- United States

- /

- Food

- /

- NYSE:HSY

How Governance Tweaks and Cost Relief Hopes Could Shape Hershey’s (HSY) Margin Story

Reviewed by Sasha Jovanovic

- Earlier in December 2025, The Hershey Company’s board amended its bylaws to reinforce independent board leadership and clarify emergency governance procedures, while JAKKS Pacific announced a new Hershey-branded “Charming” collectibles line launching at CVS on December 26, 2025.

- At the same time, Morgan Stanley highlighted easing cocoa cost pressures and a potential multiyear margin recovery as key reasons for upgrading its view on Hershey’s earnings outlook.

- Next, we’ll assess how expectations for margin recovery as cocoa costs ease could reshape Hershey’s existing investment narrative and risk profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Hershey Investment Narrative Recap

To own Hershey, you generally need to believe its brands, pricing power and snack diversification can offset cost volatility and a softer consumer backdrop. Right now, the key short term catalyst is margin relief as cocoa costs ease, while a major risk is that tariffs and weak earnings guidance keep profitability under pressure. The recent board bylaw tweaks and the JAKKS partnership do not materially change that near term earnings and margin focus.

The Morgan Stanley upgrade, built around expectations of a multiyear margin recovery as cocoa cost pressures ease, lines up most directly with this catalyst. It reinforces the existing narrative that cost relief, combined with Hershey’s broader snacks portfolio and productivity efforts, could support an earnings rebound even as volumes and the consumer remain under scrutiny.

Yet investors should be aware that potential tariff cost shocks of up to US$100 million per quarter could still...

Read the full narrative on Hershey (it's free!)

Hershey's narrative projects $12.2 billion revenue and $1.8 billion earnings by 2028. This requires 4.3% yearly revenue growth and about a $0.2 billion earnings increase from $1.6 billion today.

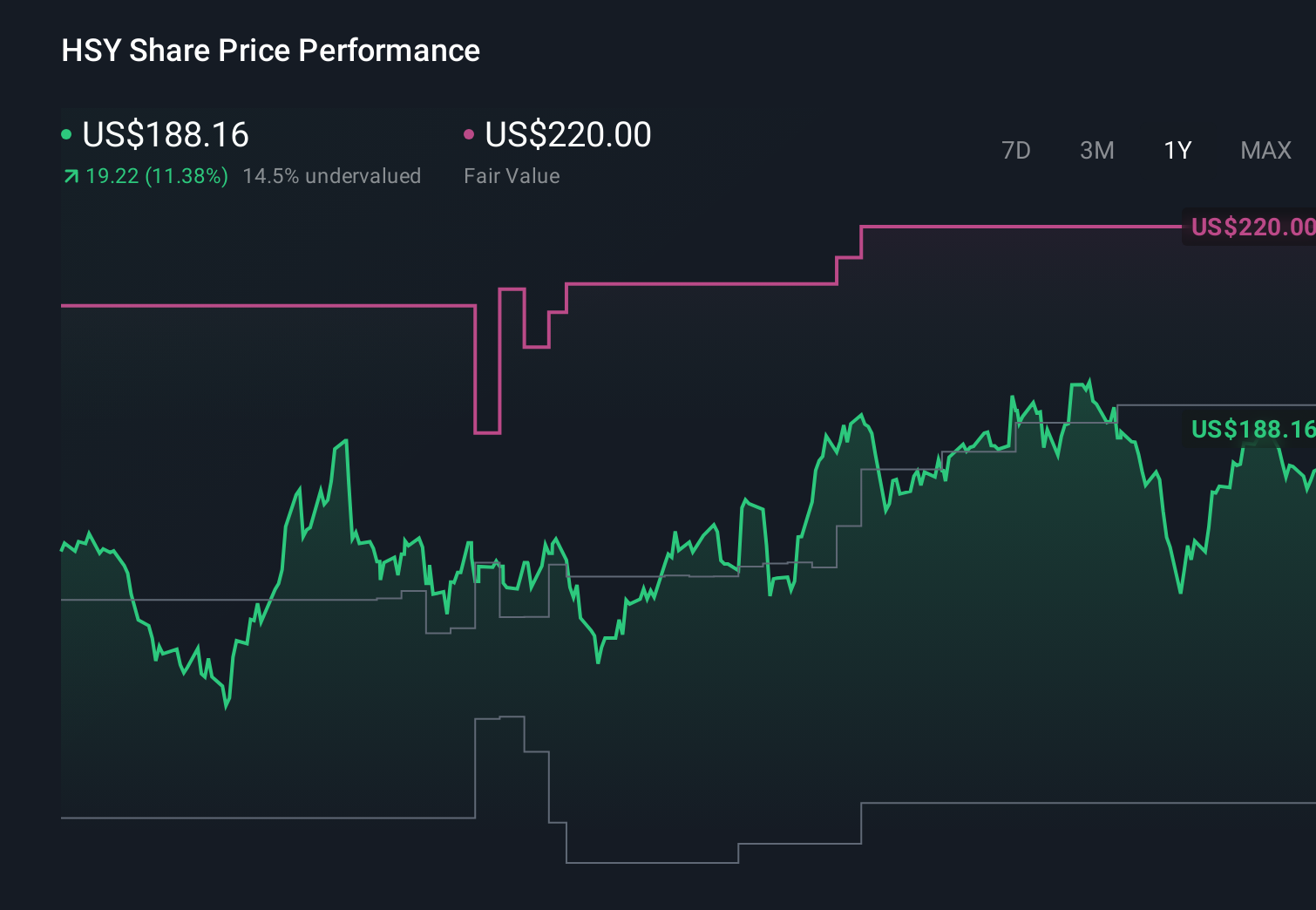

Uncover how Hershey's forecasts yield a $191.95 fair value, in line with its current price.

Exploring Other Perspectives

Nine Simply Wall St Community fair value estimates for Hershey span roughly US$138 to US$192 per share, highlighting sharply different views on upside. Set that against the current focus on cocoa driven margin recovery and you can see why it may pay to compare several perspectives on how sustainable any earnings rebound could be.

Explore 9 other fair value estimates on Hershey - why the stock might be worth as much as $191.95!

Build Your Own Hershey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hershey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hershey's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion