- United States

- /

- Beverage

- /

- NYSE:SAM

Boston Beer (SAM): Evaluating Valuation After Twisted Tea’s Limited-Run Holiday Pack Launch

Reviewed by Simply Wall St

Boston Beer Company (SAM) is leaning into holiday merchandising with a limited run Twisted Tea Twistmas Stocking, a nine-can dispenser pack that could give this struggling stock a timely sentiment boost.

See our latest analysis for Boston Beer Company.

Despite fun launches like the Twistmas Stocking, Boston Beer’s share price has slipped, with a 30 day share price return of minus 7.33 percent and a one year total shareholder return of minus 38.34 percent, suggesting momentum is still fading.

If this kind of seasonal catalyst has you rethinking where growth might come from next, it could be worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

Yet with shares down sharply over one and five years, but still trading about 25 percent below analyst targets and roughly 40 percent under some intrinsic estimates, is this a mispriced turnaround story, or is future growth already baked in?

Most Popular Narrative: 18.9% Undervalued

With the most followed narrative placing fair value well above the recent 194.10 dollar close, the gap between expectations and reality is hard to ignore.

Ongoing productivity initiatives (brewery efficiency, procurement and waste reduction) are structurally raising gross margins, which should continue to benefit earnings as volume normalizes and new, margin-accretive products (e.g., Sun Cruiser) scale.

Curious how modest top line assumptions still support a richer valuation? The narrative leans on expanding margins, disciplined reinvestment, and a surprisingly conservative future earnings multiple. Want to see how those moving parts add up?

Result: Fair Value of $239.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shrinking beer consumption and intense Beyond Beer competition could blunt premiumization gains. This may pressure volumes, margins, and ultimately the optimistic valuation narrative.

Find out about the key risks to this Boston Beer Company narrative.

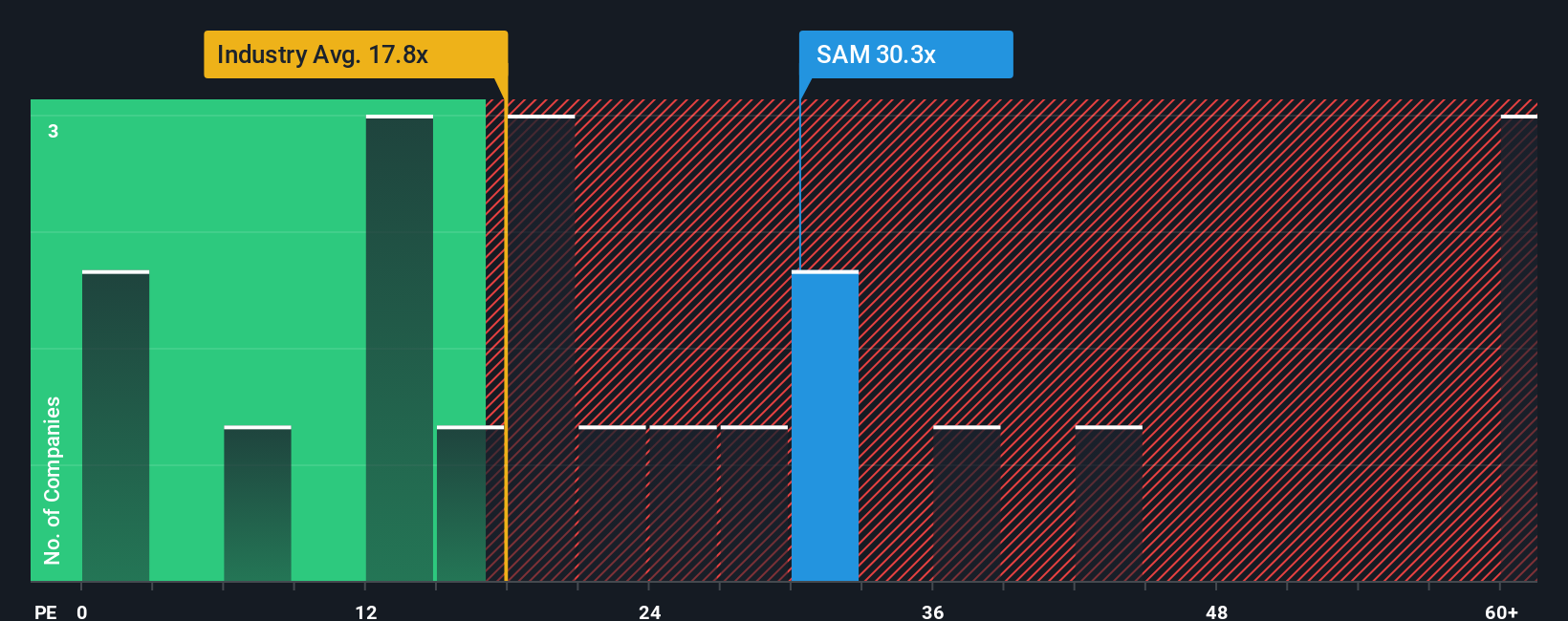

Another View on Valuation

While the narrative suggests Boston Beer is 18.9 percent undervalued, its current price to earnings ratio of 22 times appears expensive versus the global beverage average of 17.6 times and our fair ratio of 16.5 times, which may indicate downside risk if sentiment weakens.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Beer Company Narrative

If you want to dig into the numbers yourself rather than rely on these perspectives, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Boston Beer Company research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before sentiment shifts again, lock in an edge by using the Simply Wall Street Screener to uncover fresh, data driven opportunities that fit your strategy.

- Capture potential mispricings early by targeting companies trading below intrinsic value through these 908 undervalued stocks based on cash flows tailored to cash flow strength.

- Ride structural growth themes by zeroing in on innovators reshaping automation and intelligent software with these 26 AI penny stocks.

- Boost your income potential by focusing on reliable cash generators using these 15 dividend stocks with yields > 3% to spot yields above 3 percent with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Beer Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAM

Boston Beer Company

Produces and sells alcohol beverages primarily in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026