- United States

- /

- Food

- /

- NYSE:HRL

Hormel Foods (HRL) Q3 EPS Gain Tests Bullish Margin Expansion Narrative

Reviewed by Simply Wall St

Hormel Foods (HRL) has just posted Q3 2025 results with revenue of about $3.0 billion and basic EPS of $0.33, setting the tone for a steady quarter on the top and bottom line. The company has seen revenue move from roughly $2.9 billion in Q3 2024 to about $3.0 billion in Q3 2025, while quarterly EPS has edged from $0.32 to $0.33, giving investors a clear read on modest headline growth and a margin profile that looks stable rather than transformative.

See our full analysis for Hormel Foods.With the latest numbers on the table, the next step is to line them up against the prevailing narratives around Hormel to see which storylines the results support and which ones might need a rethink.

See what the community is saying about Hormel Foods

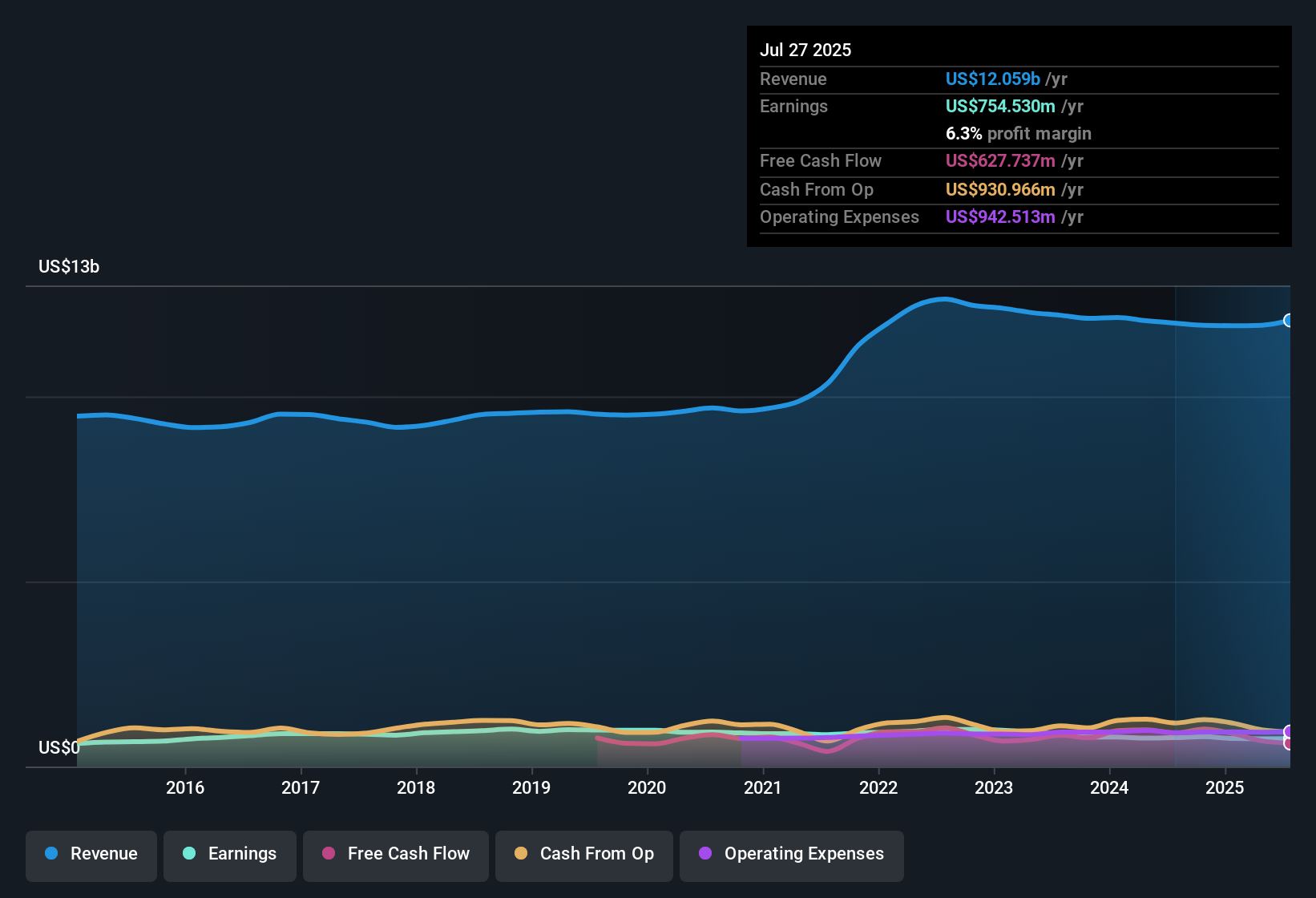

TTM revenue steady around $12.1 billion

- On a trailing twelve month basis, Hormel generated about $12.1 billion in revenue, almost unchanged from the $12.0 billion to $12.1 billion range seen across the last few quarters.

- Analysts' consensus view leans on this stable top line and expects modernization and healthier product innovation to gradually lift growth, which contrasts with the recent pattern where trailing revenue has hovered near $12.0 billion rather than clearly accelerating.

- The consensus highlights organic sales growth and demand for protein rich, wellness focused products as long term drivers, yet the recent TTM revenue prints from $11.9 billion to about $12.1 billion point to only modest progress so far.

- Consensus also expects supply chain automation and Transform and Modernize initiatives to support future sales and margins, while current revenue stability suggests those benefits are not yet visible in headline growth numbers.

Margins at 6.3% test bullish optimism

- Trailing net profit margin stands at 6.3 percent, slightly below last year’s 6.5 percent, and five year earnings have fallen about 4.4 percent per year.

- What is surprising is how this backdrop challenges the bullish narrative that major efficiency projects and healthier product mix will drive clear margin expansion, because the latest 6.3 percent margin still sits below the earlier 6.5 percent level.

- Bulls point to supply chain automation and Transform and Modernize initiatives as margin tailwinds, yet trailing twelve month net income of about $754.5 million on roughly $12.1 billion of revenue keeps profitability roughly flat rather than showing a visible uplift.

- Optimistic expectations that margins could rise toward 7.3 percent over the next few years therefore rest on future execution, while the current margin line and negative five year EPS trend show that cost pressures have not fully eased in the recent data.

Valuation gap versus 17.6x P/E

- At a share price of $24.16, Hormel trades below an analyst price target of $26.56 and below a DCF fair value of about $40.53, while its 17.6 times P/E is above peers at 8.8 times but below the US food industry at 20.5 times.

- Critics highlight a bearish angle that a richer P/E than peers and a 4.84 percent dividend not covered by free cash flow could signal the stock is too expensive, even though the roughly 40 percent discount to the $40.53 DCF fair value points to potential upside.

- The premium to peer P/E multiples supports the bearish concern that investors are already paying up versus closer comparables, despite trailing earnings having declined about 4.4 percent per year over five years.

- At the same time, trading below both the $26.56 analyst target and the much higher DCF fair value means valuation is not one sided, and the market is weighing slower forecast revenue growth of roughly 1.9 percent per year against that apparent discount.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hormel Foods on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle the market might be missing? Use the latest figures to build your own long term view in just a few minutes, Do it your way.

A great starting point for your Hormel Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Despite steady sales, Hormel’s shrinking margins, negative five year earnings trend, and premium valuation versus peers suggest its current profile lacks convincing growth momentum.

If you want companies already delivering the earnings progress Hormel still needs to prove, focus on stable growth stocks screener (2081 results) to immediately surface steadier, more predictable performers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hormel Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRL

Hormel Foods

Develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026