- United States

- /

- Tobacco

- /

- NYSE:MO

Marlboro Volume Slump And Slow Shift To Smoke-Free Products Might Change The Case For Investing In Altria (MO)

Reviewed by Sasha Jovanovic

- Earlier this quarter, Altria Group reported earnings showing an 11.7% decline in Marlboro shipment volumes and weaker performance in its smokeless tobacco products, underscoring pressure on its core cigarette franchise.

- The results also reinforced concerns that Altria is moving more slowly than peers into smoke-free alternatives, raising questions about how it will adapt its business mix over time.

- We’ll now examine how the steep Marlboro volume drop may influence Altria’s existing investment narrative and expectations for future earnings.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Altria Group Investment Narrative Recap

To own Altria, you have to believe its core cigarette cash flows can support generous shareholder returns while it gradually shifts toward smoke free products. The sharp 11.7% Marlboro volume drop directly tests that view by pressuring the key short term catalyst, stable earnings from Smokeable Products, and amplifies the biggest current risk that the transition to reduced risk products is too slow to offset ongoing declines.

Against that backdrop, Altria’s August dividend increase to US$1.06 per share each quarter highlights management’s focus on returning cash to shareholders even as volumes weaken. That move keeps the dividend front and center as a near term catalyst, but also ties investor expectations more tightly to the company’s ability to protect profit margins while funding investments in smoke free offerings.

Yet investors should also be aware of the risk that Altria’s slower pivot into smoke free products could...

Read the full narrative on Altria Group (it's free!)

Altria Group’s narrative projects $20.3 billion revenue and $9.1 billion earnings by 2028. This implies a 0.1% yearly revenue decline and a $1.1 billion earnings decrease from $10.2 billion today.

Uncover how Altria Group's forecasts yield a $63.83 fair value, a 9% upside to its current price.

Exploring Other Perspectives

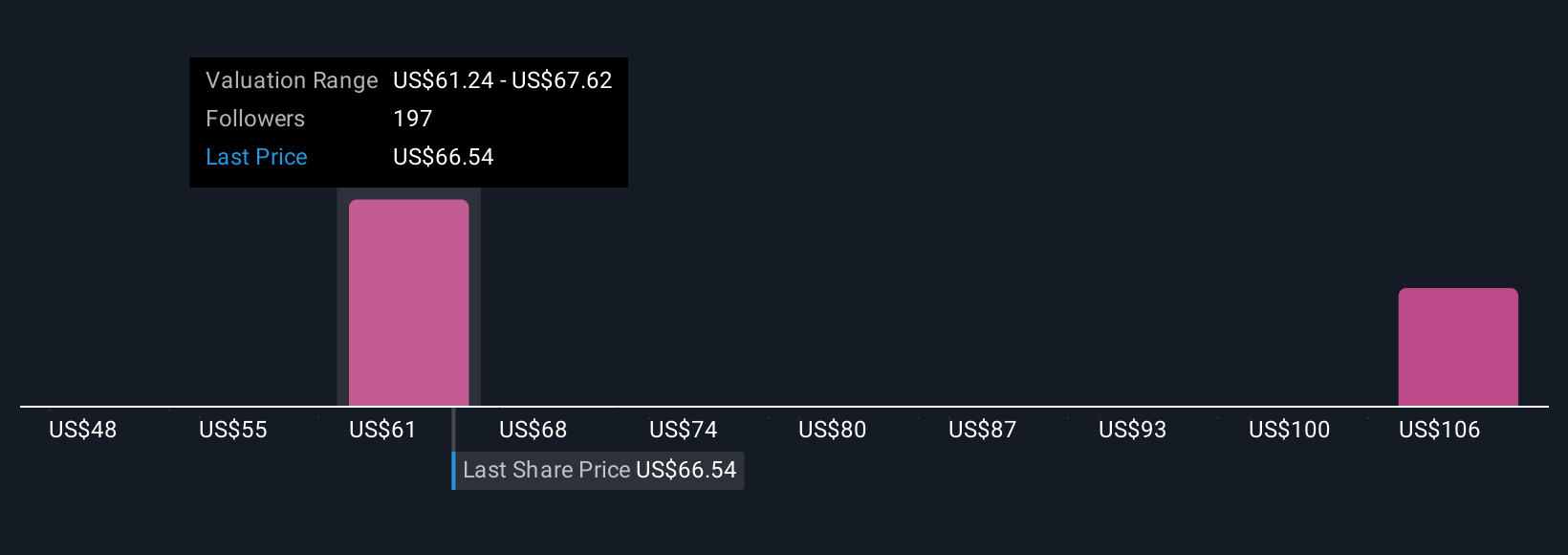

Eight fair value estimates from the Simply Wall St Community span roughly US$50 to US$104 per share, showing how far apart individual views can be. You should weigh this wide range against recent concerns that Altria’s weaker shift into smoke free products may challenge its ability to sustain earnings, then explore several of these alternative viewpoints before forming your own view.

Explore 8 other fair value estimates on Altria Group - why the stock might be worth 15% less than the current price!

Build Your Own Altria Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Altria Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Altria Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Altria Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MO

Altria Group

Through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026