- United States

- /

- Food

- /

- NYSE:DAR

Assessing Darling Ingredients (DAR) Valuation After Fresh Analyst Upgrades and Renewed Investor Optimism

Reviewed by Simply Wall St

Darling Ingredients (DAR) just caught a wave of bullish attention after TD Cowen upgraded the stock to Buy, with Jefferies and B of A Securities echoing upbeat views that are drawing fresh investor interest.

See our latest analysis for Darling Ingredients.

That bullish backdrop is arriving just as momentum starts to rebuild, with a roughly mid teens 3 month share price return off a weak base and a modest positive 1 year total shareholder return. This suggests sentiment is stabilising rather than roaring ahead.

If this kind of turnround story has your attention, it could be a good moment to explore other potentially mispriced names using Simply Wall St's fast growing stocks with high insider ownership.

With analysts seeing nearly 30 percent upside and our models hinting at an intrinsic value roughly double the current price, the key question now is clear: Is Darling Ingredients a genuine bargain, or is future growth already priced in?

Most Popular Narrative: 22.2% Undervalued

With the narrative fair value at 47 dollars versus the last close of 36 dollars and 55 cents, the valuation case leans clearly in favor of upside potential.

Policy changes favoring U.S.-sourced renewable diesel feedstocks (higher domestic fat prices, reduced foreign competition) and increasing U.S. biofuel mandates are expected to structurally expand demand and improve pricing power in Darling's Feed and Fuel segments, which should drive higher revenue and margin expansion through 2026 and beyond.

Curious how steady top line assumptions, big margin expansion, and a very different future earnings base can still point to this higher valuation? The narrative walks through the numbers, step by step, and reveals how those projections translate into today’s fair value.

Result: Fair Value of $47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainty around biofuel mandates and persistent margin pressure in renewable diesel could quickly undermine the upside implied by today’s valuation.

Find out about the key risks to this Darling Ingredients narrative.

Another Lens on Value

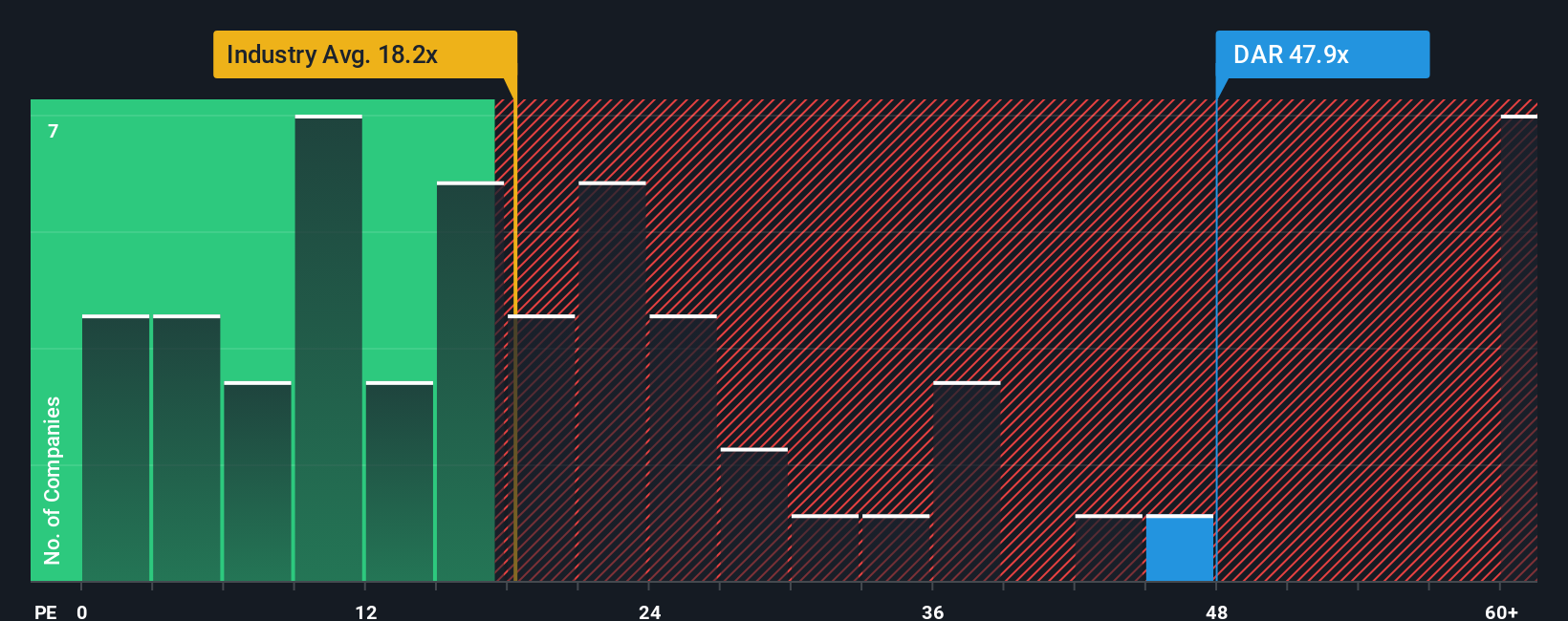

While our models point to a fair value near 47 dollars, the earnings multiple tells a tougher story. At about 53.6 times earnings, versus 20.5 times for the US Food industry and a fair ratio of 59.4 times, the stock already assumes a sharp profit rebound. Is that rebound realistic, or just hopeful?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Darling Ingredients Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view of Darling in minutes: Do it your way.

A great starting point for your Darling Ingredients research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity when you can rapidly scan fresh themes, spot patterns in the data, and upgrade your watchlist with high conviction candidates.

- Capture early stage potential by reviewing these 3571 penny stocks with strong financials that already pair promising narratives with real financial strength.

- Consider structural trends in automation and machine learning through these 26 AI penny stocks that align powerful technology tailwinds with solid fundamentals.

- Identify potential mispriced quality by targeting these 909 undervalued stocks based on cash flows that still trade below what their future cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAR

Darling Ingredients

Develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026