- United States

- /

- Food

- /

- NYSE:DOLE

Discovering Undiscovered Gems in the United States February 2025

Reviewed by Simply Wall St

In recent days, the United States market has experienced a slight dip of 2.2%, yet it remains robust with an impressive 18% growth over the past year and anticipated earnings growth of 14% annually in the coming years. In this dynamic environment, identifying stocks that are not only resilient but also poised for potential growth can uncover valuable opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Smart Share Global (NasdaqCM:EM)

Simply Wall St Value Rating: ★★★★★★

Overview: Smart Share Global Limited is a consumer tech company that offers mobile device charging services in China, with a market cap of $294.34 million.

Operations: Smart Share Global derives its revenue primarily from its rental and leasing segment, which generated CN¥1.96 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Smart Share Global, a small player in the market, recently turned profitable and is trading at 36.7% below its estimated fair value, presenting an intriguing opportunity. Over the past year, its earnings growth has outpaced the Specialty Retail industry by becoming profitable while maintaining high-quality earnings. Despite volatility in share price over recent months, it remains debt-free with no interest payment concerns. A proposed acquisition by Trustar Capital and others for approximately $130 million could further impact its trajectory; however, this deal is still subject to due diligence and definitive agreements before any conclusion can be drawn.

- Get an in-depth perspective on Smart Share Global's performance by reading our health report here.

Examine Smart Share Global's past performance report to understand how it has performed in the past.

Dole (NYSE:DOLE)

Simply Wall St Value Rating: ★★★★★☆

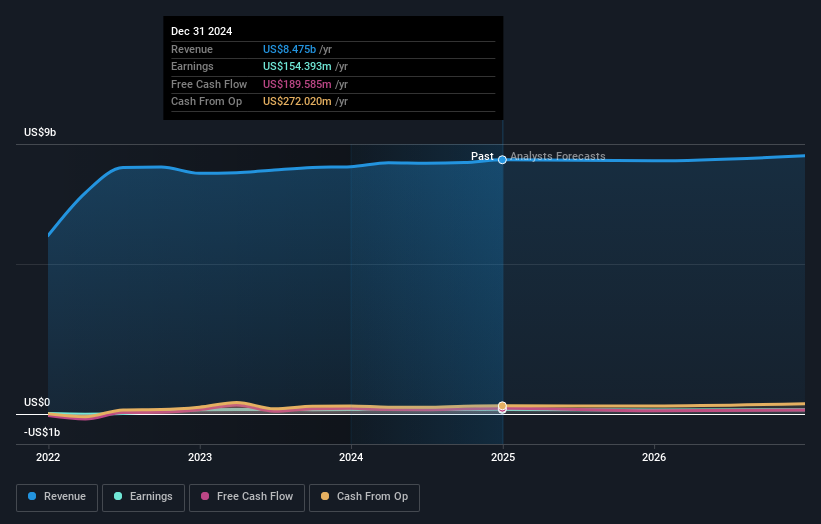

Overview: Dole plc operates globally in the sourcing, processing, marketing, and distribution of fresh fruit and vegetables, with a market capitalization of approximately $1.30 billion.

Operations: Dole generates revenue primarily from its Fresh Fruit segment at $3.22 billion and Diversified Fresh Produce in EMEA at $3.56 billion, with additional contributions from the Americas & ROW totaling $1.71 billion. The company's financial performance is characterized by a focus on these key segments to drive overall revenue growth and profitability.

Dole's recent financial performance reflects both opportunities and challenges. The company reported a 3.1% earnings growth over the past year, outpacing the food industry's 0.9%. A notable one-off gain of US$49M impacted its results, highlighting potential volatility in future earnings. Dole's debt-to-equity ratio has improved slightly from 61.2% to 59.2% over five years, yet remains high with a net debt-to-equity ratio of 41.9%. Despite trading at an attractive value—51% below fair estimate—the firm faces pressures from fleet expansion and dry docking costs that may squeeze profit margins moving forward, with analysts forecasting a modest revenue decline ahead.

Adams Natural Resources Fund (NYSE:PEO)

Simply Wall St Value Rating: ★★★★★☆

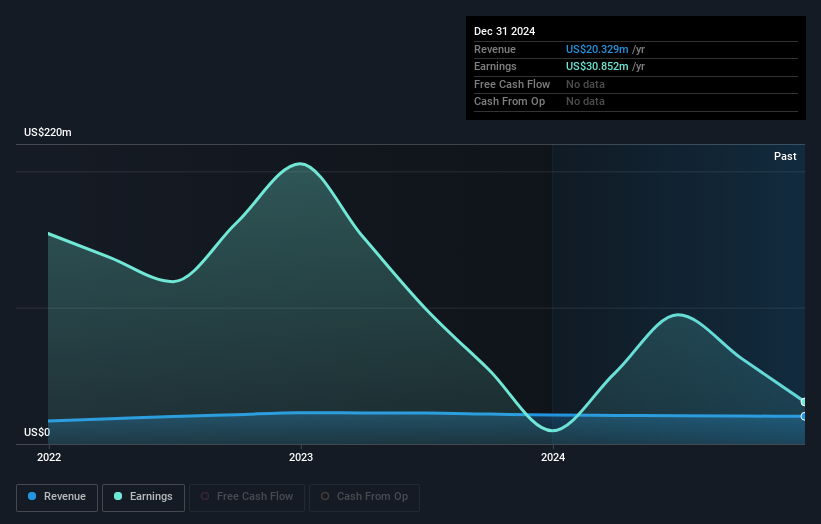

Overview: Adams Natural Resources Fund, Inc. is a publicly owned investment manager with a market capitalization of $576.02 million.

Operations: The fund generates revenue primarily through investment management activities. With a market capitalization of $576.02 million, it focuses on managing assets to drive financial returns for its stakeholders.

Adams Natural Resources Fund, a smaller player in the capital markets, has shown impressive financial strides recently. With earnings surging by 218% over the past year, it outpaced the industry average of 16.7%. This growth was partly influenced by a significant one-off gain of US$14.2 million impacting its annual results as of December 31, 2024. Trading at a substantial discount of approximately 59% below estimated fair value adds to its appeal. Despite these positives, future cash runway remains uncertain due to insufficient data on free cash flow trends. The company is debt-free and announced a dividend distribution for shareholders in early 2025.

- Click here to discover the nuances of Adams Natural Resources Fund with our detailed analytical health report.

Gain insights into Adams Natural Resources Fund's past trends and performance with our Past report.

Key Takeaways

- Delve into our full catalog of 285 US Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOLE

Dole

Engages in sourcing, processing, marketing, and distribution of fresh fruit and vegetables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives