- United States

- /

- Food

- /

- NYSE:GIS

General Mills (NYSE:GIS) Reaffirms FY 2025 Guidance Amid Strategic Shifts and Investor Activism

General Mills (NYSE:GIS) is navigating a dynamic landscape marked by both opportunities and challenges. Recent developments, including enhanced efficiency and cost savings in fiscal 2024, underscore its strategic agility, while ongoing issues such as inflation and competitive pressures pose significant hurdles. In the discussion that follows, we will delve into the core strengths, weaknesses, opportunities, and threats that shape General Mills's current and future performance.

Click here to discover the nuances of General Mills with our detailed analytical report.

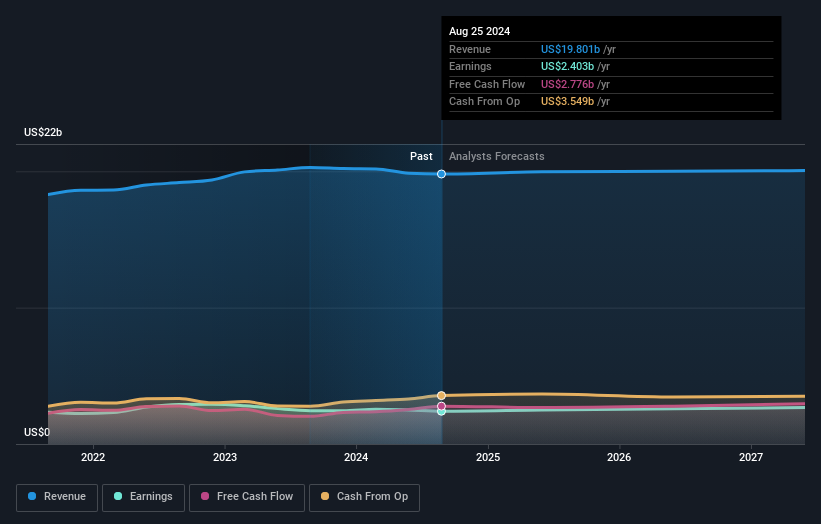

Strengths: Core Advantages Driving Sustained Success for General Mills

General Mills has demonstrated robust financial health and strategic agility, which have been pivotal to its sustained success. The company has effectively navigated challenging operating environments, as highlighted by CEO Jeff Harmening in the latest earnings call, where he noted the enhanced efficiency and cost savings achieved in fiscal 2024. This strategic pivot allowed General Mills to deliver on its updated guidance, showcasing its ability to adapt and thrive. The company also boasts a strong cash flow, generating over $2.5 billion of free cash flow with a 96% conversion rate, underscoring its financial stability. Additionally, the company’s focus on innovation, with a 40% increase in big bet launches, has bolstered its market position. Importantly, General Mills is currently undervalued, trading at a Price-To-Earnings Ratio of 16.4x, significantly below the peer average of 26.7x and the industry average of 19.6x, while also being priced at 63.1% below its estimated fair value of $199.51.

Weaknesses: Critical Issues Affecting General Mills's Performance and Areas for Growth

Despite its strengths, General Mills faces several critical issues that could impact its performance. The company reported a 1% drop in organic net sales, indicating challenges in maintaining sales momentum. CEO Jeff Harmening acknowledged that the company’s overall competitiveness fell short of expectations in fiscal 2024, partly due to challenging consumer sentiment across core markets. Additionally, inflation continues to impact input cost baskets, with labor costs being a primary driver, as noted by Harmening. This has led to higher sourcing, manufacturing, and logistics costs. Furthermore, General Mills has experienced negative earnings growth of -3.9% over the past year, making it difficult to compare favorably to the Food industry average of -2.4%. These financial challenges highlight areas where the company needs to improve to align better with industry standards and trends. For a more comprehensive look at how these weaknesses could impact General Mills's financials, explore our section on General Mills's Past Performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

General Mills has several strategic opportunities to enhance its market position and capitalize on emerging trends. The company plans to drive another year of strong holistic margin management (HMM) cost savings in fiscal 2025, which will allow for reinvestment in growth initiatives that meet consumer needs, as outlined by Harmening. Additionally, the company is focusing on creating remarkable consumer experiences and doubling down on iconic brand assets like the Pillsbury Doughboy to inspire family engagement. These initiatives are expected to accelerate organic sales growth. General Mills is also committed to sustainability goals, making progress in areas such as regenerative agriculture, reducing greenhouse gas emissions, and recyclable packaging. These strategic moves could significantly enhance the company’s competitive advantage and market position. Learn more about how these opportunities could impact General Mills's future growth by reviewing our analysis of General Mills's Future Performance.

Threats: Key Risks and Challenges That Could Impact General Mills's Success

General Mills faces several external threats that could impede its growth and market share. The ongoing macroeconomic uncertainty is expected to result in continued value-seeking behavior by consumers, as mentioned by Harmening. This could pressure the company’s pricing strategies and margins. Additionally, competition is intensifying, with improved service levels from smaller competitors and private labels, posing a threat to General Mills’s market share. Regulatory issues also loom large, with anticipated input cost inflation of 3% to 4% of the cost of goods sold, as highlighted by CFO Kofi Bruce. Market risks are another concern, with full-year category dollar growth expected to be somewhat below the long-term 2% to 3% growth expectations. These factors could challenge General Mills’s ability to maintain its competitive positioning and financial stability.

Conclusion

In conclusion, General Mills's robust financial health, strategic agility, and strong cash flow generation underscore its ability to adapt and thrive in challenging environments, positioning it well for sustained success. However, the company must address its recent drop in organic net sales and negative earnings growth to better align with industry standards. Leveraging strategic opportunities, such as cost savings from holistic margin management and investments in consumer engagement and sustainability, can enhance its competitive edge. Despite facing external threats like macroeconomic uncertainty and intensified competition, General Mills's current market price, significantly below its estimated fair value and peer averages, presents a compelling opportunity for future growth and improved market positioning.

Already own General Mills? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:GIS

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives