- United States

- /

- Food

- /

- NYSE:FDP

Fresh Del Monte Produce Inc. (NYSE:FDP) Soars 25% But It's A Story Of Risk Vs Reward

Fresh Del Monte Produce Inc. (NYSE:FDP) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.3% over the last year.

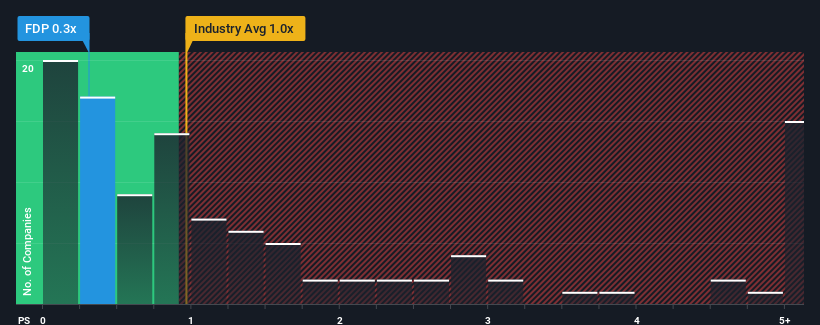

Even after such a large jump in price, Fresh Del Monte Produce's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Food industry in the United States, where around half of the companies have P/S ratios above 1x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Fresh Del Monte Produce

What Does Fresh Del Monte Produce's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Fresh Del Monte Produce's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Fresh Del Monte Produce will help you uncover what's on the horizon.How Is Fresh Del Monte Produce's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Fresh Del Monte Produce's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 3.3% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 4.5% over the next year. With the industry predicted to deliver 3.0% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Fresh Del Monte Produce's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Fresh Del Monte Produce's P/S

Despite Fresh Del Monte Produce's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Fresh Del Monte Produce currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Fresh Del Monte Produce, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDP

Fresh Del Monte Produce

Through its subsidiaries, produces, markets, and distributes fresh and fresh-cut fruits and vegetables in North America, Central America, South America, Europe, the Middle East, Africa, Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives