- United States

- /

- Food

- /

- NYSE:K

Does Kellanova’s Snacks Focus Justify Its Strong Multi Year Share Price Gains?

Reviewed by Bailey Pemberton

- Wondering if Kellanova is still fairly priced after its long run, or if there is more upside left in the tank? This breakdown will help you decide whether the current share price actually makes sense.

- The stock has been mostly treading water in the short term, down 0.6% over the last week and roughly flat over the past month at 0.1%. However, that hides a steadier climb of 2.6% year to date and 6.2% over the last year, compounding into 32.5% and 69.5% gains over the past 3 and 5 years.

- Recently, the market has been reacting to Kellanova’s ongoing push to reposition itself as a snappier, higher growth, snacks focused business, with portfolio tweaks and brand investments drawing fresh attention. At the same time, investors are weighing those moves against the company’s more defensive, staple like profile, which can temper volatility but also cap how fast the share price rerates.

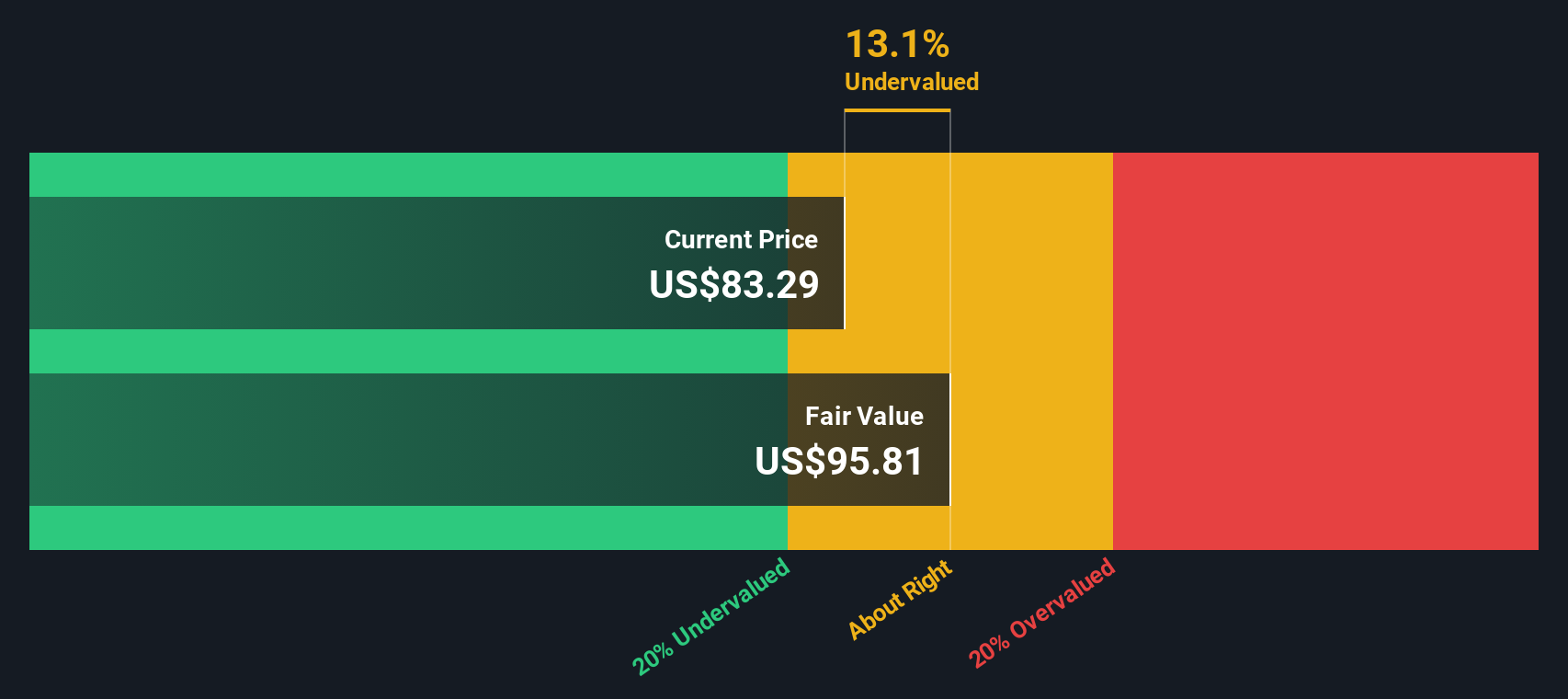

- On our framework, Kellanova currently scores a 2 out of 6 valuation checks, suggesting only limited signs of outright undervaluation right now. We will first walk through the usual valuation approaches before finishing with a more holistic way to think about what the market might be missing.

Kellanova scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kellanova Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back into today’s dollars using a required rate of return.

For Kellanova, the latest twelve month Free Cash Flow is about $594.5 Million. Analysts and internal estimates expect this to grow steadily over time, reaching roughly $1.75 Billion by 2035, as free cash flow compounds from around $1.18 Billion in 2026 to $1.69 Billion in 2034 before that. The early years draw on analyst forecasts, while the later years are extrapolated by Simply Wall St using a 2 Stage Free Cash Flow to Equity model.

When all those future cash flows are discounted back, the model arrives at an estimated intrinsic value of roughly $101.16 per share. Compared with the current share price, this implies Kellanova is about 17.8% undervalued on a DCF basis, suggesting a reasonable margin of safety for long term investors who believe these cash flow assumptions are realistic.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kellanova is undervalued by 17.8%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: Kellanova Price vs Earnings

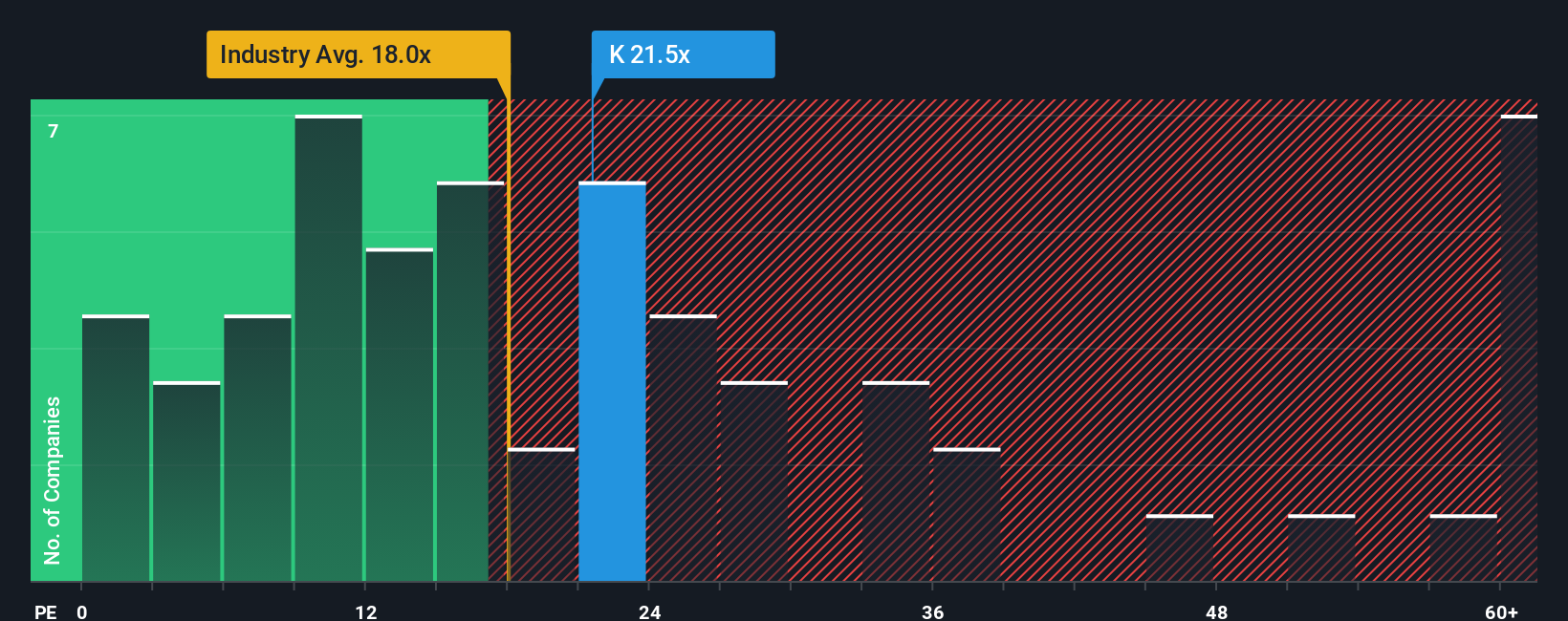

For profitable companies like Kellanova, the price to earnings, or PE, ratio is often the cleanest way to judge whether the market price lines up with underlying performance, because it directly links what investors pay to the profits the business generates.

In practice, a higher PE usually reflects stronger expected earnings growth or lower perceived risk, while a lower PE can signal slower growth, higher risk, or simply low market enthusiasm. Kellanova currently trades on about 22.7x earnings, which is above the Food industry average of roughly 20.5x but slightly below the broader peer group, which averages around 25.0x.

Simply Wall St’s Fair Ratio takes this a step further. It is a proprietary estimate of what Kellanova’s PE should be, given its earnings growth outlook, industry positioning, profit margins, market cap and company specific risks. Because it blends these fundamentals, it is more tailored than a simple comparison with industry or peer averages. For Kellanova, the Fair Ratio is 17.0x, noticeably below the current 22.7x multiple, which points to the shares trading ahead of what the fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

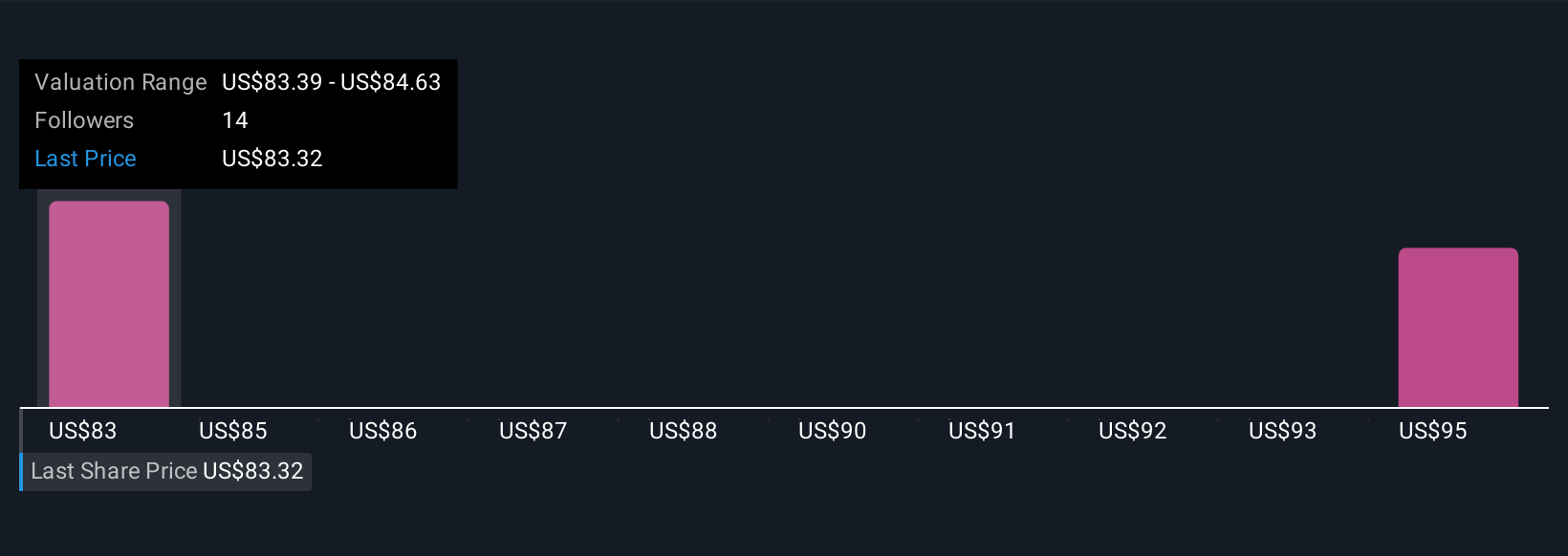

Upgrade Your Decision Making: Choose your Kellanova Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company, captured in your assumptions about its fair value, future revenue, earnings and margins. A Narrative connects what you believe is happening in the real world, like new product launches, pricing power or competitive threats, to a concrete financial forecast and then to an estimated fair value per share. On Simply Wall St, Narratives are an easy, accessible tool available on the Community page, where millions of investors build and share their views in a structured way. Each Narrative turns your thinking into numbers, so you can quickly compare Fair Value to today’s share price and consider whether Kellanova might suit a buy, hold or sell view. As fresh information like earnings releases or major news arrives, Narratives update dynamically, helping you keep your thesis current instead of static. For instance, some Kellanova Narratives on the platform see limited upside near the current $79.48 price, while others justify fair values well above the $83.39 analyst consensus target, reflecting different assumptions about growth, margins and risk.

Do you think there's more to the story for Kellanova? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kellanova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:K

Kellanova

Manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026