- United States

- /

- Food

- /

- NYSE:FDP

Can Fresh Del Monte's (FDP) NHL Partnership with the Panthers Boost Its Brand Relevance?

Reviewed by Sasha Jovanovic

- On October 15, 2025, the Florida Panthers announced a partnership with Fresh Del Monte Produce Inc. to promote healthier lifestyles through interactive in-arena experiences, youth hockey support, digital coverage, and community events during the 2025–26 NHL season.

- This collaboration reflects Fresh Del Monte’s drive to connect with fans and local communities by aligning its brand with wellness, youth engagement, and sports culture.

- We’ll explore how Fresh Del Monte’s community-focused sports partnership may influence its investment narrative and long-term brand positioning.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Fresh Del Monte Produce Investment Narrative Recap

To be a shareholder in Fresh Del Monte Produce, you likely believe in the ongoing global shift toward healthier diets, resilient supply chains, and higher-margin fresh-cut and premium produce. While the Florida Panthers partnership helps reinforce the brand’s health-conscious positioning, the immediate impact on the most important short-term catalyst, margin performance driven by premium product sales, is not expected to be material. The biggest risk remains that current profitability may overstate the company’s future earnings potential if consumer momentum or pricing power wanes as supply normalizes.

Among recent announcements, Fresh Del Monte’s expanded partnership with CMA CGM Group to upgrade cold chain shipping for pineapples and bananas from the Philippines is especially relevant. This aligns with the focus on consistent product quality and reducing waste, factors that could strengthen the company's position amidst continuing global supply constraints and the push for premium branding, which are key to near-term margin outcomes and the broader wellness narrative underpinned by the latest sports alliance.

However, even as the company deepens its community engagement, investors should be aware that intensifying cost inflation and shifts in pricing power could...

Read the full narrative on Fresh Del Monte Produce (it's free!)

Fresh Del Monte Produce's outlook projects $4.6 billion in revenue and $127.6 million in earnings by 2028. This reflects a 2.5% annual revenue growth rate and a $19.6 million decrease in earnings from current earnings of $147.2 million.

Uncover how Fresh Del Monte Produce's forecasts yield a $46.00 fair value, a 33% upside to its current price.

Exploring Other Perspectives

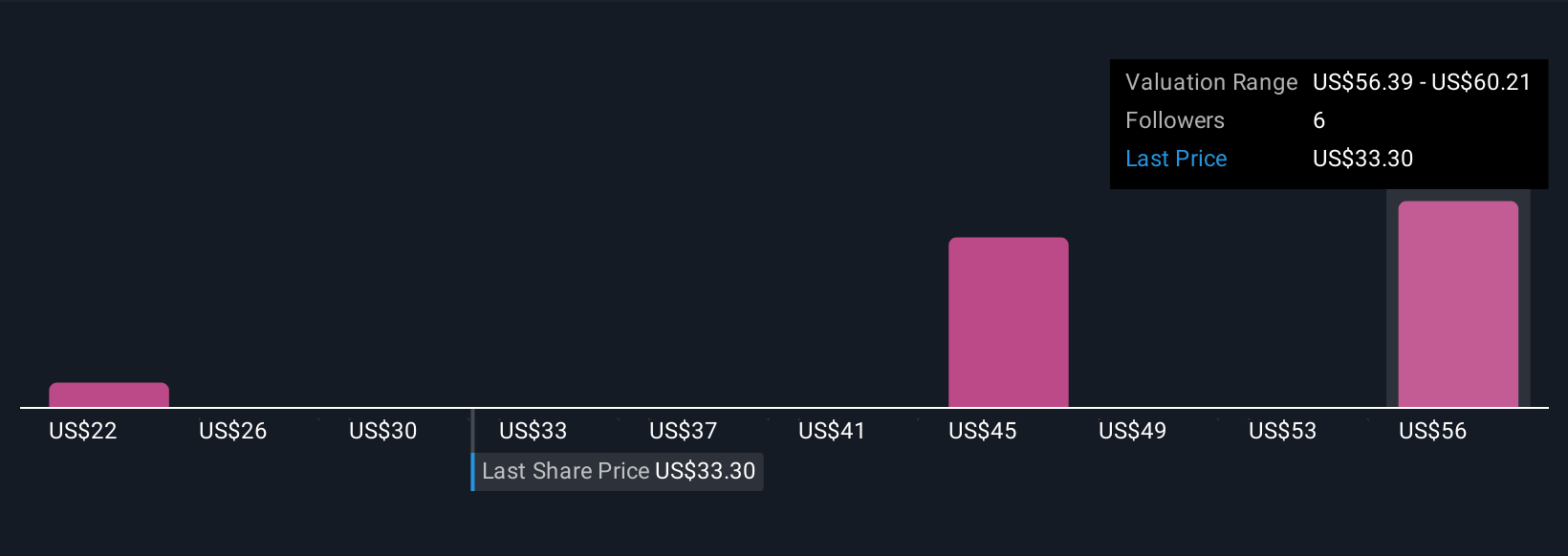

Three members of the Simply Wall St Community value the stock anywhere from US$22 to US$60.21 per share. Some highlight margin pressure if pricing power fades, inviting you to consider multiple points of view on Fresh Del Monte’s future.

Explore 3 other fair value estimates on Fresh Del Monte Produce - why the stock might be worth 36% less than the current price!

Build Your Own Fresh Del Monte Produce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fresh Del Monte Produce research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fresh Del Monte Produce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fresh Del Monte Produce's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDP

Fresh Del Monte Produce

Through its subsidiaries, produces, markets, and distributes fresh and fresh-cut fruits and vegetables in North America, Central America, South America, Europe, the Middle East, Africa, Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives