Last Update 05 Dec 25

INGR: Healthful Solutions Strength Will Support Rebound Despite Food Ingredients Weakness

Analysts have trimmed their price target on Ingredion to $124 from prior levels near the mid $150s, citing mounting caution around softer demand and profit headwinds in the Food and Industrial Ingredients segment, as well as a more challenging consumer and macro backdrop.

Analyst Commentary

Recent notes from Wall Street reflect a mixed but increasingly cautious stance on Ingredion, with target prices reset lower to reflect a tougher earnings setup and macro environment.

Bullish Takeaways

- Bullish analysts highlight that the core Texture and Healthful Solutions segment continues to deliver solid volume and profit growth, supporting a premium to purely commodity ingredient peers.

- Despite target cuts, some still see upside potential in the shares relative to current levels and argue that the stock already discounts a good portion of near term macro and demand risk.

- Ongoing portfolio exposure to higher value specialty ingredients is viewed as a structural growth driver that could re accelerate earnings once comparables ease and pricing stabilizes.

- Management’s track record of cost discipline and mix improvement is seen as a key lever to protect margins and restore earnings momentum when demand conditions normalize.

Bearish Takeaways

- Bearish analysts point to persistent demand weakness and profit pressure in the Food and Industrial Ingredients unit, particularly in Latin America and the U.S., as a material drag on overall earnings growth and valuation multiples.

- Lower economic activity in key markets such as Brazil and Mexico is expected to weigh on volumes and profitability for the medium term and limit near term re rating potential.

- The consumer backdrop is described as tepid, with ingredients facing tough year over year comparisons and a challenging price environment that could cap revenue growth and margin expansion.

- With expectations already low into upcoming earnings, some remain broadly cautious on the setup and argue that visibility on a clear inflection in volumes and pricing remains limited and could justify more muted valuation assumptions.

What's in the News

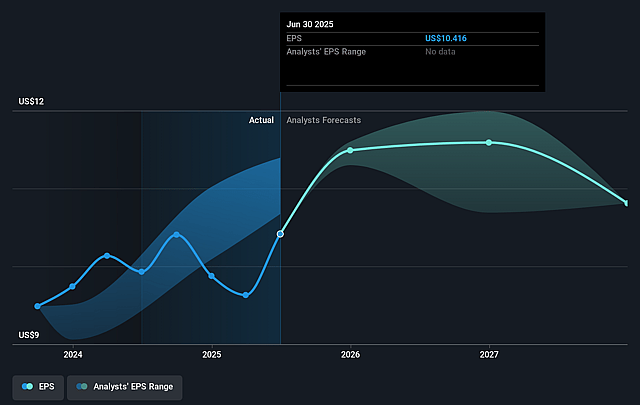

- Updated 2025 guidance calls for reported EPS of $11.11 to $11.31, with flat to low single digit decline in net sales as growth in Texture and Healthful Solutions is offset by lower price mix and FX headwinds (company guidance).

- Ingredion authorized a new share repurchase program for up to 8,000,000 shares running through December 31, 2028. This signals continued capital return to shareholders (company announcement).

- Between July 1 and September 30, 2025, the company repurchased 627,000 shares for $79.48 million, bringing cumulative buybacks under the 2022 authorization to 3,689,000 shares for $449.24 million (buyback tranche update).

- From October 1 to November 3, 2025, Ingredion bought back an additional 211,000 shares for $25.15 million, increasing total repurchases under the 2022 plan to 3,900,000 shares for $474.39 million (buyback tranche update).

- Ingredion held an Analyst and Investor Day in 2025, providing updated strategic and financial commentary to the investment community (Analyst/Investor Day event).

Valuation Changes

- Fair Value Estimate unchanged at approximately $124.33 per share, indicating no material shift in intrinsic value assessment.

- Discount Rate edged down very slightly, from about 6.96 percent to 6.96 percent, reflecting a negligible change in perceived risk profile.

- Revenue Growth effectively flat, with the long term growth assumption holding near 30.11 percent and showing only a minimal downward adjustment.

- Net Profit Margin stable at roughly 9.67 percent, with only a marginal decrease that does not alter the broader profitability outlook.

- Future P/E unchanged at about 13.10 times, suggesting no revision to the market multiple applied to forward earnings.

Key Takeaways

- Expanding specialty portfolio, innovation, and sustainability focus are driving growth, higher margins, and new business opportunities across strategic food industry segments.

- Operational efficiencies, cost optimization, and targeted investments are boosting profitability and positioning the company for sustained international and long-term expansion.

- Global economic and trade instability, input cost pressures, and declines in legacy product demand threaten revenue and margin growth, heightening reliance on specialty ingredient expansion.

Catalysts

About Ingredion- Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

- Strong consumer and customer demand for health and wellness-focused, clean label, and sugar reduction solutions continues to drive double-digit growth in Ingredion's higher-value specialty portfolio, including clean label starches, high-intensity sweeteners, and protein isolates. This trend is expected to sustain above-average revenue and margin growth for the Texture & Healthful Solutions segment.

- Ongoing innovation and investments in R&D-especially in customized formulations and proprietary plant-based ingredients-are widening Ingredion's opportunities with small and medium-sized food brands and insurgent category disruptors, expanding future revenues and allowing for premium pricing that elevates net margins.

- Enhanced operational efficiencies, supply chain digitalization, and cost optimization initiatives have resulted in a structural step-change in segment margins (notably in Texture & Healthful Solutions), with management expecting these higher levels of profitability and operating leverage to persist, improving overall net margins and earnings.

- The company's commitment to sustainable ingredient sourcing and strong ESG credentials is attracting new business from large CPG customers seeking to reformulate for environmental and regulatory objectives. This alignment with evolving food industry standards opens new revenue streams and supports long-term margin resilience.

- Selective capital allocation to high-return organic growth projects and sustained share buybacks, coupled with further international expansion (even amidst temporary LATAM headwinds), position Ingredion to accelerate both top-line growth and EPS over the long run, as secular themes around a growing middle-class and dietary shifts in emerging markets resume momentum.

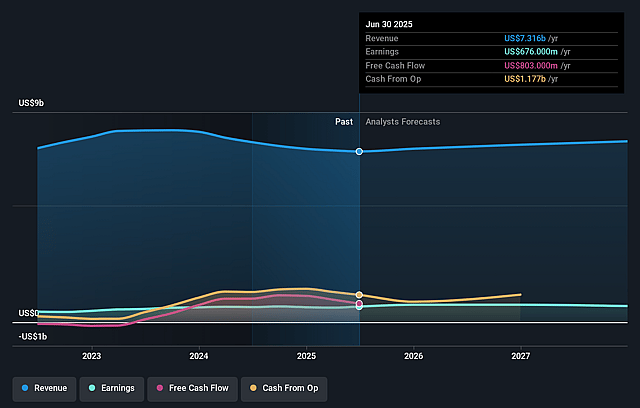

Ingredion Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ingredion's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.2% today to 9.0% in 3 years time.

- Analysts expect earnings to reach $696.0 million (and earnings per share of $10.82) by about September 2028, up from $676.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 12.1x today. This future PE is lower than the current PE for the US Food industry at 19.5x.

- Analysts expect the number of shares outstanding to decline by 1.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Ingredion Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Economic and currency volatility in key emerging markets, especially in LATAM (notably Argentina, Brazil, and Mexico), is contributing to declining volumes and negative foreign exchange impacts, which could lead to persistent revenue and earnings headwinds if macroeconomic weakness and currency depreciation continue.

- Ongoing tariff uncertainties and global trade friction create unpredictability for Ingredion and its customers, leading to conservative guidance, customer inventory rebalancing, and the risk of indirect impacts on demand that may pressure near-term and longer-term revenues and margins.

- The company continues to face price/mix headwinds across major business segments due to pass-through of lower corn and input costs, raising concerns that Ingredion's ability to maintain or grow top-line sales and net income will become more challenging if commodity cost deflation persists.

- Weaknesses in legacy product demand-such as industrial starches (impacted by soft box demand and tariffs) and high fructose corn syrup (HFCS; at risk from consumer trends toward natural or clean-label sweeteners)-put pressure on Ingredion's core revenues and increase the company's dependence on breakout growth from new, higher-margin specialty ingredients.

- While margins in Texture & Healthful Solutions have reached record highs, management acknowledged some results reflected exceptional one-time raw material procurement benefits and cost absorption, and they are signaling caution about sustaining current margin levels amid sourcing, transportation, and potential tariff challenges that could lead to net margin contraction in future periods.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $148.667 for Ingredion based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $168.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.8 billion, earnings will come to $696.0 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $127.07, the analyst price target of $148.67 is 14.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.