- United States

- /

- Food

- /

- NYSE:INGR

Does Ingredion's (INGR) Share Buyback Reveal Deeper Shifts in Management's Strategic Priorities?

Reviewed by Sasha Jovanovic

- Earlier this month, Ingredion Incorporated announced a new share repurchase program authorizing the buyback of up to 8 million shares through December 2028, and reported its third quarter 2025 results, with sales of US$1.82 billion and net income of US$171 million.

- The company also updated its full-year 2025 guidance with expected flat to low single-digit declines in net sales and reported EPS forecasted between US$11.11 and US$11.31, signaling continued focus on operational discipline amid shifting market conditions.

- We will now examine how the new long-term share repurchase program provides insight into management's confidence and affects Ingredion's investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Ingredion Investment Narrative Recap

To be a shareholder in Ingredion right now, you likely need to believe in the company’s ability to drive steady earnings through disciplined operations, ongoing growth in its specialty ingredients business, and prudent capital allocation, even as persistent price/mix headwinds and foreign exchange impacts challenge top-line momentum. The new share repurchase program, while supportive of shareholder returns, does not materially change the most important short-term catalyst: sustained growth in Texture & Healthful Solutions; nor does it reduce the biggest risk, ongoing FX and pricing pressures in LATAM.

Among recent developments, management’s decision to update 2025 earnings guidance, signaling flat to low single-digit declines in net sales but an expected EPS of US$11.11 to US$11.31, highlights its operational focus despite volume and price/mix pressures. This announcement frames the buyback in context: shareholders may see capital returns continue even as management remains cautious on near-term revenue challenges. Yet, despite these signals, investors should be aware that...

Read the full narrative on Ingredion (it's free!)

Ingredion's outlook anticipates $7.8 billion in revenue and $696.0 million in earnings by 2028. This is based on a 2.0% annual revenue growth rate and a $20.0 million increase in earnings from the current $676.0 million.

Uncover how Ingredion's forecasts yield a $141.83 fair value, a 32% upside to its current price.

Exploring Other Perspectives

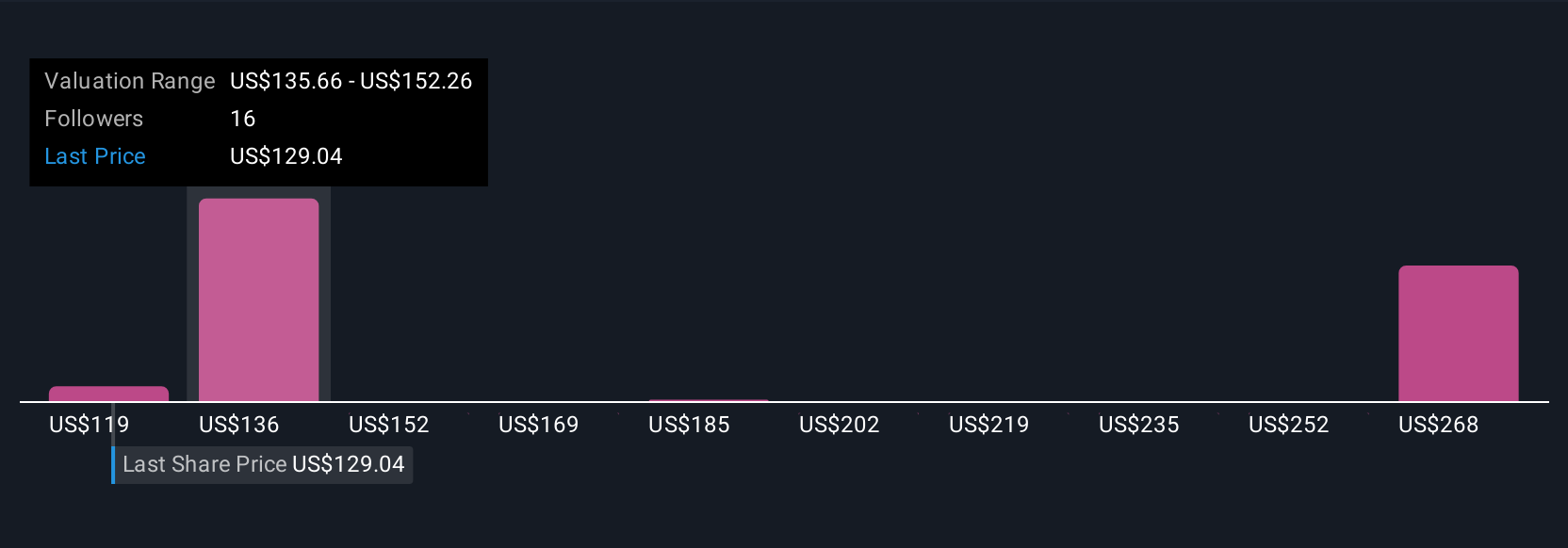

Simply Wall St Community members have fair value estimates for INGR ranging from US$97.06 to US$141.83, with five unique perspectives represented. While these span more than US$44 per share, ongoing LATAM currency and pricing risk may influence outcomes beyond these estimates, explore the range before deciding where you stand.

Explore 5 other fair value estimates on Ingredion - why the stock might be worth as much as 32% more than the current price!

Build Your Own Ingredion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingredion research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ingredion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingredion's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGR

Ingredion

Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives