- United States

- /

- Food

- /

- NYSE:LW

Lamb Weston (LW): Assessing Valuation After Major Argentina Facility Launch Targets Latin American Growth

Reviewed by Kshitija Bhandaru

Lamb Weston Holdings (NYSE:LW) has officially opened its new 40,000-square-meter production facility in Mar del Plata, Argentina, signaling a major step in its strategy to serve rising demand across Latin America, particularly in Brazil.

See our latest analysis for Lamb Weston Holdings.

These expansions arrive during a period of strengthening momentum for Lamb Weston Holdings. The 30-day share price return is nearly 13%, and gains over the past 90 days exceed 24%. Even so, the company’s one-year total shareholder return remains negative at -8.5%, signaling that while recent initiatives may be restoring investor confidence, there is still ground to recover compared to longer-term performance.

If new production capacity and fresh market opportunities have you curious about what else is gaining steam, now’s a great time to discover fast growing stocks with high insider ownership

With robust expansion underway and recent gains in share price, the question remains: Is Lamb Weston still undervalued after recent momentum, or is the company’s growth story already factored into its current valuation?

Most Popular Narrative: 3% Undervalued

Lamb Weston Holdings closed at $63.75, just below the consensus fair value of $66. According to the most widely followed narrative, this small gap sets the stage for a debate about whether recent company expansion is fully reflected in the share price, or if the market is still underestimating future momentum and profitability gains.

The global expansion of QSRs and modernization of foodservice channels, especially in emerging markets, is creating new distribution opportunities for Lamb Weston. The company's focus on strategic investments in priority global markets positions it to capture this demand, potentially driving sustained volume growth and topline revenue expansion.

What’s fueling the math behind this target? Analysts are betting on increased profitability, rising margins and a lower future profit multiple to support a higher price. The key assumptions might surprise you.

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing price headwinds and persistent competitive pressures in key markets could still dampen Lamb Weston’s recovery and challenge the optimistic outlook.

Find out about the key risks to this Lamb Weston Holdings narrative.

Another View: Valuation Gaps Widen Under Closer Scrutiny

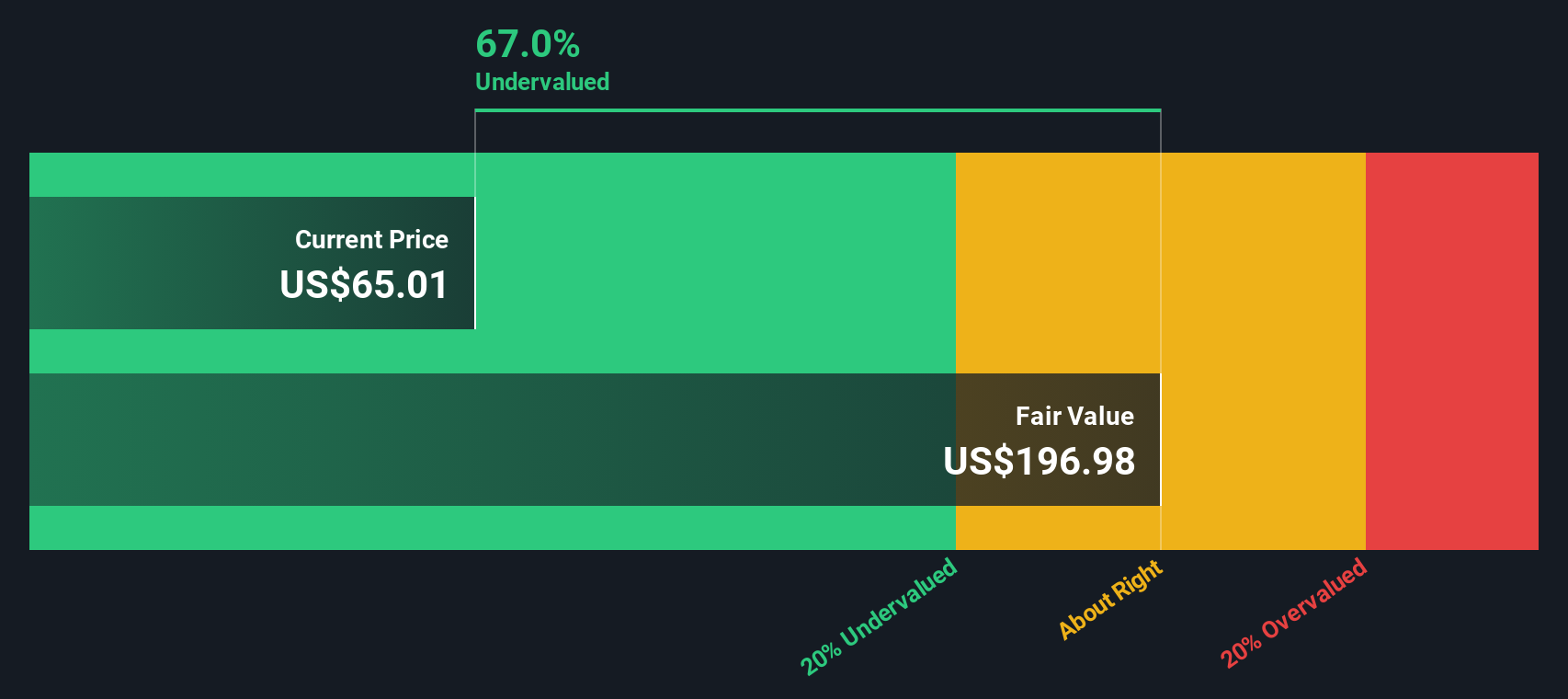

While consensus opinion pegs Lamb Weston as 3% undervalued, our DCF model paints a dramatically different picture. According to this approach, shares trade almost 68% below fair value, signaling a much deeper disconnect between current market price and the company’s long-term cash flows. Which perspective will prove more accurate as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lamb Weston Holdings Narrative

If you have a different viewpoint or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Lamb Weston Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Smart investors stay ahead by scouting multiple winning trends. Take charge of your financial future and explore standout opportunities beyond Lamb Weston Holdings.

- Find the next disruptors in artificial intelligence by checking out these 24 AI penny stocks, where today’s innovators are building the tech platforms of tomorrow.

- Maximize potential gains by targeting these 892 undervalued stocks based on cash flows, which features companies that offer compelling value based on rigorous cash flow analysis and healthy fundamentals.

- Secure steady income streams by reviewing these 19 dividend stocks with yields > 3%, highlighting companies with exceptionally strong dividend yields surpassing 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives