- United States

- /

- Beverage

- /

- NYSE:KO

Coca-Cola (KO) Margin Surge Reinforces Bullish Narratives Despite Slower Revenue Growth Projection

Reviewed by Simply Wall St

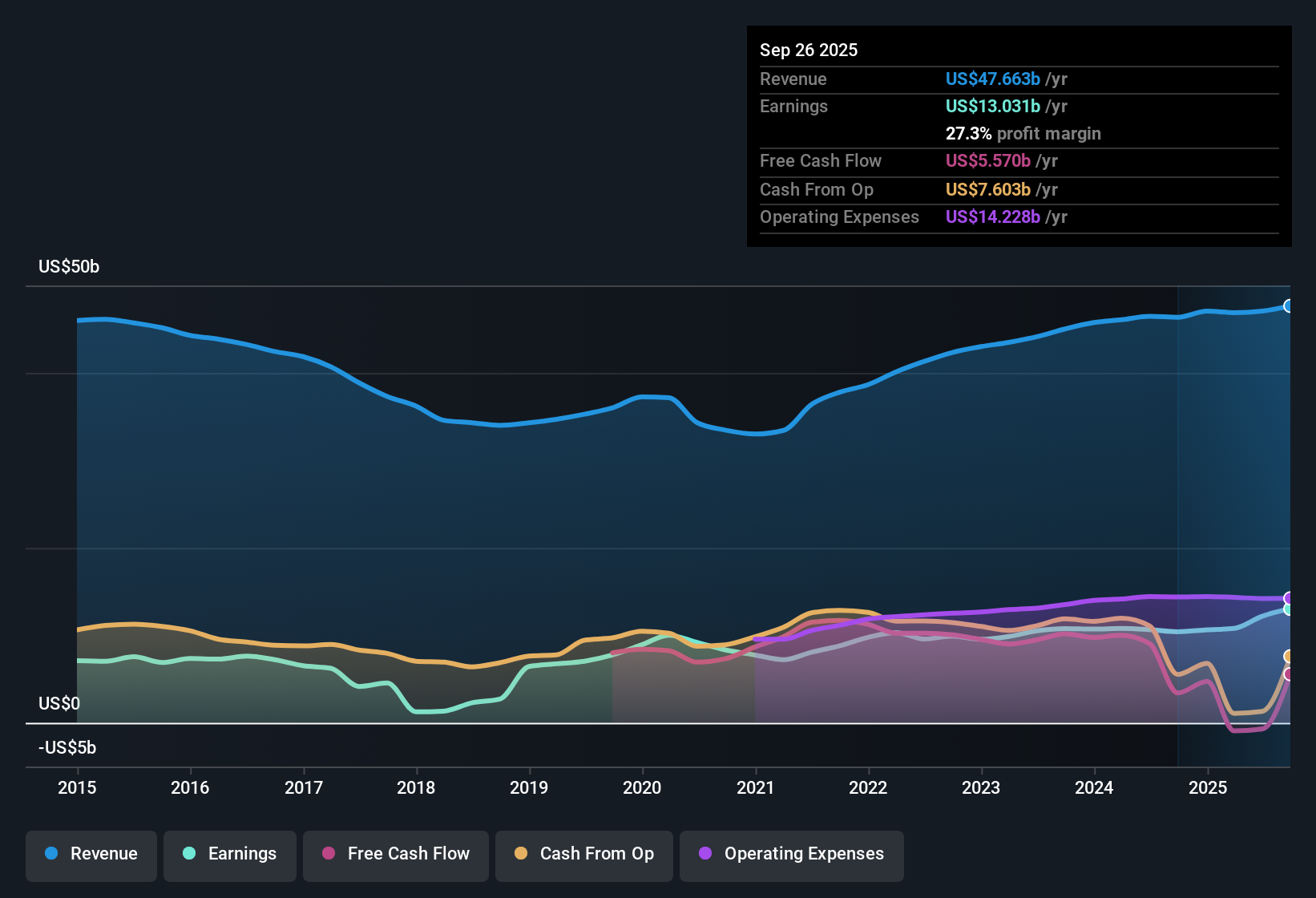

Coca-Cola (KO) posted a net profit margin of 27.3% in its recent results, up from last year’s 22.5%. Earnings grew 25.2% over the past year, well above its five-year annual average of 8.1%. The company’s earnings have climbed at a rate of 8.1% per year over the past five years, and future earnings are projected to rise about 5.2% per year. However, anticipated revenue growth of 5% annually lags behind the broader US market forecast of 10.1%. For investors, the continued earnings momentum, expanding margins, and relative value versus industry peers stand out, balanced by considerations around financial position and dividend sustainability.

See our full analysis for Coca-Cola.With the headline results in place, it is time to see how these numbers compare with the strongest narratives shaping sentiment around Coca-Cola. Let’s dive into how the story stacks up against market expectations.

See what the community is saying about Coca-Cola

Emerging Markets Propel Revenue Potential

- Revenue is projected to grow by 5.4% annually for the next three years, primarily driven by expansion in markets such as Africa, the Middle East, and Asia where increased beverage consumption and targeted marketing campaigns are fueling growth.

- According to the analysts' consensus view, these emerging market gains, combined with Coca-Cola's push into digital sales channels and value-added dairy, are seen as key to offsetting slower revenue growth versus the broader US market.

- Consensus highlights Coca-Cola's direct-to-consumer and e-commerce investments as major levers for both revenue and margin expansion in developing economies.

- The focus on brand equity and operational efficiency through sustainable packaging and marketing transformation is expected to shore up long-term earning power even as global health trends challenge traditional product categories.

- The latest results strengthen analysts' argument that Coca-Cola's global brand and strategic investments still give it an edge even amid sector headwinds. 📊 Read the full Coca-Cola Consensus Narrative.

Operating Margins Benefit From Asset-Light Strategy

- Net profit margin has risen to 27.3%, with analysts projecting margins to increase further to 26.9% in three years as Coca-Cola expands its asset-light model and scales up higher-margin businesses like value-added dairy.

- Consensus narrative notes that ongoing cost management and refranchising are expanding operating margins, and near-term productivity gains are being reinvested into marketing and digital technology.

- This margin improvement directly supports the view that Coca-Cola’s pivot to efficiency and brand-driven channels is making its business more resilient to rising input costs and competitive pressures.

- Analysts see the combination of disciplined spending and e-commerce initiatives as critical in maintaining both profitability and flexibility in changing markets.

Valuation Shows Mixed Signals Versus Peers

- Coca-Cola trades at a Price-to-Earnings ratio of 23.5x, which is less expensive than the peer average of 27.5x, but is above the global beverage industry average of 17.8x. Its current share price of $71.22 also sits below both the DCF fair value of $78.25 and the consensus price target of $77.57.

- The consensus narrative points out that while the current share price offers a potential 9.9% upside to analyst targets, investors must weigh that the required PE ratio for targets (27.7x by 2028) exceeds today’s valuation and would put Coca-Cola at a premium to its sector.

- Analysts emphasize that to justify such a premium, Coca-Cola will need to demonstrate sustained growth in high-margin categories and further operating margin improvement, or risk lagging peers if industry multiples retract.

- This creates a tension. Valuation looks attractive versus peers but less so against industry averages, and depends on the company successfully executing its strategic pivots to justify higher future earnings multiples.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Coca-Cola on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your perspective and create a unique narrative in just a few minutes. Do it your way

A great starting point for your Coca-Cola research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Coca-Cola’s moderate revenue growth and reliance on executing strategic pivots raise concerns about whether it can truly deliver the sustained expansion required to justify a premium valuation.

If you’re seeking steadier progress and fewer question marks, check out stable growth stocks screener (2089 results) to focus on companies with more predictable earnings and consistent revenue momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives