- United States

- /

- Food

- /

- NYSE:HSY

Hershey (HSY) Valuation in Focus After Leadership Reshuffle and Stock Rally

Reviewed by Simply Wall St

Most Popular Narrative: 0.3% Undervalued

According to community narrative, Hershey is currently considered fairly valued, trading just below the calculated fair value when weighing its long-term growth potential and risks.

The Hershey Company is actively focusing on mitigating the impact of tariffs, particularly those related to cocoa and Canadian imports. Efforts include productivity enhancements, pricing strategies, sourcing adjustments, and manufacturing changes. These measures could help stabilize or improve net margins and earnings if tariffs are reduced or successfully mitigated.

Want to know why this price point might be justified? One key factor behind the fair value is a future profit outlook that pushes Hershey into premium territory. Wondering what precise growth rates and profit assumptions are included in this consensus? There is a surprising set of forward estimates driving the current target. Find out what makes Hershey stand out.

Result: Fair Value of $181.91 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high cocoa prices or a sudden drop in consumer demand could quickly challenge the outlook that currently supports Hershey’s fair value.

Find out about the key risks to this Hershey narrative.Another View: Challenging the Fair Value

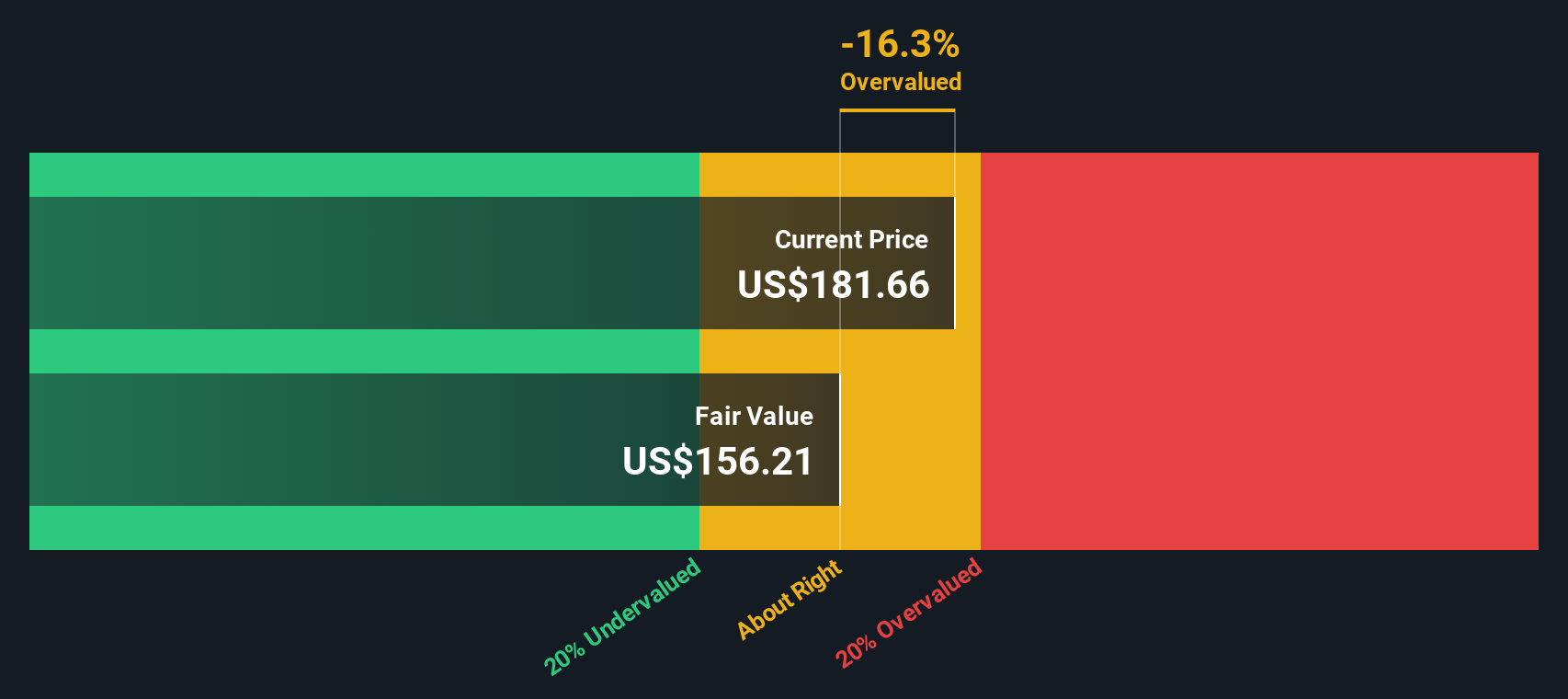

While fair value analysis suggests Hershey could be fairly priced, our DCF model tells a different story. This method indicates the stock might actually be overvalued and suggests approaching with more caution. Which view will prove more accurate as the market evolves?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hershey for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hershey Narrative

If you have a different perspective or prefer hands-on research, you can independently analyze the numbers and craft your own view in just a few minutes, then do it your way.

A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Opportunities?

Staying ahead means keeping your options open. The smartest investors never limit themselves to just one story. Broaden your view and spot your next move with powerful investment ideas tailored to your strategy. See what you could be missing—your next big winner might be one great stock screen away.

- Uncover companies revolutionizing patient care and health analytics by tapping into healthcare AI powerhouses with healthcare AI stocks.

- Boost your portfolio with steady cash flow and attractive payouts when you target high-yield plays using dividend stocks with yields > 3%.

- Accelerate your returns and catch today’s best bargains. Filter for stocks trading below their intrinsic value thanks to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives