- United States

- /

- Health Care REITs

- /

- NYSE:SILA

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 12% over the past year with earnings forecasted to grow by 15% annually. In such a dynamic environment, selecting dividend stocks that offer consistent payouts and potential for growth can be a strategic way to enhance portfolio stability and income.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.76% | ★★★★★☆ |

| Universal (UVV) | 5.87% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.22% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.73% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.24% | ★★★★★★ |

| Ennis (EBF) | 5.64% | ★★★★★★ |

| Dillard's (DDS) | 5.89% | ★★★★★★ |

| CompX International (CIX) | 4.67% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.03% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.67% | ★★★★★☆ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Fresh Del Monte Produce (FDP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fresh Del Monte Produce Inc. operates through its subsidiaries to produce, market, and distribute fresh and fresh-cut fruits and vegetables globally, with a market cap of approximately $1.59 billion.

Operations: Fresh Del Monte Produce Inc.'s revenue is primarily derived from three segments: Banana at $1.46 billion, Fresh and Value-Added Products at $2.61 billion, and Other Products and Services at $197.20 million.

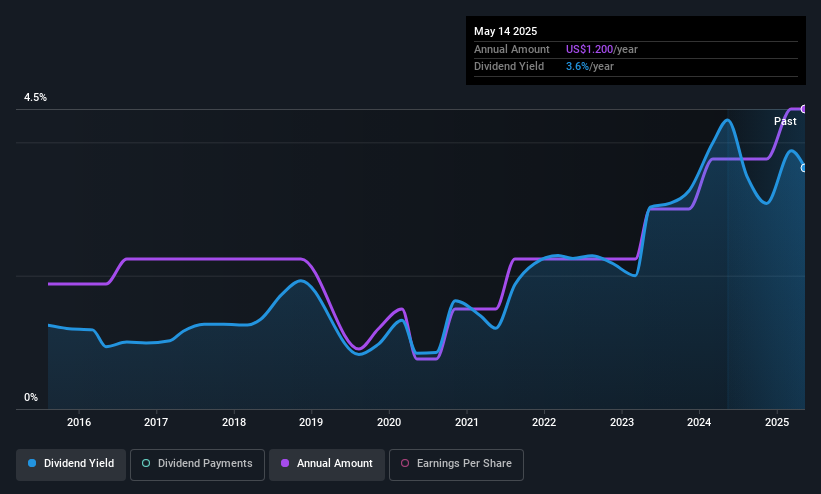

Dividend Yield: 3.6%

Fresh Del Monte Produce has a dividend yield of 3.58%, which is below the top 25% in the US market, but its payout ratio of 34.2% suggests dividends are well covered by earnings and cash flow. Despite a volatile dividend history, recent profitability and value trading at 51.2% below fair value could appeal to investors seeking long-term growth potential. The company's global expansion efforts, like launching Pinkglow® pineapples in the UAE, may enhance future revenue streams.

- Unlock comprehensive insights into our analysis of Fresh Del Monte Produce stock in this dividend report.

- Our valuation report unveils the possibility Fresh Del Monte Produce's shares may be trading at a discount.

Interpublic Group of Companies (IPG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Interpublic Group of Companies, Inc. is a global provider of advertising and marketing services with a market cap of approximately $8.94 billion.

Operations: Interpublic Group of Companies generates revenue through three main segments: Media, Data & Engagement Solutions ($4.14 billion), Integrated Advertising & Creativity Led ($3.44 billion), and Specialized Communications & Experiential Solutions ($1.42 billion).

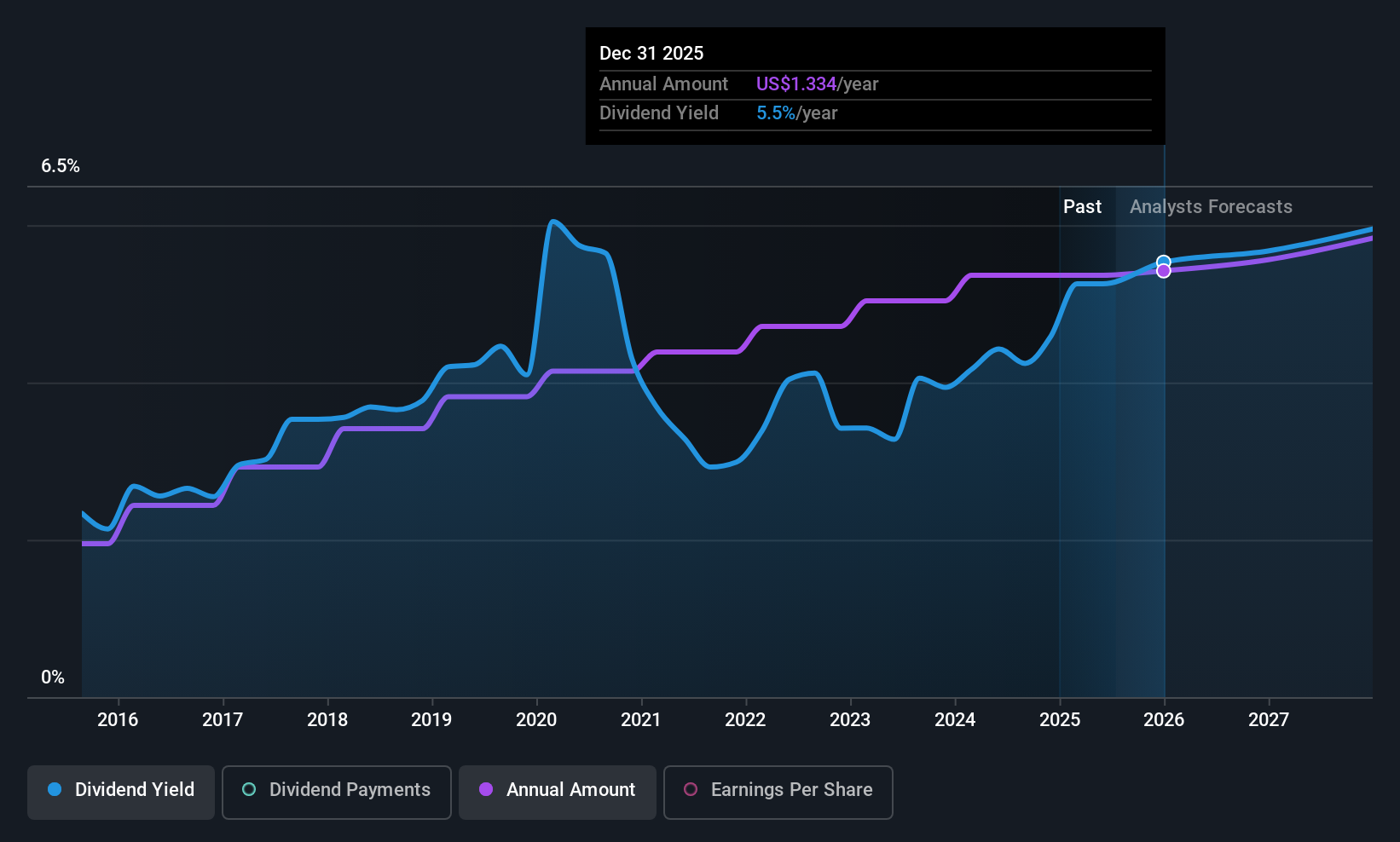

Dividend Yield: 5.2%

Interpublic Group's dividend yield of 5.24% ranks in the top 25% of US market payers, though its high payout ratio of 99.9% indicates dividends are not covered by earnings but are supported by a low cash payout ratio of 46.6%. Recent inclusion in the Russell indices may bolster its defensive appeal. Despite recent net losses and declining revenue, stable and growing dividends over the past decade highlight consistency for income-focused investors.

- Navigate through the intricacies of Interpublic Group of Companies with our comprehensive dividend report here.

- The analysis detailed in our Interpublic Group of Companies valuation report hints at an deflated share price compared to its estimated value.

Sila Realty Trust (SILA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sila Realty Trust, Inc., based in Tampa, Florida, is a net lease real estate investment trust specializing in the healthcare sector with a market cap of approximately $1.31 billion.

Operations: Sila Realty Trust generates its revenue primarily from commercial real estate investments in the healthcare sector, amounting to $184.47 million.

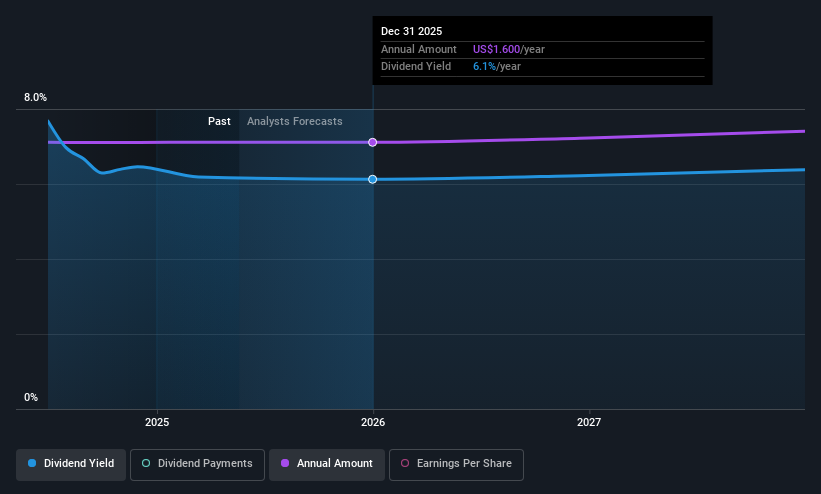

Dividend Yield: 6.6%

Sila Realty Trust's dividend yield of 6.56% places it in the top 25% of US dividend payers, supported by a payout ratio of 75.9%, indicating coverage by earnings and cash flows. However, its dividends have been volatile over the past four years, with payments decreasing. Recent additions to multiple Russell indices could enhance visibility and appeal among value-focused investors, despite shareholder dilution and declining sales impacting near-term attractiveness for income investors.

- Click here to discover the nuances of Sila Realty Trust with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Sila Realty Trust is priced higher than what may be justified by its financials.

Seize The Opportunity

- Reveal the 143 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives