- United States

- /

- Food

- /

- NYSE:HSY

Is Hershey’s Sweet Stock Run Justified After Recent 5% Jump in 2025?

Reviewed by Simply Wall St

If you have ever found yourself wondering whether now is the right time to buy, sell, or simply hold onto Hershey stock, you are not alone. Hershey is as much a staple in investors’ portfolios as it is in America’s homes, making each shift in share price worthy of a closer look. Over the past month, Hershey has managed a 5.1% climb, yet year-to-date performance is even sweeter at up 13.0%. Despite this momentum, the one-year return sits at a modest 1.9%, and the three-year stretch has actually shown a -6.9% dip. Zoom out even further and the five-year return tells a far more compelling story at 51.8% growth.

Lately, investors seem to have regained some appetite for defensive consumer staples, especially as markets digest ongoing economic uncertainty and shifts in consumer preferences. While not every move has a direct news trigger, Hershey’s recent lift mirrors a broader market pivot back to companies with stable cash flows.

But here comes the twist. According to standard valuation checks, Hershey currently scores a 0 out of 6 for undervaluation criteria, meaning that by typical metrics, the stock looks overvalued or at best, fully priced in. So, what should you make of this disconnect between the company’s legacy strengths, recent momentum, and a valuation score that does not scream “bargain”?

Let’s break down the various valuation approaches to see what story they tell about Hershey today. Stay tuned, because I will also share a more insightful way to look at value that goes beyond the usual numbers.

Hershey scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Hershey Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and discounts them back to today’s value, providing an estimate of what the company is truly worth based on its ability to generate cash.

For Hershey, the latest reported Free Cash Flow stands at $1.44 billion, a sizable sum reflecting the company’s established position in the food industry. Analyst estimates suggest this strong cash generation will generally persist in the coming years, with projections ranging from $1.26 billion to $1.64 billion through 2030. These forecasts, though robust, anticipate only modest growth over the next decade. After 2028, the projections are largely extrapolated based on reasonable trends rather than direct analyst guidance.

Using these projections, the DCF model arrives at an intrinsic value of $137.35 per share. Comparing this to Hershey’s current market price, the analysis indicates the stock is 38.9% above its fair value. In other words, the model suggests Hershey may be overvalued relative to the cash it is expected to generate moving forward.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Hershey.

Approach 2: Hershey Price vs Earnings (PE Ratio)

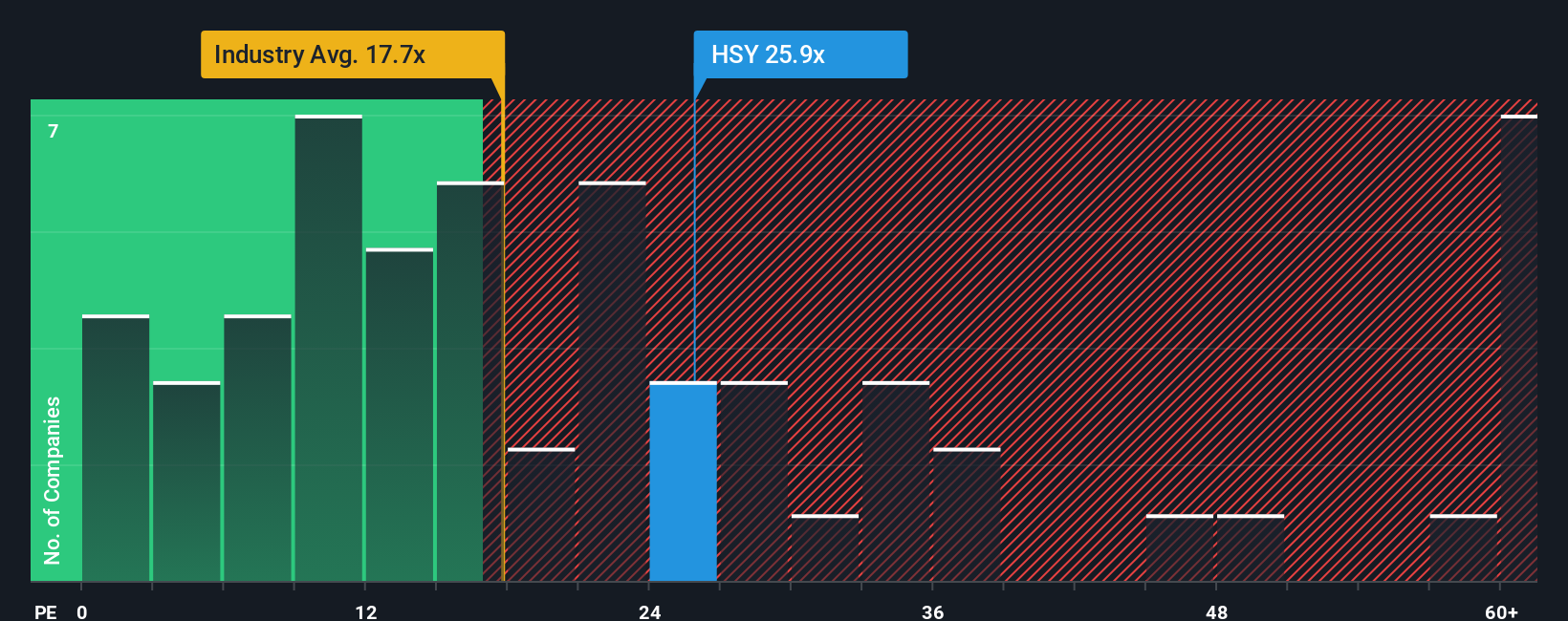

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Hershey. It provides a straightforward way to gauge whether a stock’s price reflects its underlying earnings power, making it particularly useful for established, consistently profitable businesses.

A "normal" or "fair" PE ratio depends on how fast a company is expected to grow and how stable or risky its earnings are. Generally, companies with higher growth prospects or lower risks command higher PE ratios, while more mature or riskier companies warrant lower multiples.

Hershey’s current PE ratio stands at 25x. This is comfortably above both the industry average of about 19x and its direct peer group average of 19x. At first glance, this appears to suggest a premium valuation, possibly reflecting Hershey’s strong brand and consistent profitability.

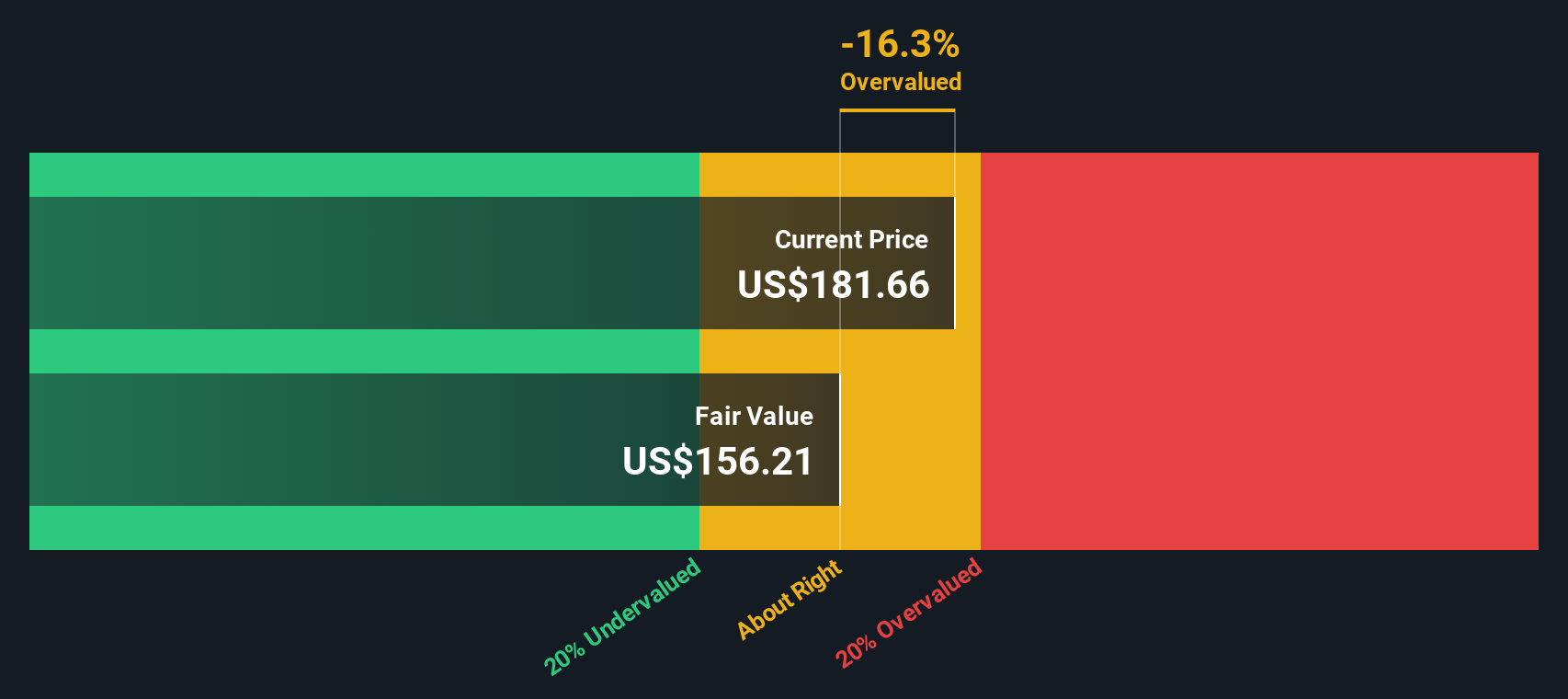

This is where the Simply Wall St "Fair Ratio" comes in. The Fair Ratio is a proprietary benchmark that goes a step beyond industry or peer comparisons by factoring in Hershey’s earnings growth, profit margin, market cap, business risks, and its specific sector dynamics. In Hershey’s case, the Fair Ratio is 23.9x, just slightly below its current PE. This tailored approach provides deeper insight, especially for a mature, stable company in the Food sector.

With a difference of just 1.1x, Hershey’s valuation is very close to what its fundamentals justify. On this measure, the stock price appears appropriate given the quality and profile of the business.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Hershey Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that helps investors tell their story about a company by combining their own outlook on revenue growth, profit margins, and fair value into one easily updated forecast.

Rather than just focusing on what the market or analysts think, Narratives let you connect the dots from Hershey’s business story to your financial projections and what you believe is a fair stock price. Available to millions on Simply Wall St’s Community page, Narratives make it easy to see how changing assumptions or new events affect your view. They update automatically whenever fresh news or earnings are released.

Narratives are especially helpful for buy or sell decisions, as they put your Fair Value side by side with the current price, making it clear whether Hershey is above or below your expectations. For example, some investors see opportunities in new Reese’s launches and successful tariff mitigation, aiming for a fair value as high as $211 per share, while others are more cautious about cocoa costs and margin pressures, setting a fair value closer to $123 per share.

However you frame your Narrative, it is the fastest way to put your perspective into action so you are always investing with the whole story in mind.

Do you think there's more to the story for Hershey? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives