- United States

- /

- Food

- /

- NYSE:LW

Lamb Weston (LW): Is the Recent 10% Pullback Creating a Valuation Opportunity?

Reviewed by Simply Wall St

Lamb Weston Holdings (LW) has quietly drifted lower this year, even as its earnings and revenue continue to grow. With the stock down about 10% year to date, investors are revisiting its long term case.

See our latest analysis for Lamb Weston Holdings.

At around a 10% year to date share price decline and a 1 year total shareholder return of roughly negative 21 percent, the stock looks more like a slow bleed than a collapse. Recent setbacks appear to reflect investors reassessing execution risks rather than abandoning the company’s long term growth story.

If Lamb Weston’s pullback has you rethinking where to look for steadier momentum, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings still growing, shares trading below analyst targets, and valuation indicators mixed, the key question now is whether Lamb Weston’s recent slide has opened up a genuine buying opportunity or if the market already reflects its future growth.

Most Popular Narrative: 9.5% Undervalued

With Lamb Weston closing at $59.70 against a narrative fair value of $66, the gap hints at unpriced recovery potential in volumes and margins.

The analysts have a consensus price target of $63.727 for Lamb Weston Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the more bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $57.0.

Curious what kind of slow but steady revenue climb, margin rebuild, and lower future earnings multiple still justify a higher value than today? The narrative spells it out.

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained restaurant traffic weakness and prolonged pricing pressure could stall volume recovery and undermine the margin rebuild the bullish narrative depends on.

Find out about the key risks to this Lamb Weston Holdings narrative.

Another View: Multiples Flash a Very Different Signal

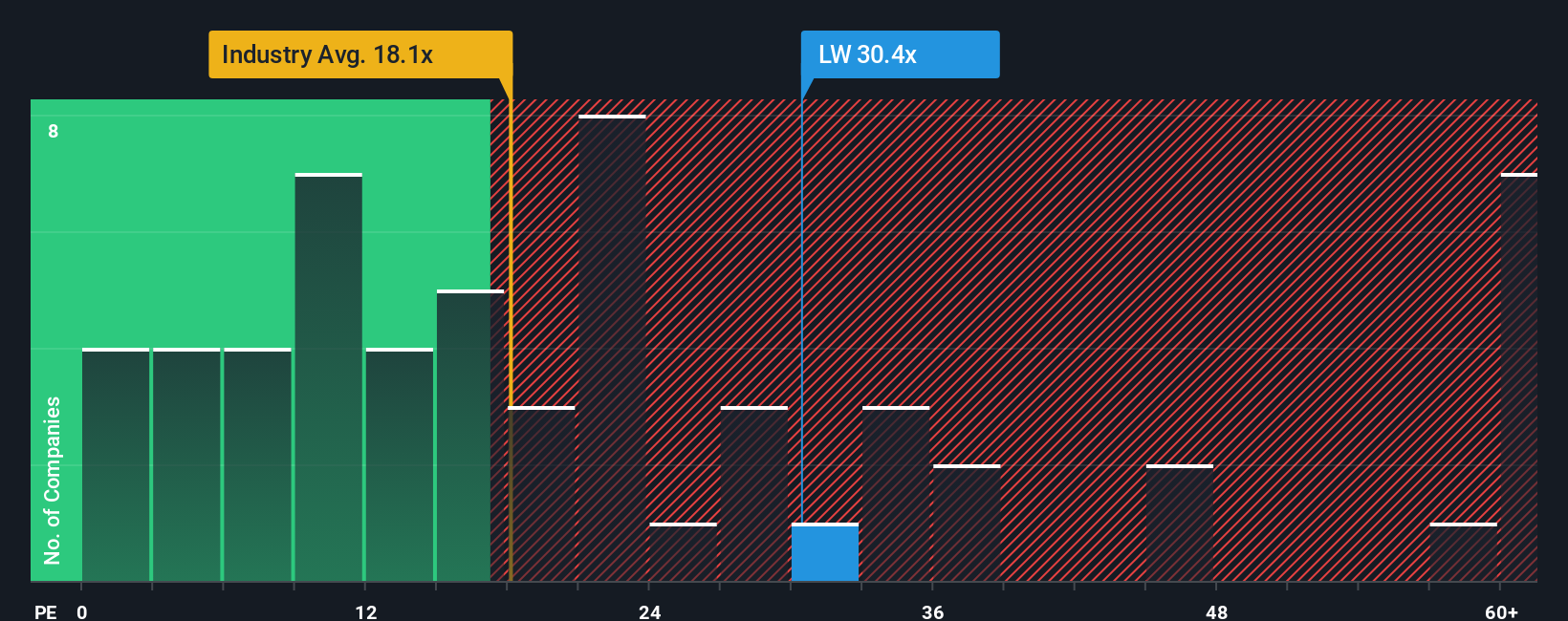

While the narrative fair value suggests Lamb Weston is modestly undervalued, the earnings multiple tells a tougher story. At about 28.3 times earnings versus 20.4 times for the US Food industry and a fair ratio of 24.3 times, the stock screens rich, not cheap, raising the question of which signal deserves more weight.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lamb Weston Holdings Narrative

If the story here does not quite match your own view, you can dig into the numbers yourself and build a fresh narrative in minutes: Do it your way.

A great starting point for your Lamb Weston Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity using the Simply Wall Street Screener, or you risk overlooking stocks that may be quietly contributing to tomorrow’s returns.

- Identify potential mispricings early by scanning these 906 undervalued stocks based on cash flows that the market may not have fully appreciated yet.

- Gain exposure to structural shifts in technology by targeting these 26 AI penny stocks positioned to participate in demand for intelligent automation.

- Support your long term income stream by focusing on these 15 dividend stocks with yields > 3% that can help underpin cash flows in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026