- United States

- /

- Beverage

- /

- NYSE:KOF

Is Now the Right Moment to Reevaluate Coca-Cola FEMSA After 9.5% Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Coca-Cola FEMSA. de is offering real value right now? This could be the perfect time to see if there is upside left or if the stock is already priced for perfection.

- Shares have surged 9.5% over the last month and are up an impressive 18.5% over the past year, hinting at optimism or renewed risk among investors.

- The recent momentum has coincided with sector-wide interest in beverage companies after expanding distribution partnerships were announced, as well as broader market enthusiasm for consumer staples with strong cash flows. News of Coca-Cola FEMSA. de’s increased market share in Latin America, along with strategic brand launches, has caught the eye of both institutional and retail investors.

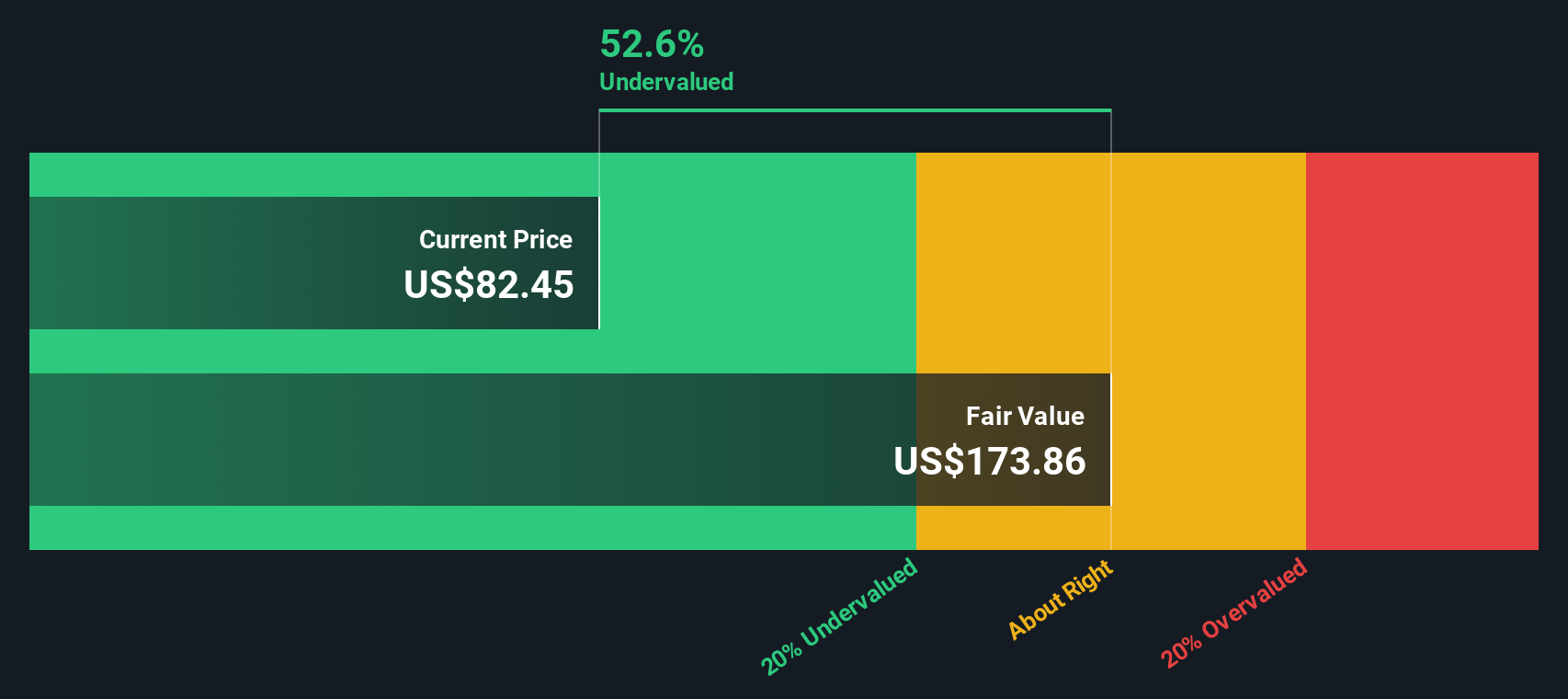

- According to our latest check, the company scores a 5 out of 6 on our valuation scale, signaling undervaluation in most key measures. Let’s break down the standard approaches to valuation for a deeper look, but if you stick around, we’ll show you an even sharper way to cut through the numbers.

Approach 1: Coca-Cola FEMSA. de Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by forecasting its future cash flows and then discounting those projections back to their value today. This approach helps investors determine whether a stock price reflects the company’s actual underlying value based on its potential for generating cash.

Coca-Cola FEMSA. de reported a trailing twelve-month Free Cash Flow of MX$7.46 billion. Looking ahead, analysts forecast steady growth, projecting Free Cash Flow to reach MX$35.12 billion by 2029. It is important to note that direct analyst estimates are provided for the next five years, while longer-term figures are extrapolated.

After running these projections through the model, the estimated intrinsic value per share comes out to $164.45. Compared with the current trading price, this implies the stock is trading at a 46.3% discount to its fair value.

In other words, Coca-Cola FEMSA. de appears significantly undervalued based on its future cash flow potential in MX$ terms. This may offer possible upside for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coca-Cola FEMSA. de is undervalued by 46.3%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Coca-Cola FEMSA. de Price vs Earnings (PE)

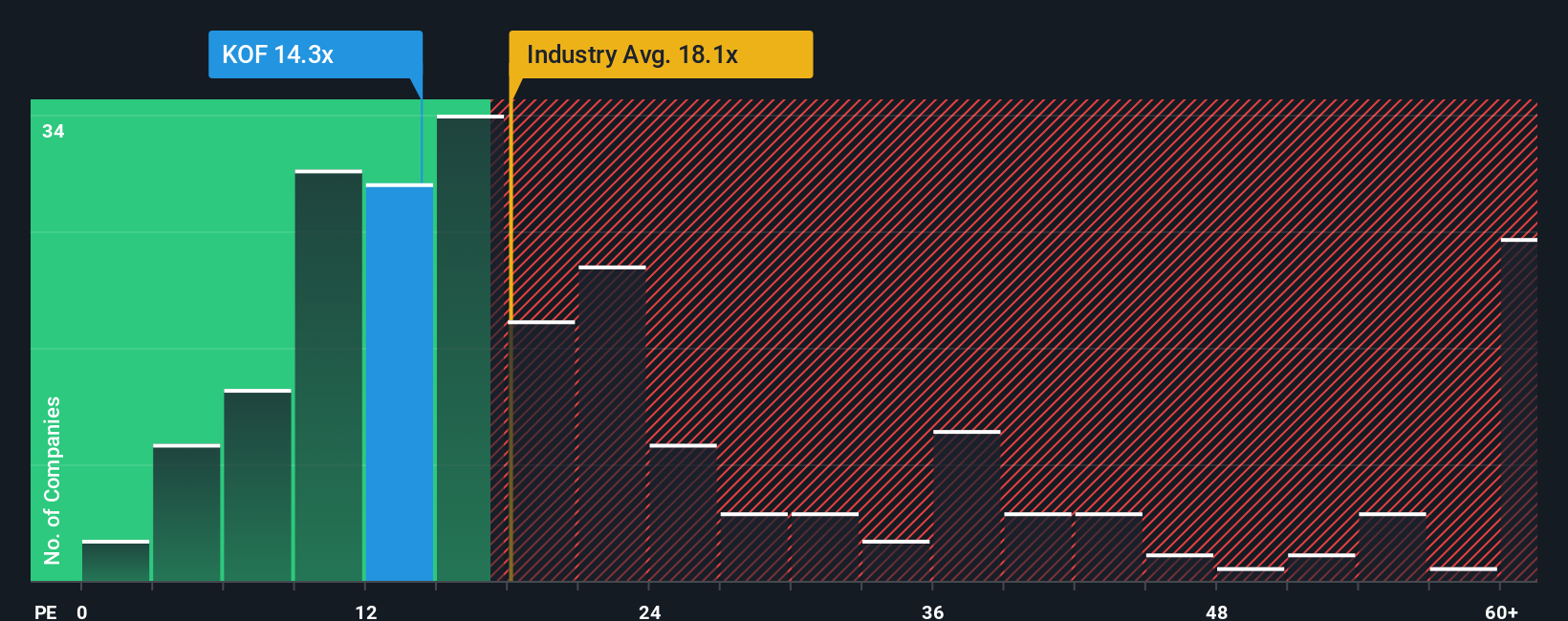

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies, as it reflects what investors are willing to pay for a dollar of the company's current earnings. For a stable, profit-generating business like Coca-Cola FEMSA. de, the PE ratio provides a straightforward way to compare value across peers and the industry.

Growth expectations and perceived risk play major roles in determining a "normal" or "fair" PE ratio for any stock. Higher expected earnings growth or lower business risk can justify a higher PE. Lower growth or more uncertainty tends to pull the number down. A context-based approach is essential to set the right benchmark.

Currently, Coca-Cola FEMSA. de is trading at a PE ratio of 14.4x. This is notably lower than the industry average of 18.5x and the average for its comparable peers at 25.6x. Simply Wall St’s proprietary “Fair Ratio” for the company, which incorporates expectations for growth, margins, industry trends, risk, and market cap, is set at 17.7x.

Unlike basic industry or peer comparisons, the Fair Ratio reflects a more nuanced valuation by recognizing Coca-Cola FEMSA. de’s specific earnings growth prospects, business risks, margin profile, and scale within the beverage sector. This results in a valuation benchmark that is both targeted and pragmatic, rather than a one-size-fits-all number.

With the stock’s PE multiple at 14.4x and the Fair Ratio at 17.7x, Coca-Cola FEMSA. de trades at a meaningful discount to where its fundamentals suggest it should be valued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coca-Cola FEMSA. de Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful feature that helps investors put a company’s story behind the numbers by linking the latest forecasts, future revenue and margin estimates, and a personal perspective to an actionable fair value.

A Narrative is simply your perspective on a company’s future, turned into an investment thesis and a full financial forecast, so you can see how much you think a business is truly worth and why. Narratives make it easy to ground your investment decisions in real stories, not just ratios, letting you transparently share how each key business driver shapes your expectations for revenue, earnings, and fair value. Unlike static models, Narratives update instantly as new news or earnings data arrives, keeping your outlook fresh.

You will find Narratives on Simply Wall St's Community page, where millions of investors compare their stories, check if their estimated Fair Value beats the market price, and decide when to buy or sell with confidence. For example, one bullish Narrative for Coca-Cola FEMSA. de assumes future earnings and margins remain strong even as Mexico’s tax changes have minimal impact, supporting a high price target of $200. Meanwhile, a more cautious Narrative sees risks in regional dependence and margin pressure, setting a conservative target of just $93. This way, you can see the range of views and build your own Narrative that matches your outlook.

Do you think there's more to the story for Coca-Cola FEMSA. de? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KOF

Coca-Cola FEMSA. de

A franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives