- United States

- /

- Food

- /

- NYSE:FDP

Discovering Undiscovered Gems in the US Market with 3 Promising Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced a 12% increase over the past year with earnings forecasted to grow by 15% annually. In such an environment, identifying stocks that are not only poised for growth but also relatively undiscovered can offer unique opportunities for investors seeking to capitalize on emerging potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.19% | -28.34% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Next Technology Holding (NXTT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Next Technology Holding Inc. offers software development services across the United States, Hong Kong, and Singapore with a market cap of $1.14 billion.

Operations: NXTT generates revenue primarily from software development services in the United States, Hong Kong, and Singapore. The company has a market cap of $1.14 billion.

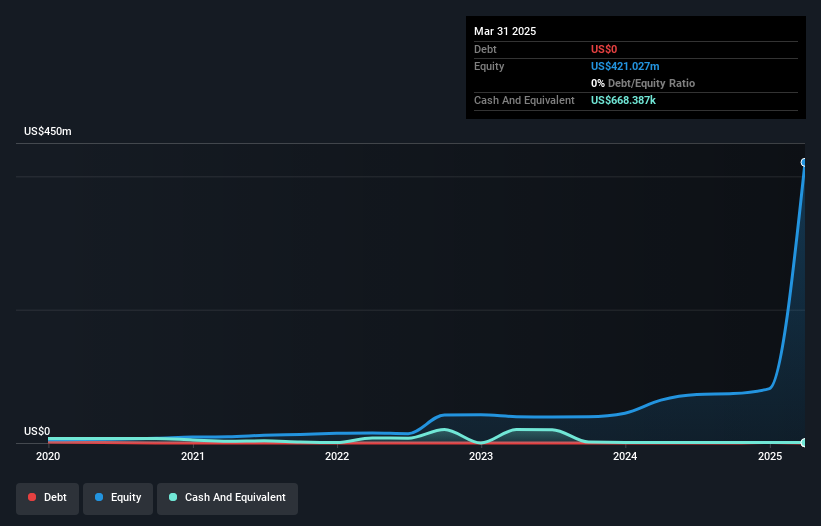

Next Technology Holding, a small player in the tech space, has shown remarkable earnings growth of 759.7% over the past year, significantly outpacing the software industry average of 18.9%. Despite its high volatility and shareholder dilution recently, it maintains a satisfactory net debt to equity ratio at 0.2%, reduced from 36% five years ago. The company’s price-to-earnings ratio stands at an attractive 5.6x compared to the US market's average of 18.4x, suggesting potential undervaluation. Recent developments include a $197.6 million shelf registration filing for common stock and significant first-quarter earnings with net income reaching US$193 million from US$19 million last year.

- Click here to discover the nuances of Next Technology Holding with our detailed analytical health report.

Evaluate Next Technology Holding's historical performance by accessing our past performance report.

Solesence (SLSN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Solesence, Inc. is a science-driven company that focuses on developing, manufacturing, and selling an integrated family of technologies in the United States with a market capitalization of $250.97 million.

Operations: Solesence generates revenue primarily from its Specialty Chemicals segment, which recorded $57.10 million.

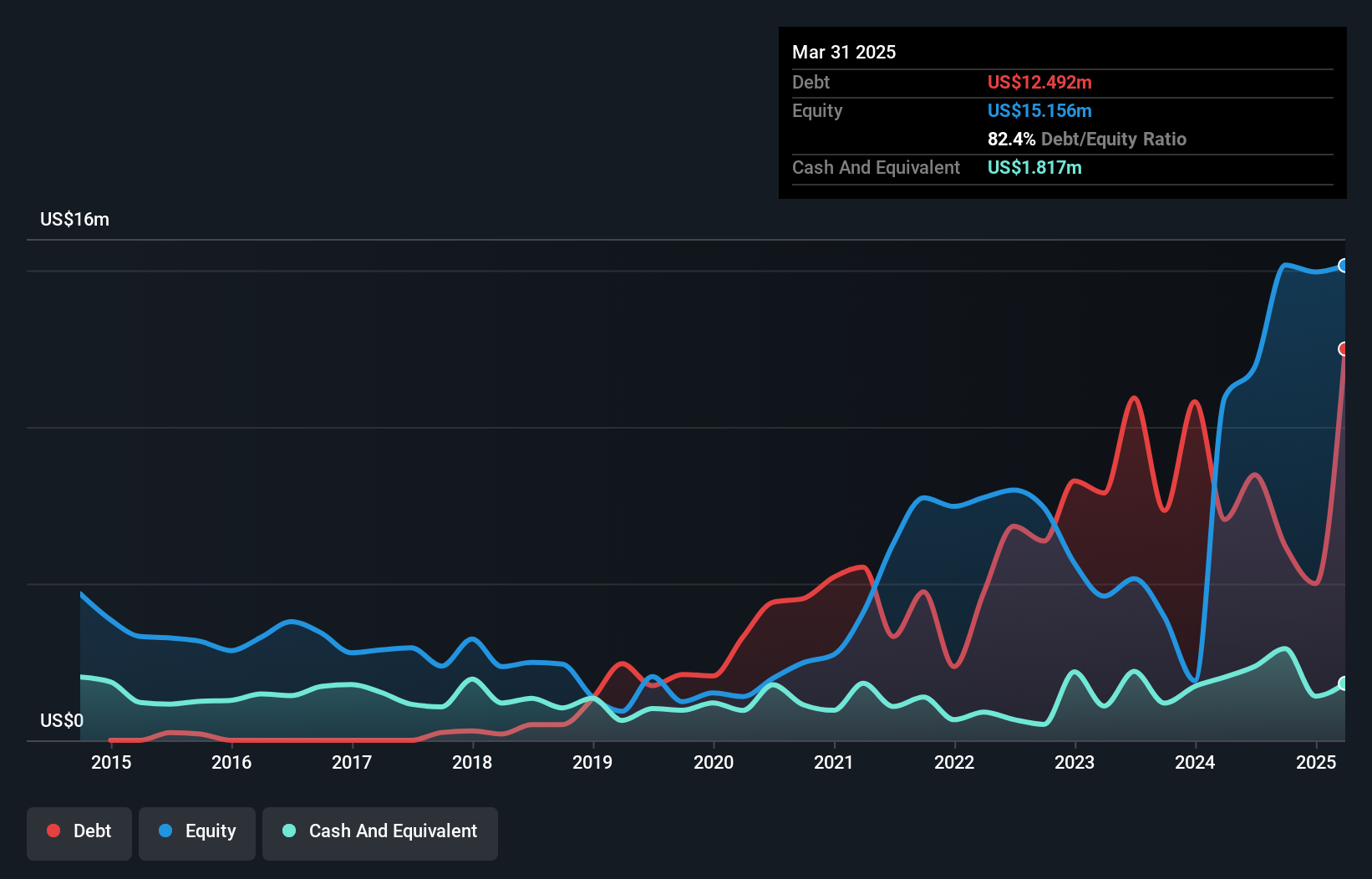

Solesence, a rising name in the chemicals sector, has seen significant developments recently. The company became profitable this year, marking a shift from prior performance trends. Its net debt to equity ratio stands at 70.4%, which is high but an improvement from 236.2% five years ago. Despite this leverage, interest payments are well covered by EBIT at 6.8 times over, indicating manageable financial obligations. Recent inclusion in multiple Russell indexes highlights its growing market presence and potential for increased visibility among investors. However, substantial insider selling and shareholder dilution over the past year could be points of concern for stakeholders.

Fresh Del Monte Produce (FDP)

Simply Wall St Value Rating: ★★★★★★

Overview: Fresh Del Monte Produce Inc. operates globally through its subsidiaries to produce, market, and distribute fresh and fresh-cut fruits and vegetables, with a market cap of approximately $1.59 billion.

Operations: FDP generates revenue primarily from three segments: Fresh and Value-Added Products ($2.61 billion), Bananas ($1.46 billion), and Other Products and Services ($197.20 million). The company's cost structure impacts its net profit margin, which is a key indicator of profitability trends over time.

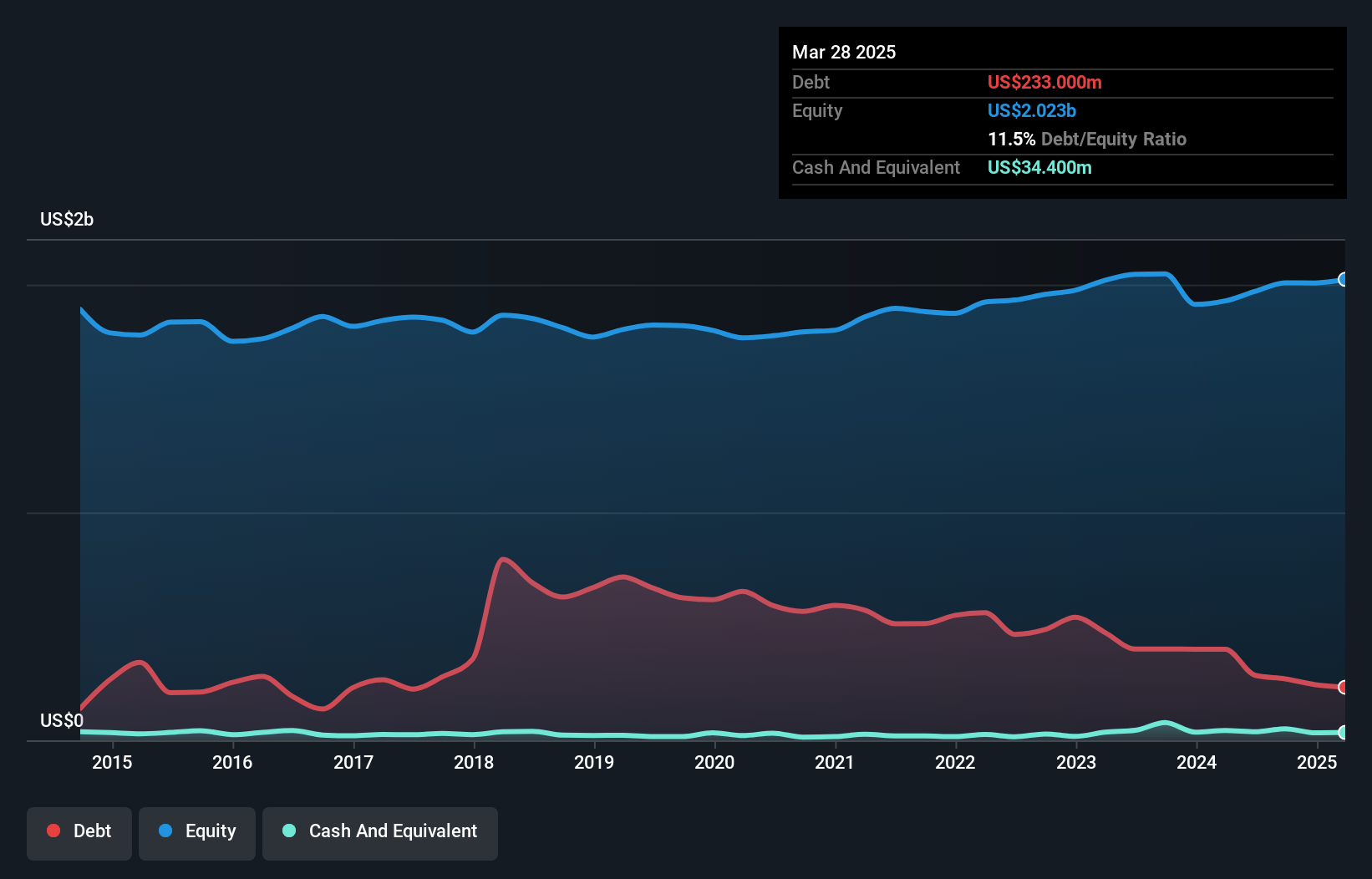

Fresh Del Monte Produce, a notable player in the food industry, has seen its net income rise to US$31.1 million from US$26.1 million year-over-year, reflecting improved profitability. The company recently repurchased 253,850 shares for US$7.61 million, indicating confidence in its valuation and future prospects. With a net debt to equity ratio of 9.8%, Fresh Del Monte maintains a solid financial position while trading at 51% below estimated fair value compared to peers and industry standards. Recent strategic moves include expanding premium fruit offerings globally and investing in automation to enhance operational efficiency and diversify revenue streams through innovative products like Pinkglow® pineapples.

Make It Happen

- Click this link to deep-dive into the 280 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDP

Fresh Del Monte Produce

Through its subsidiaries, produces, markets, and distributes fresh and fresh-cut fruits and vegetables in North America, Central America, South America, Europe, the Middle East, Africa, Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives