- United States

- /

- Food

- /

- NYSE:HSY

Hershey (NYSE:HSY) Appoints New U.S. Confection President Amid Strong Dividend Growth and Product Innovations

Hershey (NYSE:HSY) is navigating a dynamic market landscape marked by robust innovation and strategic growth opportunities, yet faces notable financial challenges and external threats. Recent developments, including a significant dividend increase and new product launches, highlight its strengths, while declining net sales and market volatility underscore areas for concern. In the discussion that follows, we will delve deeper into Hershey's core advantages, critical issues, potential growth strategies, and the key risks that could impact its future success.

Click here to discover the nuances of Hershey with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success For Hershey

Hershey has demonstrated robust financial health, exemplified by a 31.2% increase in dividends paid to shareholders, totaling $271 million, as highlighted by Steven Voskuil, Senior Vice President and CFO, during the latest earnings call. The company’s strong performance in the confection category, with everyday candy mint and gum retail sales up 2% year-to-date, underscores its market stability. Additionally, Hershey's innovation pipeline is a significant strength, with new products like the Reese's Chocolate Lava Big Cup and Halloween-themed offerings poised to energize the market. CEO Michele Buck emphasized the strong retailer interest and sell-in for these innovations, which is likely to bolster future sales.

Weaknesses: Critical Issues Affecting Hershey's Performance and Areas For Growth

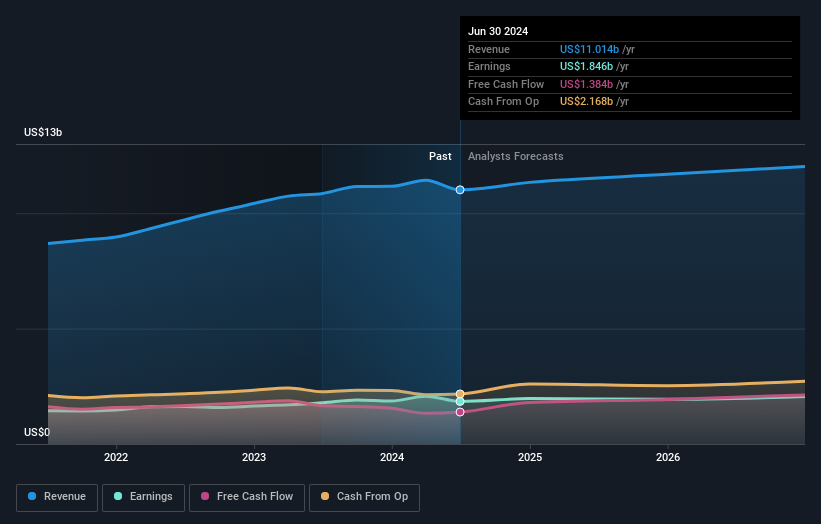

Hershey faces several financial challenges, including a 16.7% decline in reported net sales for Q2, as reported by Steven Voskuil. This decline was partly due to a significant volume drop impacted by planned inventory depletion and lower retailer inventory levels. Additionally, the company's advertising and marketing spend decreased by 15% in the second quarter, potentially affecting brand visibility and consumer engagement. Despite these challenges, Hershey's current Price-To-Earnings Ratio (22x) is considered expensive compared to the US Food industry average of 19.6x, indicating a need for cost management and efficiency improvements. The company's high level of debt also skews its return on equity, which stands at an impressive 46.04% but is influenced by leverage. For a more comprehensive look at how these weaknesses could impact Hershey's financial stability, explore our section on Hershey's Past Performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Hershey has several strategic opportunities to enhance its market position. The expansion into e-commerce and club channels, as noted by Michele Buck, represents a significant growth avenue, given these segments' high growth rates. The company's innovation in product offerings, such as the collaboration with Shaquille O'Neal for the Shaq-a-licious gummy line, can attract new customer segments and drive sales. Additionally, strategic pricing initiatives to cover expected inflation, as mentioned by Buck, can help maintain profit margins. The successful ERP implementation, which allows for improved demand planning and service levels, further strengthens Hershey's operational efficiency. These strategies can help Hershey capitalize on emerging market opportunities and enhance its competitive advantage. Learn more about how these opportunities could impact Hershey's future growth by reviewing our analysis of Hershey's Future Performance.

Threats: Key Risks and Challenges That Could Impact Hershey's Success

Hershey faces several external threats that could impact its growth and market share. The current dynamic operating environment, with consumers pulling back on discretionary spending, poses a significant risk, as noted by Michele Buck. Market volatility, particularly in commodity prices like cocoa and sugar, could further strain profit margins despite the company's robust hedging program. Additionally, competition in the snack market remains intense, with brands like SkinnyPop showing improved sales and share trends despite a soft ready-to-eat popcorn category, as highlighted by Steven Voskuil. Economic factors, including expected declines of approximately 200 basis points due to inflation, also pose challenges. These external factors, combined with Hershey's financial weaknesses, could impact its competitive positioning and long-term growth prospects.

Conclusion

In conclusion, Hershey's robust financial health, evidenced by a 31.2% increase in dividends and strong performance in the confection category, underscores its market stability and potential for sustained success. However, financial challenges such as a 16.7% decline in Q2 net sales and reduced advertising spend highlight areas needing strategic focus to maintain consumer engagement and operational efficiency. The company's strategic opportunities, including e-commerce expansion and innovative product offerings, present significant growth avenues that can enhance its competitive advantage. Despite facing external threats like market volatility and intense competition, Hershey's current trading price below its estimated fair value of $317.63 suggests it may offer attractive investment potential, with a target price less than 20% higher than the current share price, indicating room for future growth.

Already own Hershey's? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Undervalued established dividend payer.