- United States

- /

- Food

- /

- NYSE:HSY

Hershey (HSY): Evaluating Valuation After Goldman Sachs Endorsement and Bold New Product Launches

Reviewed by Kshitija Bhandaru

Goldman Sachs recently highlighted Hershey (NYSE:HSY) by adding it to its US Conviction List. The firm cited the company's momentum with pricing strategies and market share opportunities. New product launches have also been driving fresh attention.

See our latest analysis for Hershey.

After a year packed with new snack launches and even a high-profile class action win, Hershey’s stock has been quietly shifting gears. Despite some noise around CEO transition and margin pressures, momentum appears to be building again. The latest 1-year total shareholder return sits in positive territory, and five-year holders have enjoyed a robust overall gain. Recent excitement about bold product innovation and favorable analyst sentiment only adds intrigue to the medium-term outlook.

If Hershey's steady gains and product innovation have you curious about the broader market, now’s a great time to discover fast growing stocks with high insider ownership

But with shares near Goldman Sachs' price target and margin pressures still in the picture, is Hershey’s long-term potential fully reflected in today's price? Or is there still a real buying opportunity for investors?

Most Popular Narrative: Fairly Valued

Hershey’s most widely followed narrative sets a fair value of $189.18, aligning closely with the recent closing price of $189.02. Analyst consensus points to a balanced market view, with new product catalysts and strategic moves keeping sentiment steady at these levels.

Hershey’s innovation pipeline, particularly with the upcoming significant Reese's innovation, is poised to drive incremental market share gains and increased sales, promising revenue growth and potentially improving earnings given successful execution.

Want to uncover what’s fueling Hershey’s current price? This fair value is built on bold revenue ambitions, evolving margins, and rising profit projections. Discover which high-stakes assumptions are shaking up the valuation calculus and see what every analyst is betting on for the years ahead.

Result: Fair Value of $189.18 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high cocoa prices and shifting consumer preferences toward healthier snacks could present significant challenges to Hershey’s optimistic outlook and may impact future returns.

Find out about the key risks to this Hershey narrative.

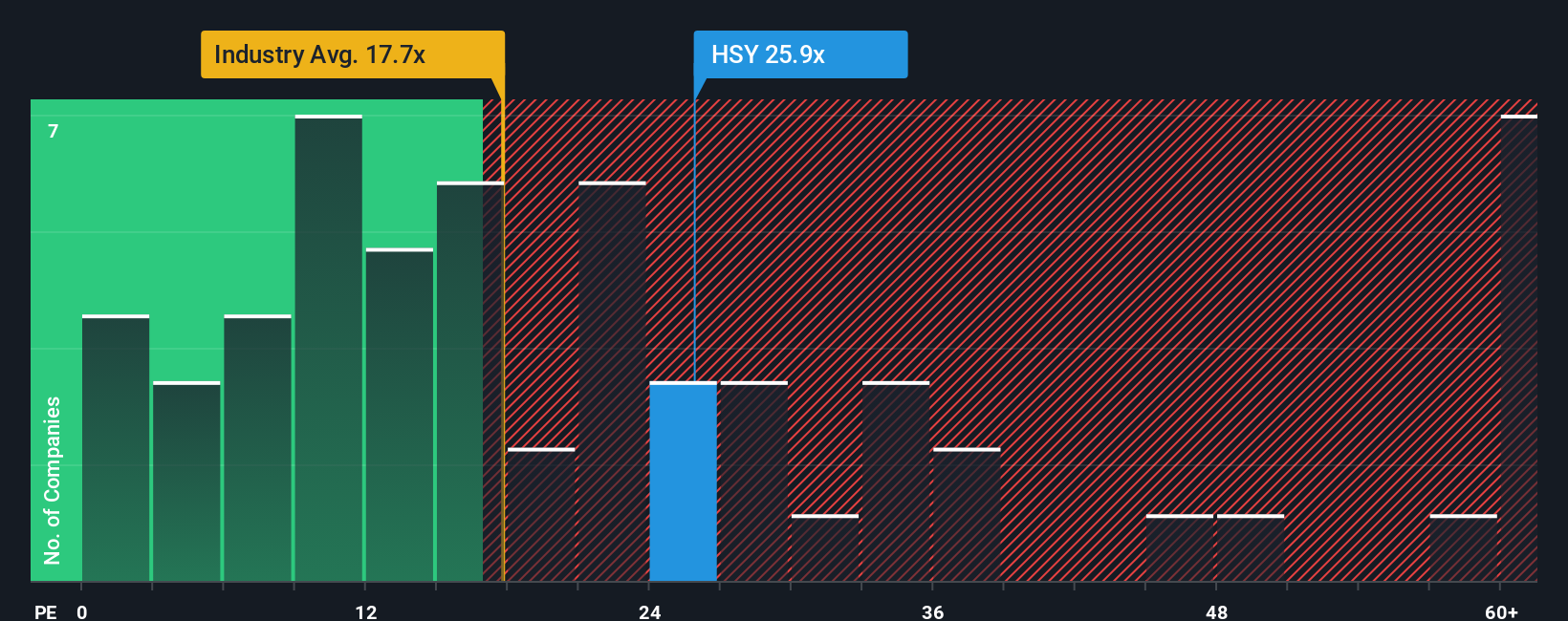

Another View: Earnings Ratios Raise Eyebrows

While the consensus sees Hershey as fairly valued, another lens highlights a premium price. Its price-to-earnings ratio of 25x stands well above peers at 19.8x, the industry at 18x, and even exceeds the fair ratio of 22.4x. This gap suggests investors are paying up for perceived stability and future growth. Is this justified, or could expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hershey Narrative

Keep in mind, if you have a different perspective or want to dive into the numbers on your own terms, you can craft a personalized view in just a few minutes. Do it your way

A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count and gain an edge with stock picks tailored to different opportunities and themes. Don’t let the momentum pass you by.

- Capitalize on high-yield opportunities by reviewing these 19 dividend stocks with yields > 3%, offering robust income streams above 3%.

- Tap into emerging technology trends with these 24 AI penny stocks, which are disrupting industries and unlocking new avenues for growth.

- Uncover value gems in the market through these 909 undervalued stocks based on cash flows, which could be poised for strong upside based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives