- United States

- /

- Food

- /

- NYSE:LW

What Recent 17% Jump Means for Lamb Weston’s 2025 Outlook

Reviewed by Bailey Pemberton

Deciding what to do with Lamb Weston Holdings stock right now? You are not alone. With shares recently closing at $64.75 and delivering a solid 16.9% bump over the last month, investors are looking for clues about where this frozen potato powerhouse might be headed next. That March turnaround comes after a tougher year, with shares down 14% over the past 12 months and still showing a modest 10.8% gain over five years, which trails the broader market by quite a margin. So, is the worst over, or is this a value trap in disguise?

Zooming in on recent news, changes in consumer trends and rising input costs have dominated headlines. These industry challenges may sound familiar, but Lamb Weston has been proactive in recalibrating its operational strategies. Some analysts suggest this is helping change investor perceptions about the company’s risk profile, accounting for at least part of its recent surge. At the same time, management has pushed forward with cost efficiencies and targeted expansion in international markets. These are moves investors should pay close attention to when considering the long-term outlook.

When we run the numbers, Lamb Weston earns a value score of just 2 out of 6, meaning it appears undervalued on only a third of standard valuation checks. So, how exactly does the company stack up using different valuation methods? In the next section, we will break down the approaches one by one before exploring whether there is a better way altogether to judge if Lamb Weston is a buy, sell, or hold.

Lamb Weston Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lamb Weston Holdings Discounted Cash Flow (DCF) Analysis

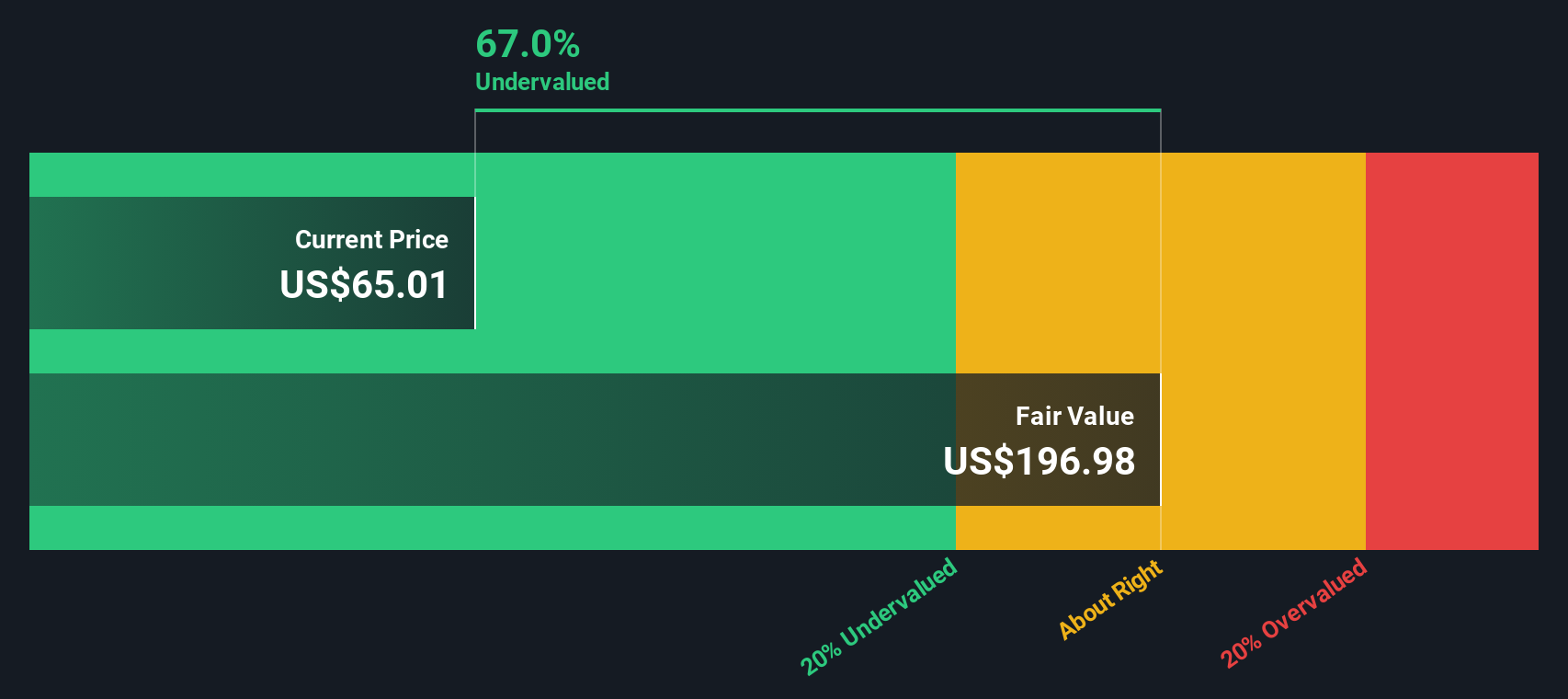

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s terms. For Lamb Weston Holdings, this approach uses analyst forecasts for Free Cash Flow (FCF) over the next five years and extrapolates further based on reasonable growth assumptions.

Currently, Lamb Weston’s Free Cash Flow stands at $136.7 million. According to analyst consensus, FCF is projected to grow steadily, reaching $939 million by 2030. These forecasts indicate expectations of significant improvement in the company’s ability to generate cash. It is worth noting that after the fifth year, projections are extended using broader financial modeling techniques rather than direct analyst estimates.

After tallying these discounted future cash flows, the DCF model calculates an intrinsic fair value of $196.98 per share. With shares recently trading at $64.75, this implies that Lamb Weston stock is 67.1% undervalued based on this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lamb Weston Holdings is undervalued by 67.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Lamb Weston Holdings Price vs Earnings

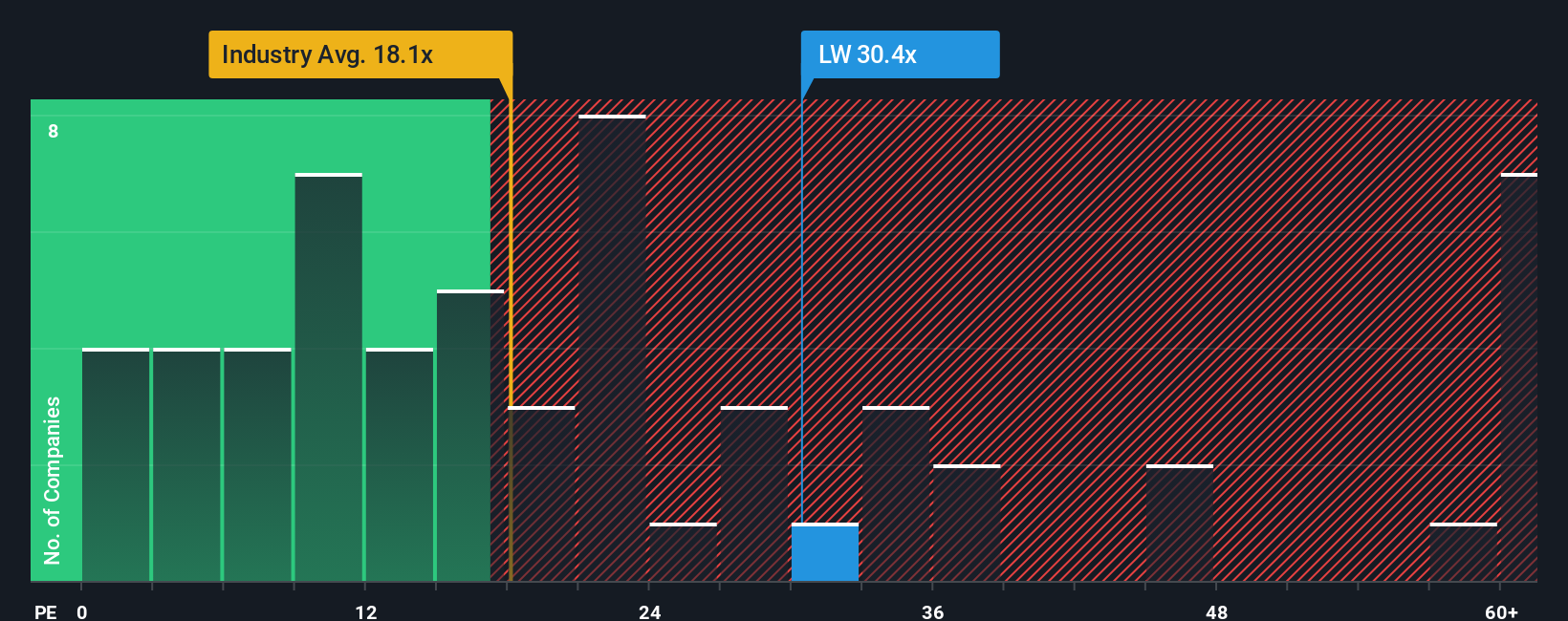

The Price-to-Earnings (PE) ratio is a popular and effective valuation tool, especially for established, profitable companies like Lamb Weston Holdings. This metric gives investors a straightforward way to gauge how much the market is willing to pay today for a dollar of future profits.

It is important to recognize that a “normal” or fair PE ratio is not set in stone. Growth expectations play a major role, as fast-growing companies often command higher multiples. Similarly, businesses with more stable earnings or lower risks tend to be valued at a premium compared to peers with uncertain outlooks.

Right now, Lamb Weston trades at a PE ratio of 30.7x. For context, this is meaningfully above the food industry average of 17.9x and the peer average of 11x. At face value, this might signal the stock is expensive relative to its sector. However, comparing only to peers and industry benchmarks can miss important nuances.

This is where the Simply Wall St “Fair Ratio” comes in. The Fair Ratio for Lamb Weston currently stands at 25.8x, calculated with proprietary criteria that account for factors such as the company’s growth prospects, industry characteristics, profit margins, overall risk profile, and market capitalization. This multifaceted approach takes the analysis further than a simple industry or peer comparison.

Comparing Lamb Weston’s current PE of 30.7x to its Fair Ratio of 25.8x, the stock appears overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lamb Weston Holdings Narrative

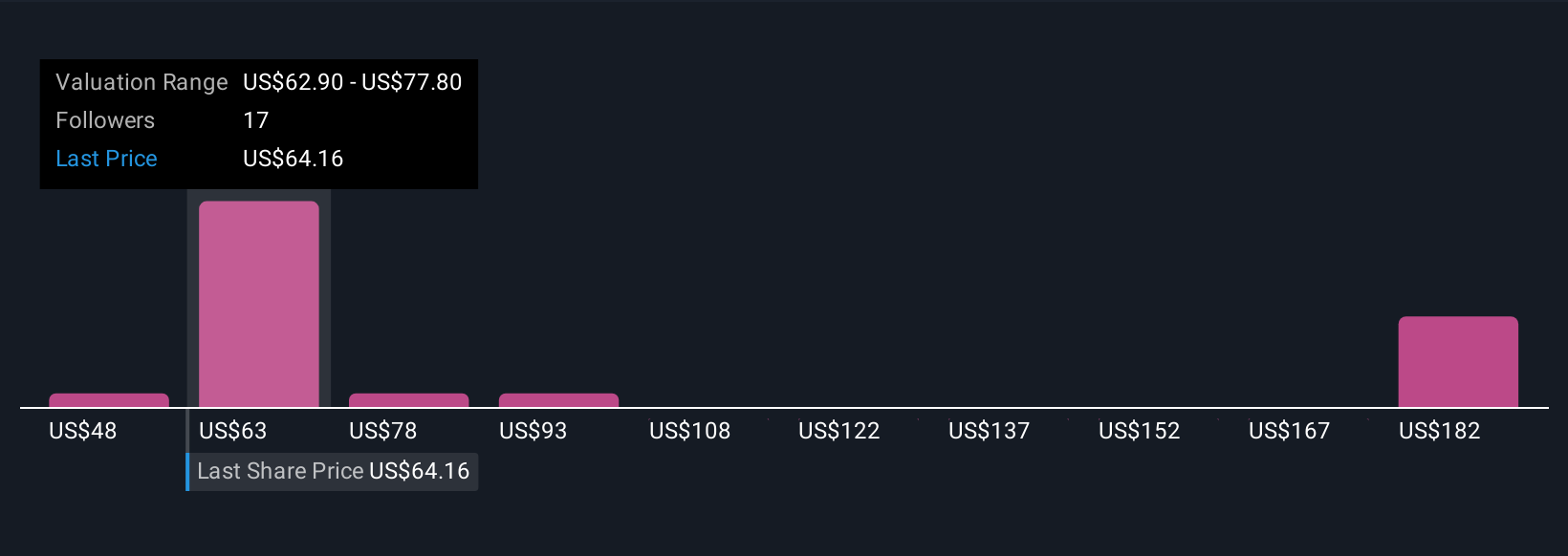

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company—the why behind your beliefs about its future—paired with the numbers you expect for revenue, profit margins, and fair value. Narratives allow you to link your perspective and research to a concrete financial forecast, making your viewpoint concrete and actionable rather than just a hunch.

On Simply Wall St's Community page, millions of investors use Narratives to set out their forecasts and see how they compare to others, all with just a few clicks. Narratives make it easy to update your outlook as new news or earnings come out, dynamically reflecting the latest data. By connecting your personal Narrative to a fair value, you can see at a glance whether the current price looks attractive or not, helping you decide when to buy, sell, or hold.

For example, some investors see Lamb Weston unlocking significant opportunity from global QSR channel expansion and operational efficiency, projecting a fair value around $80 per share. Others focus on headwinds like competition or slimmer margins in emerging markets, with Narratives supporting a more cautious target near $57. In short, Narratives empower you to invest with clarity and confidence, based on your own reasoning.

Do you think there's more to the story for Lamb Weston Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives