insider ownership

Amid persistent share price weakness and a recent uptick in earnings, investors are left wondering: is Boston Beer Company now trading at a bargain, or has the market already accounted for any future upside?

Most Popular Narrative: 8.5% Undervalued

Boston Beer Company's narrative fair value sits noticeably above its last close, indicating market expectations may be lagging behind forward-looking projections. This creates buzz among those tracking emerging shifts in the premium beverage sector and considering whether there's hidden value still left on the table.

Ongoing productivity initiatives (brewery efficiency, procurement and waste reduction) are structurally raising gross margins. These improvements should continue to benefit earnings as volume normalizes and new, margin-accretive products (e.g., Sun Cruiser) scale.

Curious what earnings power and financial assumptions fuel this higher valuation? One core ingredient of the story is a top-line outlook and projected profit jump that diverges from the market consensus. See the surprising growth levers and margin tactics that drive this target, only in the full narrative.

Result: Fair Value of $239.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer moderation trends and rising competition in crowded beverage categories could quickly challenge Boston Beer's optimistic outlook and margin resilience.

Find out about the key risks to this Boston Beer Company narrative.

Another View: Market Ratios Raise Fresh Questions

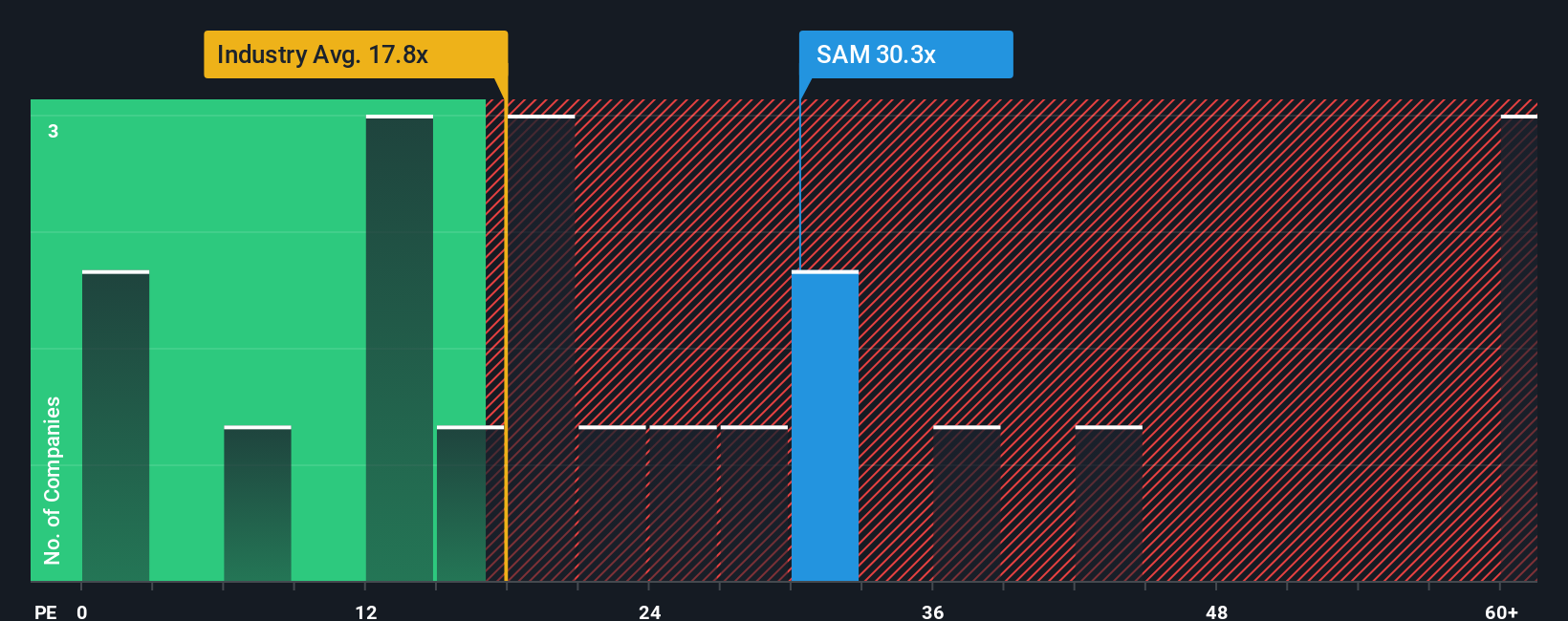

Boston Beer Company may look undervalued in narrative-driven fair value models. However, when you compare its price-to-earnings ratio of 29.4x to industry averages, a different story appears. The company trades at a premium to the sector, with its ratio well above the U.S. Beverage industry average of 17.7x and the peer group average of 18.7x. The fair ratio, or what the market could move toward based on fundamentals, is 17.8x. This suggests Boston Beer is currently expensive by traditional measures. Is the market pricing in too much optimism, or is there a risk that reality will not meet these lofty expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Beer Company Narrative

If you have a different perspective or enjoy diving into the numbers yourself, it only takes a few minutes to build your own narrative using the latest data, so why not Do it your way?

A great starting point for your Boston Beer Company research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors look beyond one stock. If you want to stay ahead, use these hand-picked shortcuts to find fresh winners before the crowd moves in:

- Uncover stocks with reliable yields and steady income by checking out these 17 dividend stocks with yields > 3%, which features dividends over 3% right now.

- Tap into the future of AI-powered breakthroughs with these 24 AI penny stocks, making waves across industries and setting the pace in innovation.

- Spot overlooked opportunities by browsing these 3577 penny stocks with strong financials, which combines strong financials with big potential for outsized gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Beer Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAM

Boston Beer Company

Produces and sells alcohol beverages primarily in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives