- United States

- /

- Food

- /

- NYSE:LW

Earnings Working Against Lamb Weston Holdings, Inc.'s (NYSE:LW) Share Price Following 27% Dive

The Lamb Weston Holdings, Inc. (NYSE:LW) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 41% in that time.

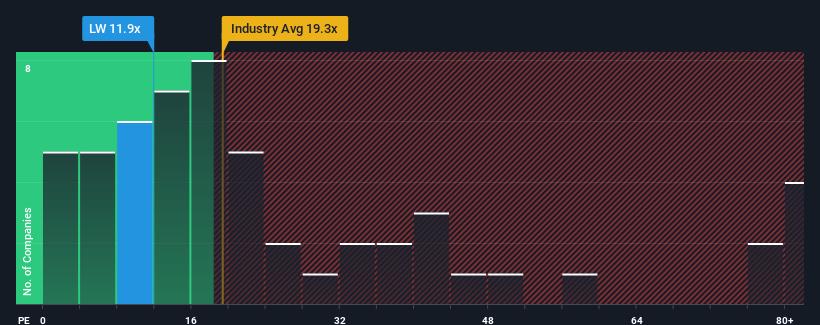

Even after such a large drop in price, Lamb Weston Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.9x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 34x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Lamb Weston Holdings has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Lamb Weston Holdings

What Are Growth Metrics Telling Us About The Low P/E?

Lamb Weston Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 28%. Still, the latest three year period has seen an excellent 133% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 2.4% each year during the coming three years according to the twelve analysts following the company. That's shaping up to be materially lower than the 10% per year growth forecast for the broader market.

In light of this, it's understandable that Lamb Weston Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Lamb Weston Holdings' P/E has taken a tumble along with its share price. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Lamb Weston Holdings maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Lamb Weston Holdings that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives