- United States

- /

- Food

- /

- NYSE:DOLE

How Dole plc (NYSE:DOLE) Stacks up on Growth, Competition and a Possible Risk Factor

Dole plc (NYSE:DOLE), recently entered the market as a newly formed entity, the result of the combination of Dole Food Company and Total Produce. As analysts are beginning to cover the stock, we may expect more traction from institutions and retail in the future. Since this is the beginning of their operation as a publicly traded entity, we will go over their business and fundamentals.

Check out our latest analysis for Dole

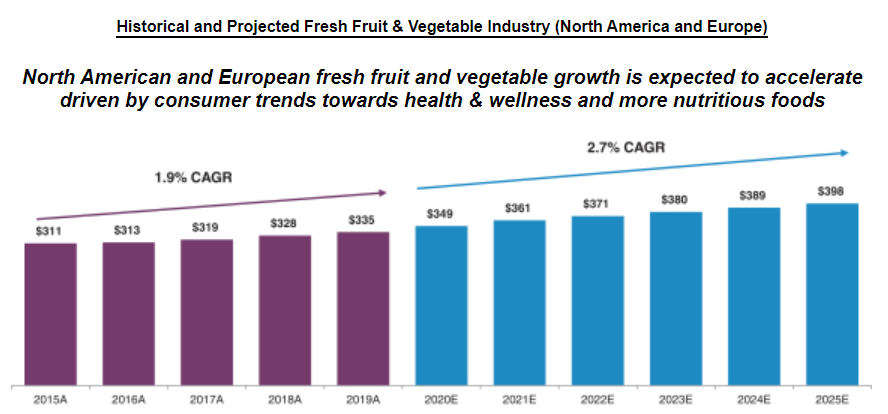

Dole plc will be re-organized by the following segments: Fresh Fruit, Fresh Vegetables, Diversified Fresh Produce. The company primarily operates in the North American and European Markets for fresh fruit and vegetables. The 2 markets have a combined size of US$335b and are expected to grow at an annualized rate of 2.7% from 2020 to 2025.

The business expects to capitalize on the interest in organic foods given increased focus on health and nutrition, and reference a higher growth in categories such as berries, avocados, organic produce, and Value Added Salads, with annualized growth rates of 7.9%, 7.1%, 10.6% and 8.4%, respectively, from 2018 to 2020.

Dole Plc has global competitors, but the US$9b revenue size of the newly combined business puts them in the #1 place in relation to competitors.

The most notable companies that compete against Dole are:

- Greenyard (ENXTBR:GREEN)

- Fresh Del Monte Produce (NYSE:FDP)

- Bonduelle (ENXTPA:BON)

When analyzing a company like Dole, it is always good to stack it against the performance of competitors, so that we have a better sense of how the market may react to the stock, and what is the level of expected performance.

Fundamentals Review

The chart below outlines the expected revenue level after the company files the first joint annual report. Remember, Dole went public as a combined entity of Dole Food Company and Total Produce. The projected revenue is US$9.5b for the full year of 2022.

The earnings of the company have historically hovered above 1%, and the last trailing twelve months yielded a 1.3% profit margin.

Unfortunately, except for the last 12 months, the free cash flows have been below statutory profits - this might be a point of caution since free cash flows do not match profits.

However, the joint entity is just starting and the value drivers for shareholders will include:

- Simplification of operations

- Successful merger integration

- Early expression of cost synergies - management manages to cut costs from for business expenses

- Economies of scale - the size of the entity should give them pricing power, and brand recognition

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares.

Key Takeaways

Dole recently entered the market, and with that come a host of risks and opportunities. For investors, it might be a great chance to keep watch of a stock in the not so popular agricultural industry.

The main value of the stock comes from the possibility of it being mispriced, rather than a high-growth opportunity.

One possible reason why investors are not jumping on the stock just yet, is the historical mismatch of free cash flows and profits.

For investors that found the stock underwhelming, there are a few alternatives that seem attractive in this industry.

So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Case in point: We've spotted 1 warning sign for Dole you should be aware of.

If you are no longer interested in Dole, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:DOLE

Dole

Engages in sourcing, processing, marketing, and distribution of fresh fruit and vegetables worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives