- United States

- /

- Food

- /

- NYSE:MKC

McCormick (NYSE:MKC) Reports Q1 Sales Rise to US$1,605 Million but 2% Profit Dip

Reviewed by Simply Wall St

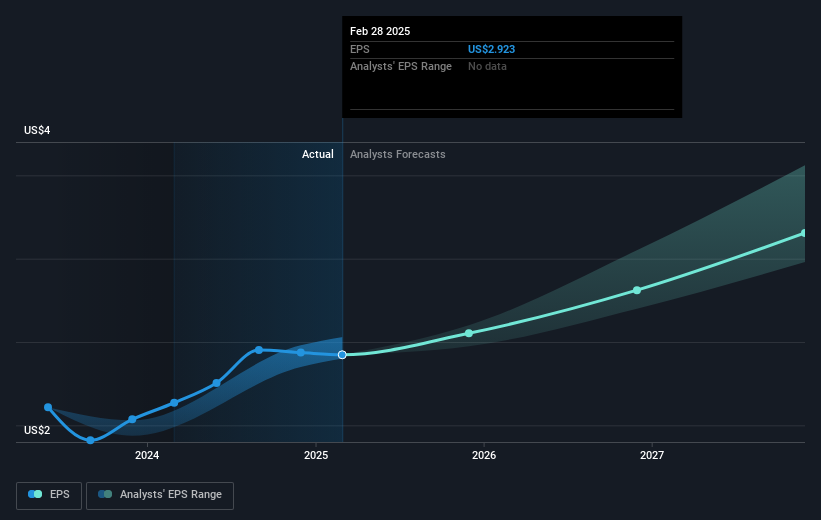

McCormick (NYSE:MKC) recently announced its Q1 2025 earnings, reporting a slight increase in sales to $1,606 million, but a fall in net income and earnings per share, reflecting subtle pressures on the company's profitability. Meanwhile, the market showed resilience with the S&P 500 and Nasdaq gaining after a recent downturn, which might paint a favorable backdrop for the company's 2.96% price increase over the last quarter. Potential acquisition plans hinted by the company could also play a role in its stock performance as investors assess growth strategies amid a recovering market scenario.

Buy, Hold or Sell McCormick? View our complete analysis and fair value estimate and you decide.

Over the past five years, McCormick's total shareholder return of 23.06% reflects its consistent efforts to enhance profitability through strategic initiatives such as digital transformation and expansion into high-margin product categories. Notably, the company's ongoing investment in brand marketing and product optimization has underpinned its earnings growth. Despite some regional challenges, these steps have bolstered McCormick's competitive edge. Moreover, recent dividend increases underscore the company's commitment to returning value to shareholders, which has been a positive factor in its five-year performance.

Throughout the last year, McCormick outperformed both the US Market, which returned 8.1%, and the US Food industry, which saw an 8.9% decline. While earnings growth over one year improved by 15.9%, its five-year average was a modest decline of 0.3% annually. Additionally, McCormick's focus on acquisitions aims to drive long-term growth, potentially offsetting revenue pressures from geopolitical issues and currency headwinds. Investors should consider these elements in the context of ongoing market developments.

Review our growth performance report to gain insights into McCormick's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKC

McCormick

Manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavorful products to the food industry.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives