- United States

- /

- Food

- /

- NasdaqGS:CPB

Campbell Soup (NYSE:CPB) is an Interesting Stock for Yield-Oriented Contrarian Investors

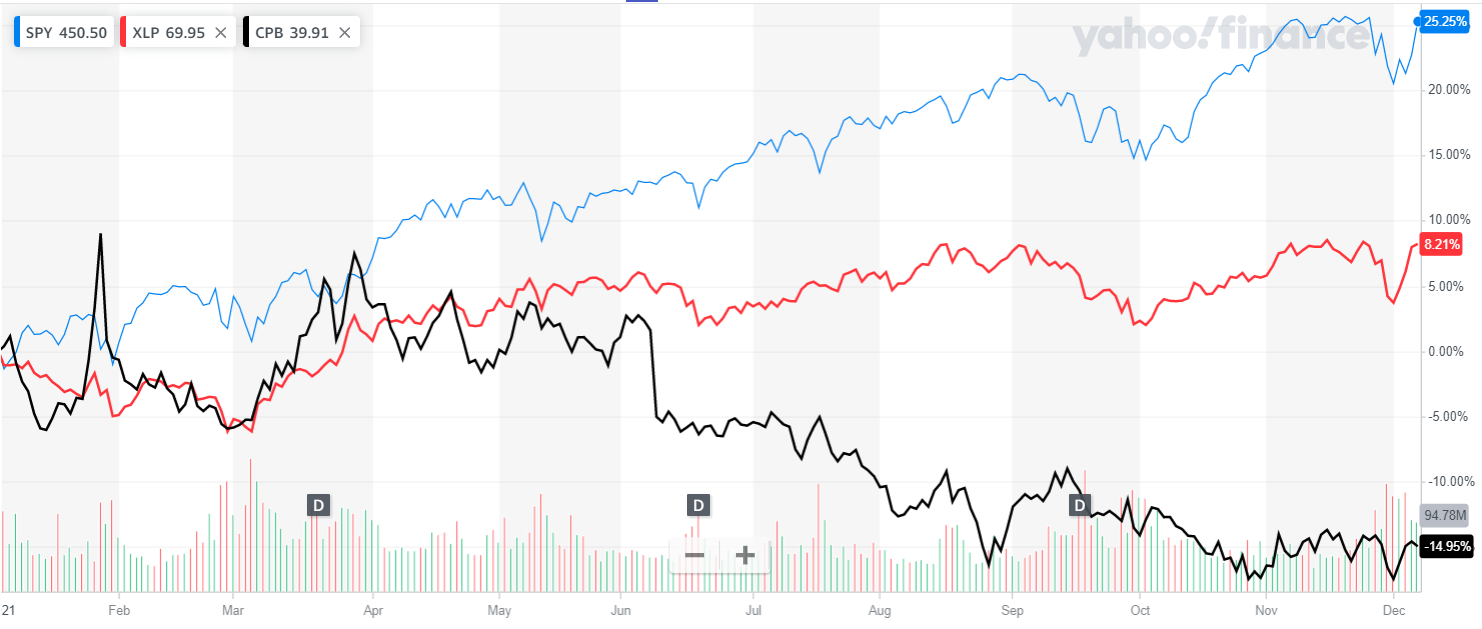

While the broad market rallied significantly in 2021, the consumer staples sector lagged despite the inflationary pressures, with stocks like Campbell Soup Company(NYSE: CPB)producing negative returns. Yet, the company is paying a high and reliable dividend while successfully reducing the debt over time.

View our latest analysis for Campbell Soup

Earnings results

- Non-GAAP EPS: US$0.089 (beat by US$0.08)

- GAAP EPS: US$0.86 (beat by US$0.05)

- Revenue: US$2.24b (miss by US$40m)

- FY Guidance reaffirmed at US$8.48b vs. consensus of US$8.44b.

CEO Mark Clouse pointed out that the company is addressing the labor challenges and improving productivity to maintain the full-year guidance.

The company recently declared a US$0.37/share dividend yield which will be paid on January 31 for shareholders on record January 6. With a 3.60% yield, the dividend is well above the industry average. Payments have been stable in the last 10 years, and the current payout ratio is at a very reasonable 44%.

Looking at the chart, we can see that the stock has underperformed the sector, which underperformed the broad market in 2021.

However, it is worth noting that the adjusted gross margin fell to 32.5% from 34.5%, mainly due to higher cost inflation, elevated marketing costs, and supply chain productivity improvements. Furthermore, another downside is the high concentration of top customers, which creates pressure to keep the prices low.

With the top 5 customers accounting for 46% of sales, Walmart (20% of net sales) will certainly leverage their volumes to keep the prices low because their branding depends on it. On the positive side, the company is producing returns on invested capital above the industry standards while also successfully reducing the debt by almost 20%.

What Is Campbell Soup's Net Debt?

As you can see below, Campbell Soup had US$5.04b of debt in August 2021, down from US$6.19b a year prior. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Campbell Soup's Balance Sheet?

The latest balance sheet data shows that Campbell Soup had liabilities of US$1.81b due within a year and liabilities of US$6.77b falling due after that. Offsetting these obligations, it had cash of US$69.0m as well as receivables valued at US$595.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$7.92b. Compared to the market cap of US$12.4b, this is rather significant.

To size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Campbell Soup has a net debt to EBITDA of 2.6, suggesting it uses a fair bit of leverage to boost returns. However, the consumer staples sector does tend to have a higher debt-to-equity ratio on average.

On the plus side, its EBIT was 7.7 times its interest expense, and its net debt to EBITDA was quite high, at 2.6. We note that Campbell Soup grew its EBIT by 25% in the last year, and that should make it easier to pay down debt from now on. There's no doubt that we learn most about debt from the balance sheet. But future earnings, more than anything will determine Campbell Soup's ability to maintain a healthy balance sheet going forward. So if you're focused on the future, you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Campbell Soup produced sturdy free cash flow equating to 68% of its EBIT, about what we'd expect. This cash means it can reduce its debt when it wants to.

Our View

While Campbell Soup produced a strong cash flow, it still carries a significant amount of liabilities. However, looking back, we can see that the debt peaked in 2018 at US$9.89b, and it has been declining quickly. In fact, it has almost halved in the last 2 years, pointing out that the company is on track with better managing its balance sheet.

The balance sheet is the obvious place to start when analyzing debt levels. But ultimately, every company can contain risks outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Campbell Soup you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives