Three Undiscovered Gems in the United States to Enhance Your Portfolio

Reviewed by Simply Wall St

The United States market has shown robust performance, with a 3.1% increase over the last week and a remarkable 24% climb in the past year, while earnings are forecast to grow by 15% annually. In such an environment, identifying stocks that are not only aligned with these growth trends but also offer unique potential can be key to enhancing your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

World Acceptance (NasdaqGS:WRLD)

Simply Wall St Value Rating: ★★★★★☆

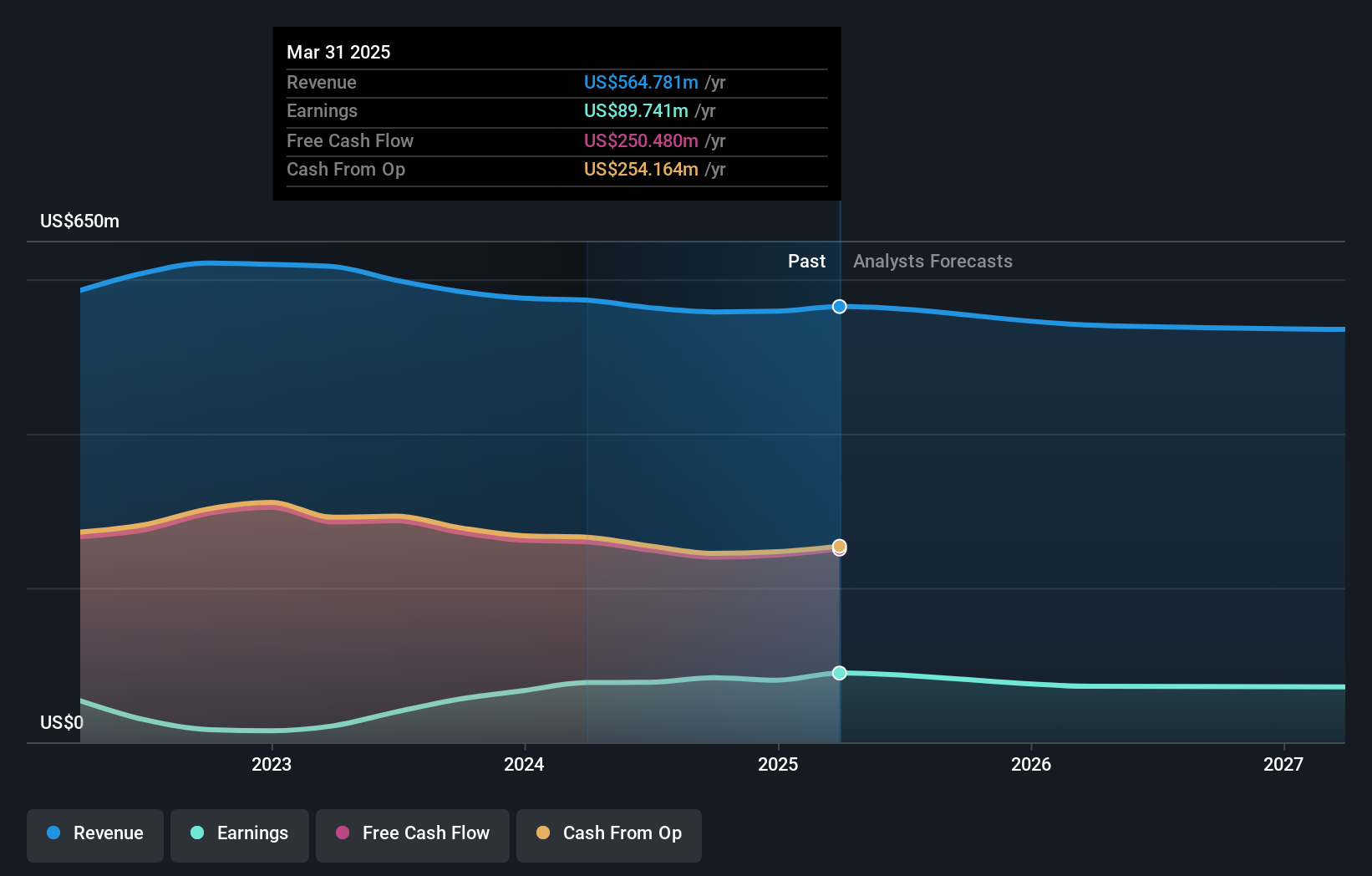

Overview: World Acceptance Corporation operates in the consumer finance sector within the United States, with a market cap of $685.34 million.

Operations: World Acceptance generates revenue primarily from its consumer finance segment, totaling $557.89 million.

World Acceptance, a player in consumer finance, is notable for its high-quality earnings and robust financial positioning. Over the past year, earnings surged by 49.5%, outpacing the industry average. The company’s debt-to-equity ratio has improved from 131% to 121% over five years, with interest payments well-covered at 3.4 times EBIT. Despite a high net debt-to-equity ratio of 119%, free cash flow remains positive. Trading at a price-to-earnings ratio of 8x compared to the US market's 19x suggests value potential, although projected earnings may decline by an average of 1.6% annually over three years.

Dole (NYSE:DOLE)

Simply Wall St Value Rating: ★★★★★☆

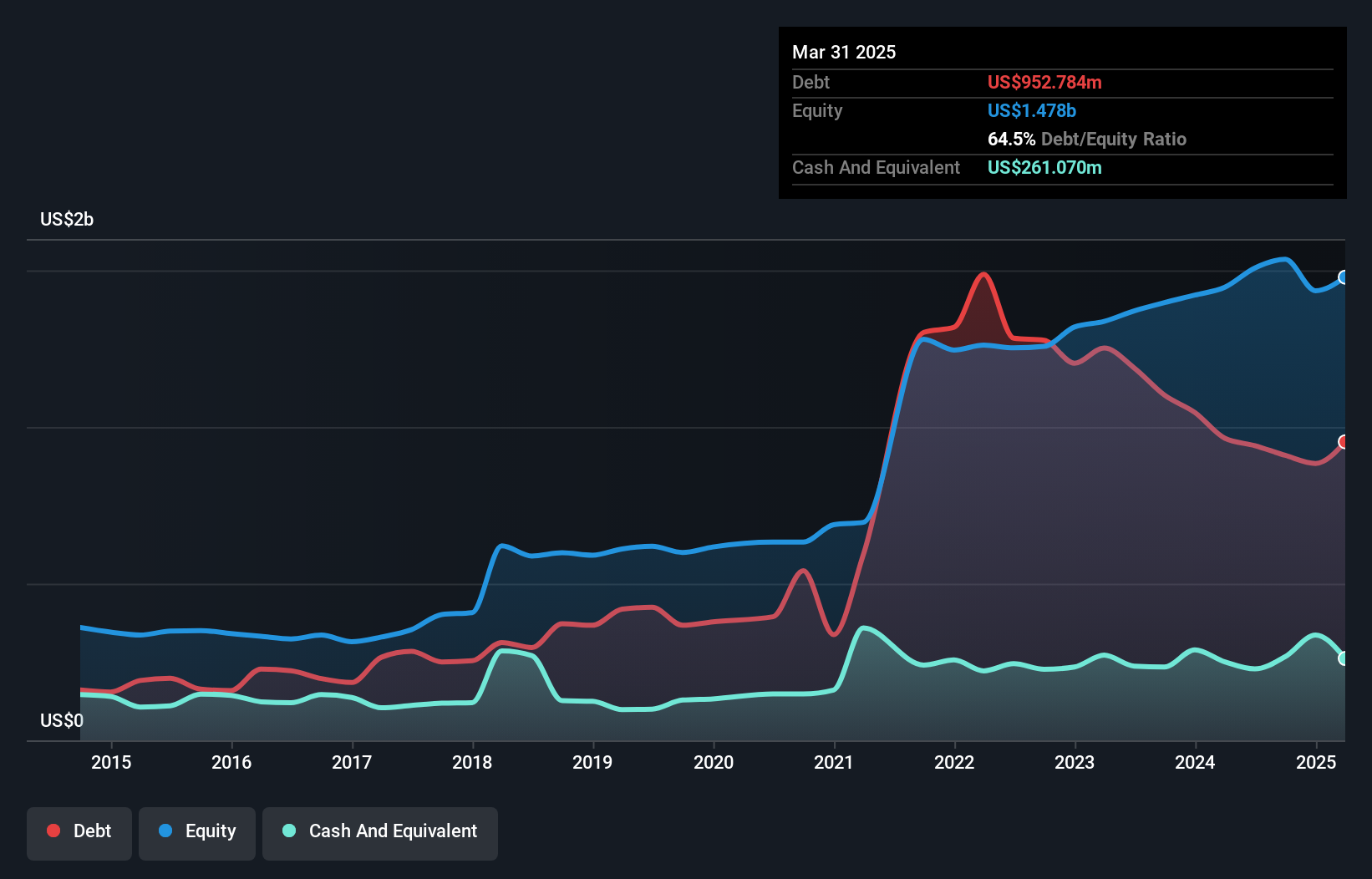

Overview: Dole plc is involved in the sourcing, processing, marketing, and distribution of fresh fruit and vegetables on a global scale, with a market capitalization of approximately $1.26 billion.

Operations: The company's revenue streams are primarily derived from Fresh Fruit at $3.22 billion and Diversified Fresh Produce in EMEA and Americas & ROW, totaling $5.27 billion.

Dole, a notable player in the food industry, has seen its earnings grow by 3.1% over the past year, outpacing the industry's 2.1% growth rate. Trading at 51.1% below estimated fair value suggests potential undervaluation compared to peers. However, with a net debt to equity ratio of 41.9%, debt levels are high despite interest payments being well-covered at 3.9 times by EBIT. Recent financials show a significant one-off gain of US$49 million impacting results for September 2024, highlighting non-recurring influences on profitability while maintaining strong cash flow performance amid these dynamics.

Knowles (NYSE:KN)

Simply Wall St Value Rating: ★★★★★☆

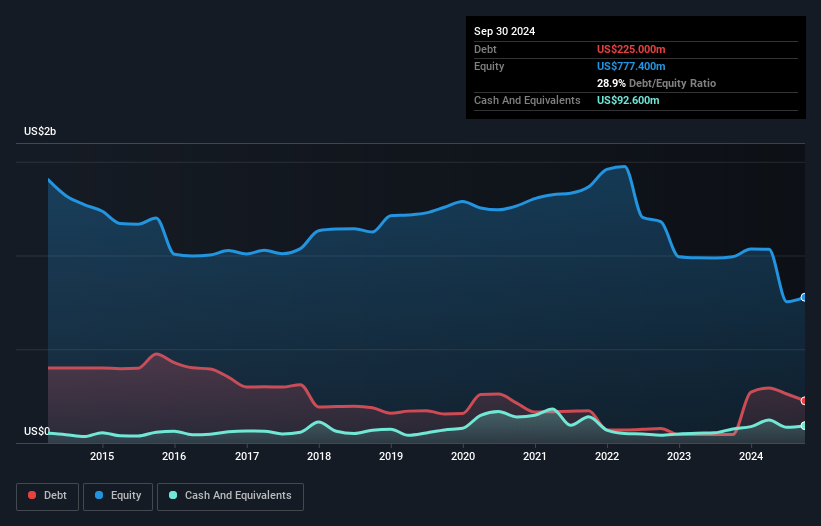

Overview: Knowles Corporation provides capacitors, RF filtering products, balanced armature speakers, micro-acoustic microphones, and audio solutions globally with a market cap of approximately $1.79 billion.

Operations: Knowles generates revenue primarily from its Precision Devices segment, contributing $296.90 million, and the Medtech & Specialty Audio segment with $247.90 million. The company shows a notable net profit margin trend over recent periods.

Knowles, a player in the audio tech space, has made strides with its profitability, now trading at 57.8% below estimated fair value. Over the past five years, its debt to equity ratio rose from 12.3% to 28.9%, yet remains satisfactory at 17%. Recent strategic moves include teaming up with Mimi Hearing Technologies for personalized audio solutions, showcasing innovation in true wireless stereo earbuds. Despite significant insider selling recently and a net loss of $256 million over nine months ending September 2024, Knowles' earnings are forecasted to grow by an impressive 77% annually.

- Click here and access our complete health analysis report to understand the dynamics of Knowles.

Examine Knowles' past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Gain an insight into the universe of 253 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knowles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KN

Knowles

Offers capacitors, radio frequency (RF) and microwave filters, balanced armature speakers, and medtech microphones in Asia, the United States, Europe, rest of Americas, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives