- United States

- /

- Beverage

- /

- NYSE:KO

Is Coca-Cola a Good Value After Latest Dividend Increase in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Coca-Cola stock right now? You are definitely not alone. The famous soft drinks giant continues to attract attention from investors, both seasoned and new. Coca-Cola has delivered a healthy 10.7% gain so far this year, but if you zoom in, the picture gets even more interesting: up 2.1% in the past month, barely budging over the last year, and boasting a strong 57.6% return over five years. That mix of near-term stability and long-term growth has been catching more eyes on Wall Street lately, especially as consumer staples get reevaluated in light of global market shifts.

That said, while big swings are rare for this stock, subtle shifts in consumer trends and changing sector sentiment do impact how the market sees its value. So, the real question is: Is Coca-Cola undervalued, overhyped, or exactly where it should be right now?

To help put a number on that, Coca-Cola currently scores a 3 out of 6 on a popular undervaluation check, meaning it is undervalued by half of the measures analysts typically use. But not all valuation approaches are created equal. Next, we will break down what each of these measures actually tells us, and tease out the strengths and blind spots in each. And if you are looking for a more holistic way to think about Coca-Cola's worth, stick around until the end; I have got one more angle you might not want to miss.

Approach 1: Coca-Cola Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects Coca-Cola’s future cash flows and then discounts them back to today’s dollars, aiming to estimate the company’s true intrinsic value. This method highlights how much money Coca-Cola is expected to generate, adjusted for the time value of money.

At present, Coca-Cola’s last twelve months (LTM) free cash flow stands at a negative $634.5 million, but that number is expected to change significantly. According to analysts and model estimates, annual free cash flow is forecast to grow from $11.89 billion in 2026 to $16.43 billion in 2035. While the next few years are based on actual analyst forecasts, the later years use broader growth rates projected by financial modelers.

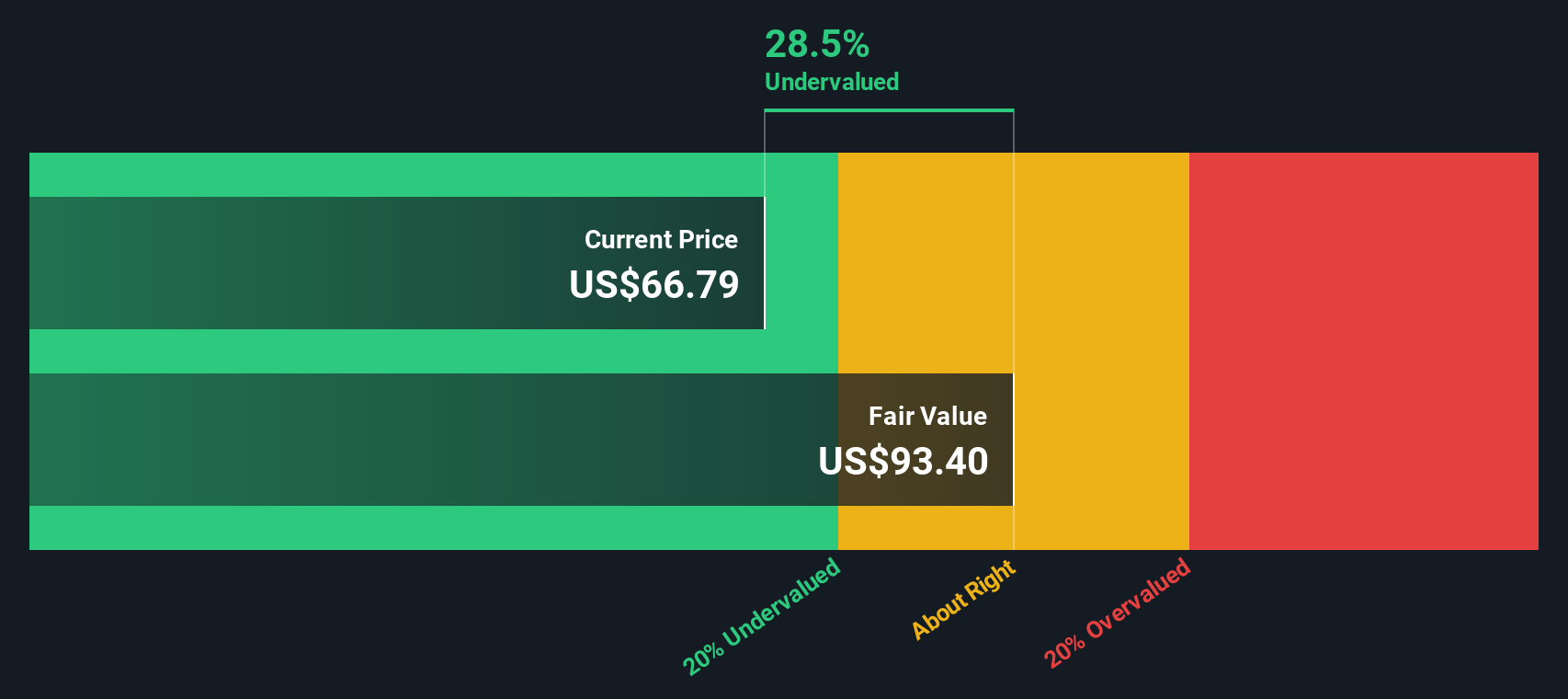

Taking these projected numbers into account, the DCF model estimates Coca-Cola’s intrinsic value at $78.25 per share. This valuation indicates the stock is approximately 12.5% undervalued compared to its current market price. In this analysis, the DCF model suggests investors could be receiving more value than what is reflected by the price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coca-Cola is undervalued by 12.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Coca-Cola Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like Coca-Cola. This ratio is a simple but powerful shorthand that tells investors how much they are paying for each dollar of current earnings. For established businesses with consistent profits, the PE gives a clear sense of whether a stock is expensive or cheap relative to its earnings power.

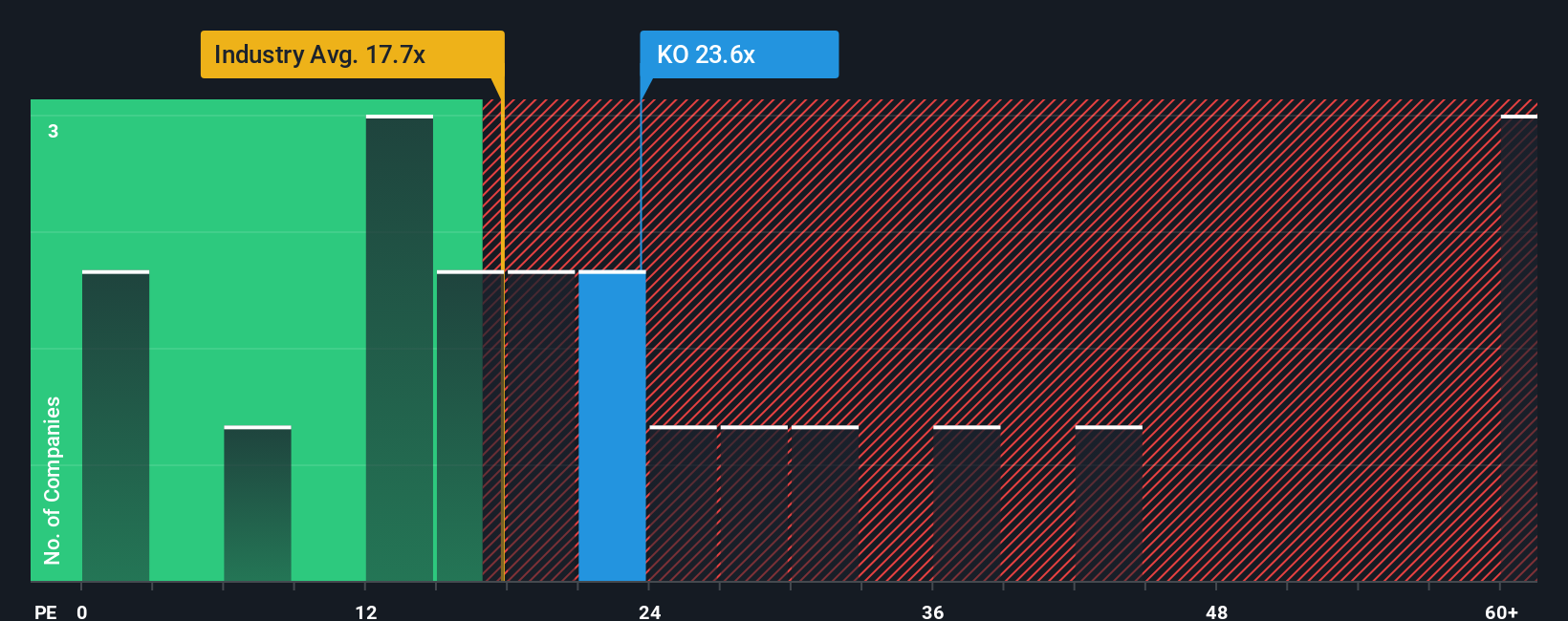

Growth expectations and risk play a big part in shaping what a “normal” PE should look like. Businesses with faster growth or lower risk usually justify a higher PE, while slower-growing or riskier firms see lower multiples. When looking at Coca-Cola, its current PE stands at 24.18x, which is a bit below the average PE of its beverage industry peers at 27.57x, but quite a bit higher than the broader industry average of 17.70x. This difference reflects Coca-Cola’s reliable profits and brand strength, as well as its global scale.

Simply Wall St’s “Fair Ratio” takes these factors much further. It is a proprietary measure built to reflect what a reasonable PE for Coca-Cola should be, once you factor in its profit margins, growth potential, risk profile, industry dynamics, and market cap. Compared to simply benchmarking against similar companies or industry averages, the Fair Ratio offers a more comprehensive and nuanced valuation anchor.

Currently, Coca-Cola’s Fair Ratio is calculated at 24.50x. This is almost exactly in line with its actual PE of 24.18x. This close alignment suggests that Coca-Cola stock is trading very near its fair value based on fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coca-Cola Narrative

Earlier, we alluded to an even better way to make investment decisions. Let’s introduce you to Narratives. A Narrative is a clear, approachable way for investors to connect a company’s story with the numbers behind its valuation. You form and share your own perspective about Coca-Cola’s business strengths, market outlook, and management, then tie that story directly to your assumptions about future revenue, profit margins, and fair value.

Think of Narratives as a bridge between “what you believe” and “what you calculate.” They update dynamically whenever new information hits, keeping you in sync with the latest news and earnings. On Simply Wall St’s Community page (used by millions), Narratives are easy to access for any stock; you can compare your views with others, or build your own, making it a powerful tool for smarter decision making.

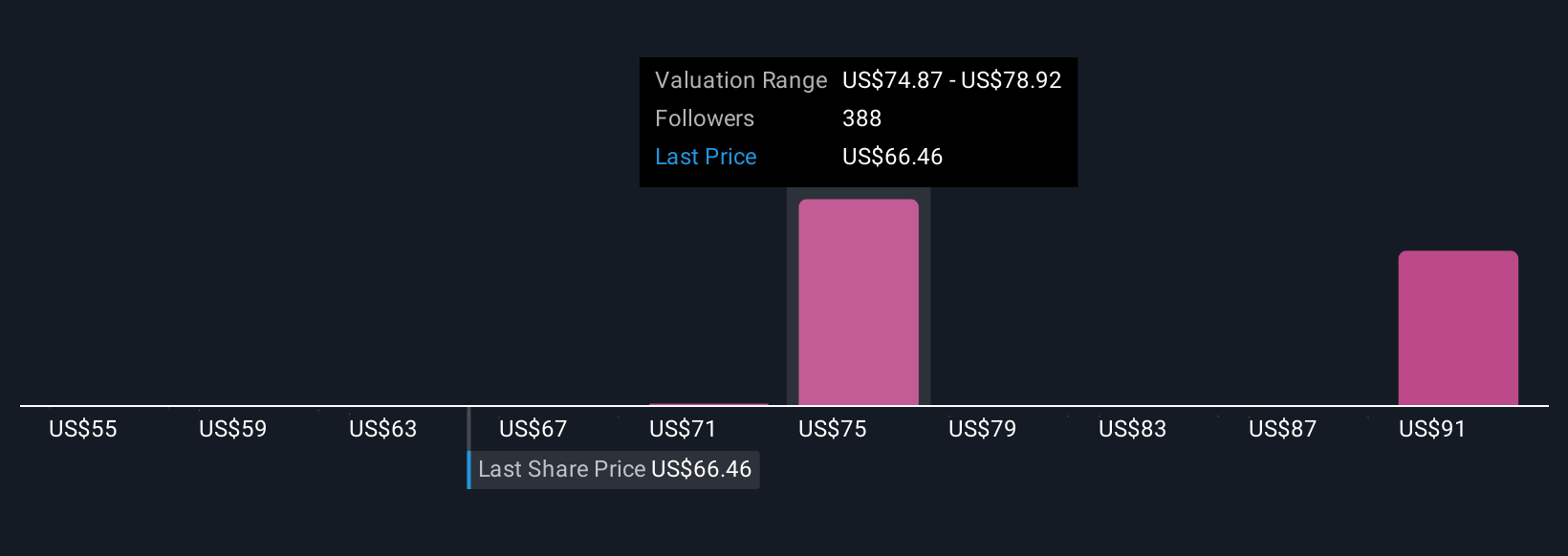

By using Narratives, you can quickly see when your Fair Value (based on your story and forecasts) is higher or lower than the current share price. This can help you decide whether to buy, sell, or hold. For example, on Coca-Cola, some investors forecast modest growth and set a fair value of just $67.50, while others see a stronger decade ahead and set their fair value as high as $77.79 per share.

For Coca-Cola, we’ll make it really easy for you with previews of two leading Coca-Cola Narratives:

🐂 Coca-Cola Bull CaseFair Value: $71.00

Current Price vs. Fair Value: 3.6% undervalued

Revenue Growth Rate: 6.64%

- Coca-Cola’s stable, recession-tested business model and over sixty years of dividend hikes make it a safe haven for investors seeking steady returns.

- Emerging markets and health-conscious beverage trends offer growth. Risks include currency volatility, tariffs, and rising input costs.

- Digital transformation and direct-to-consumer strategies are boosting efficiency. New regulatory and sustainability challenges mean Coca-Cola must stay adaptive to maintain its premium.

Fair Value: $67.50

Current Price vs. Fair Value: 1.4% overvalued

Revenue Growth Rate: 5.23%

- Recent Fed rate cuts boost intrinsic value via lower discount rates. Much of this benefit may already be priced in as cash flow growth moderates.

- Strong margins and predictable free cash flow support a generous dividend. Long-term growth could slow with mounting regulation and consumer shifts.

- If bond yields continue to fall, Coca-Cola could benefit from a “defensive yield” narrative. Future upside is likely limited compared to historic returns.

Do you think there's more to the story for Coca-Cola? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives