- United States

- /

- Food

- /

- NYSE:JBS

JBS (NYSE:JBS): Assessing Valuation After $70 Million Campo 9 Acquisition and Expansion Plans

Reviewed by Kshitija Bhandaru

JBS (NYSE:JBS) has announced a $70 million investment over the next two years to expand and modernize its newly acquired Campo 9 plant in Paraguay. The move comes as the company aims to position the facility as a strategic hub for domestic and international chicken markets. This reflects its ongoing push to diversify operations and enhance competitiveness.

See our latest analysis for JBS.

Despite the bold new investment and expansion into Paraguay, JBS’s share price return has struggled recently, with a 30-day loss of 18.2% and a slide of 7.4% year-to-date. Momentum has faded in the short term as investors weigh market volatility against the company’s longer-term growth moves and international diversification strategies.

If major moves in protein production have you watching global players, it could be the perfect moment to discover fast growing stocks with high insider ownership.

With the stock still trading at a sizable discount to analyst price targets after recent declines, the question for investors is whether JBS now represents an undervalued growth play or if the market is already accounting for its future potential.

Price-to-Earnings of 6.2x: Is it justified?

JBS trades at a price-to-earnings (P/E) ratio of 6.2x, substantially below both its peer average (19.7x) and the US Food industry average (17.8x). This suggests the stock is attractively valued compared to competitors. With the last close at $12.85, the market appears to be pricing in a conservative outlook relative to its peers.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. It is an important benchmark for companies in established sectors like food production, where profitability can be cyclical yet measurable. A lower P/E may signal market skepticism about future growth or confidence in underlying value, depending on company context.

For JBS, this discounted multiple could reflect investor caution regarding its forecasted earnings decline and slower revenue growth compared to market averages. However, it also presents potential upside if the company can capitalize on recent investments or outperform these muted expectations.

Notably, JBS’s P/E stands at less than one-third of the industry norm. This represents a significant discount for a company of its scale and market presence. If market sentiment or growth trajectory improves, there could be room for the valuation to move closer to industry levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.2x (UNDERVALUED)

However, slower revenue growth and a slight annual net income decline could weigh on sentiment if recent investments do not quickly deliver improved performance.

Find out about the key risks to this JBS narrative.

Another View: Discounted Cash Flow Perspective

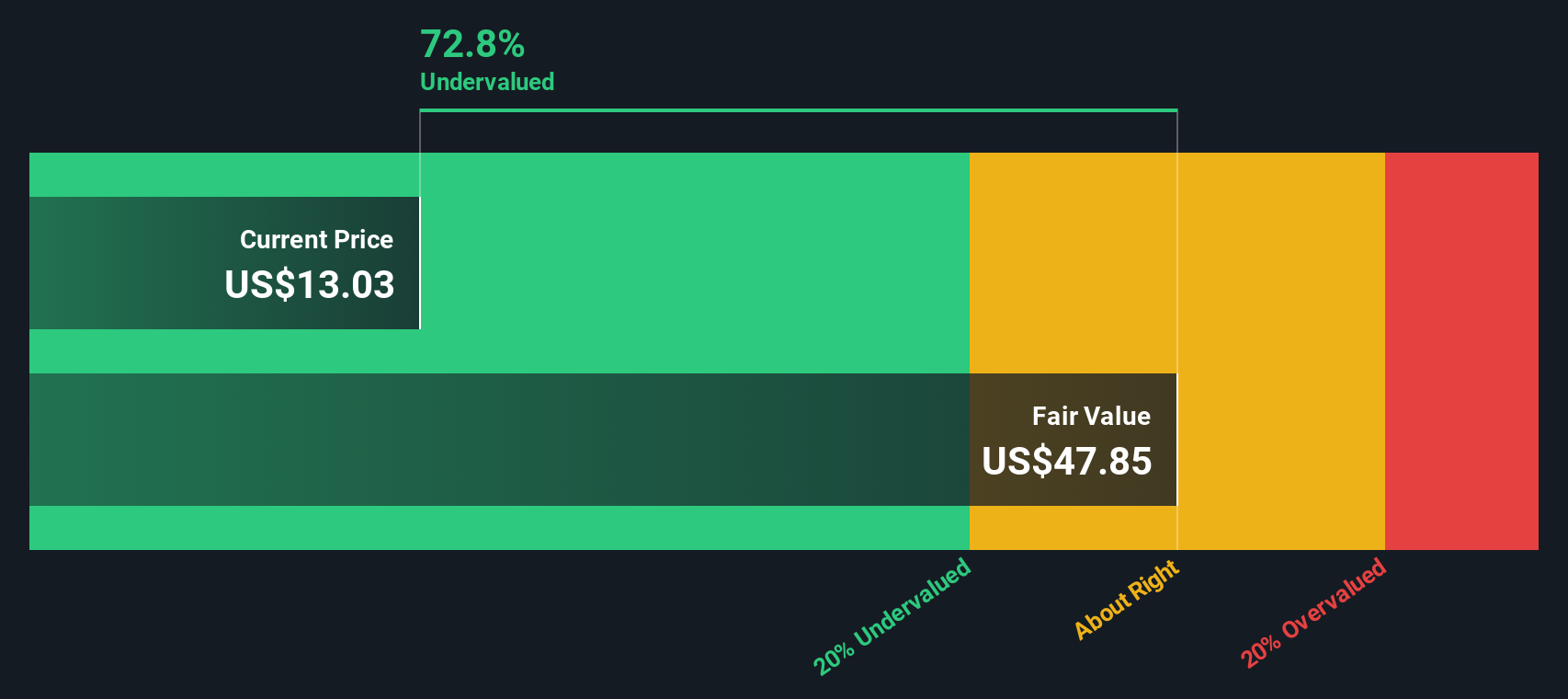

Looking at JBS from the SWS DCF model's perspective, the valuation picture appears even more dramatic. The stock trades at $12.85, while our DCF model estimates fair value at $48.68, which suggests it is undervalued by a wide margin. Is the market missing something, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JBS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JBS Narrative

If you see things differently or want to follow your own research path, crafting your own perspective on JBS takes less than three minutes. Do it your way

A great starting point for your JBS research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio with unique stock picks that stand out in today’s market. Gain an edge now by seeking out these exciting opportunities before others do:

- Capture real value by targeting these 891 undervalued stocks based on cash flows that analysts believe are currently priced below their true worth.

- Unlock growth potential with these 25 AI penny stocks, which are at the forefront of artificial intelligence innovation and industry disruption.

- Secure reliable returns by exploring these 19 dividend stocks with yields > 3%, which offer attractive yields above 3% for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBS

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives