- United States

- /

- Food

- /

- NYSE:CAG

Is There Now an Opportunity in Conagra After Recent Price Slide?

Reviewed by Bailey Pemberton

Thinking about what to do with Conagra Brands stock? You’re definitely not alone. Whether you’re eyeing your pantry or your portfolio, the company’s performance lately has sparked quite a debate among investors. Over the past year, the stock has slipped by 35.1%, and it’s down nearly 33% year to date. Even looking further back, the five-year return has lagged behind expectations, sitting at -39.6%. These declines have raised questions, but they’ve also opened up opportunities, especially as the broader packaged food sector faces a mix of shifting consumer trends and cost pressures.

But here’s where things get interesting: despite the rough ride, Conagra Brands earns a value score of 5 out of 6 based on six key valuation checks. That means analysts see it as undervalued in almost all the ways that count. It’s a strong signal for bargain hunters or anyone wondering whether the recent negativity is mostly priced in. As we dig into what’s driving these numbers and how the market’s shifting risk perception might affect your next move, we’ll break down each valuation approach. Stick around, because at the end, I’ll share the smartest way to truly gauge if Conagra offers real value right now.

Why Conagra Brands is lagging behind its peers

Approach 1: Conagra Brands Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation tool that estimates the value of a company by projecting its future cash flows and discounting them back to their present value. In simple terms, it takes what Conagra Brands is expected to earn in the coming years, adjusts those figures for risk and time, and assesses what that is worth in today’s dollars.

For Conagra Brands, analysts estimate the company generated $1.17 billion in free cash flow over the past twelve months. Looking ahead, projections suggest incremental annual growth, with free cash flow expected to reach $1.29 billion by 2029. Most projections for the next five years are based on direct analyst forecasts, but estimates beyond that are calculated by Simply Wall St with gradual growth assumptions.

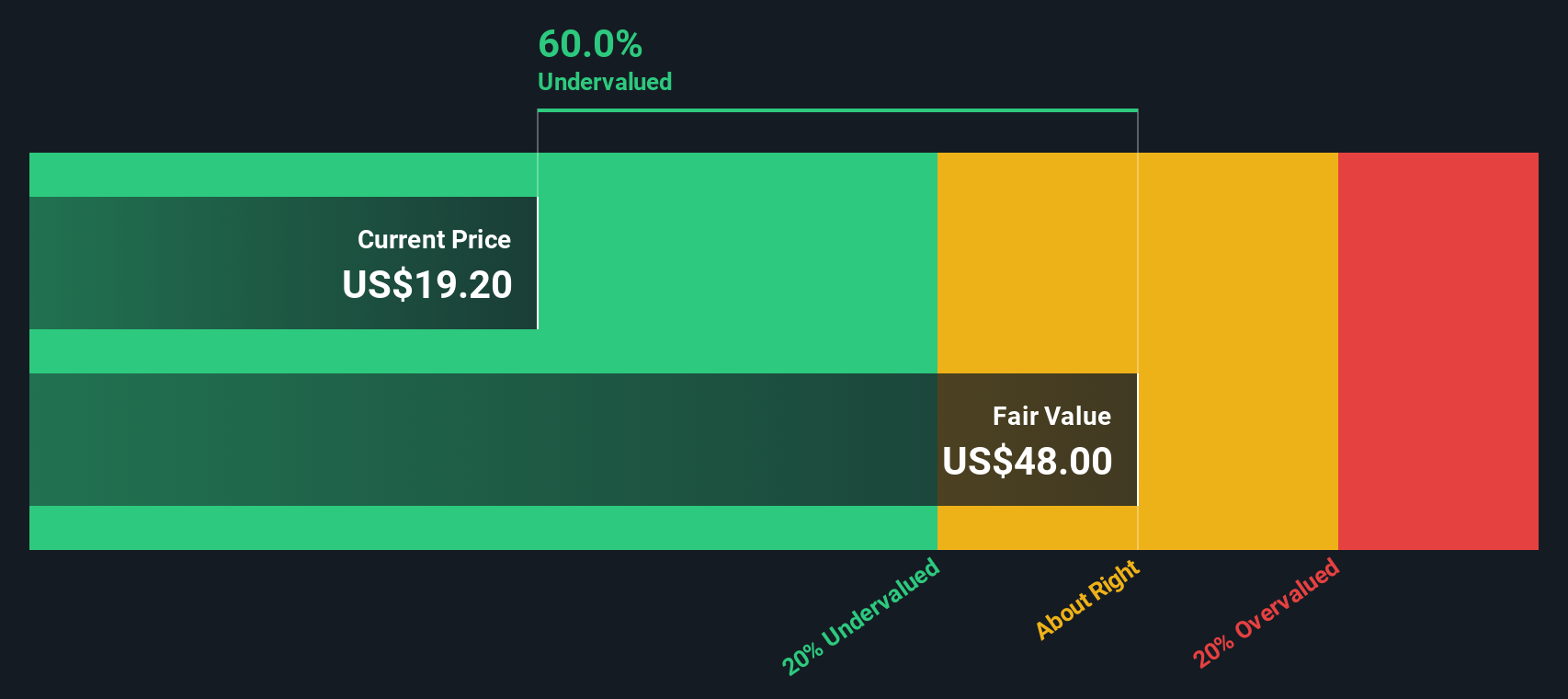

When all of these future cash flows are tallied up and discounted, the resulting intrinsic value per share comes to $78.13. Compared to the current trading price, this implies the stock is trading at a 76.2% discount. This suggests that, based on traditional cash flow fundamentals, Conagra Brands is substantially undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Conagra Brands is undervalued by 76.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Conagra Brands Price vs Earnings

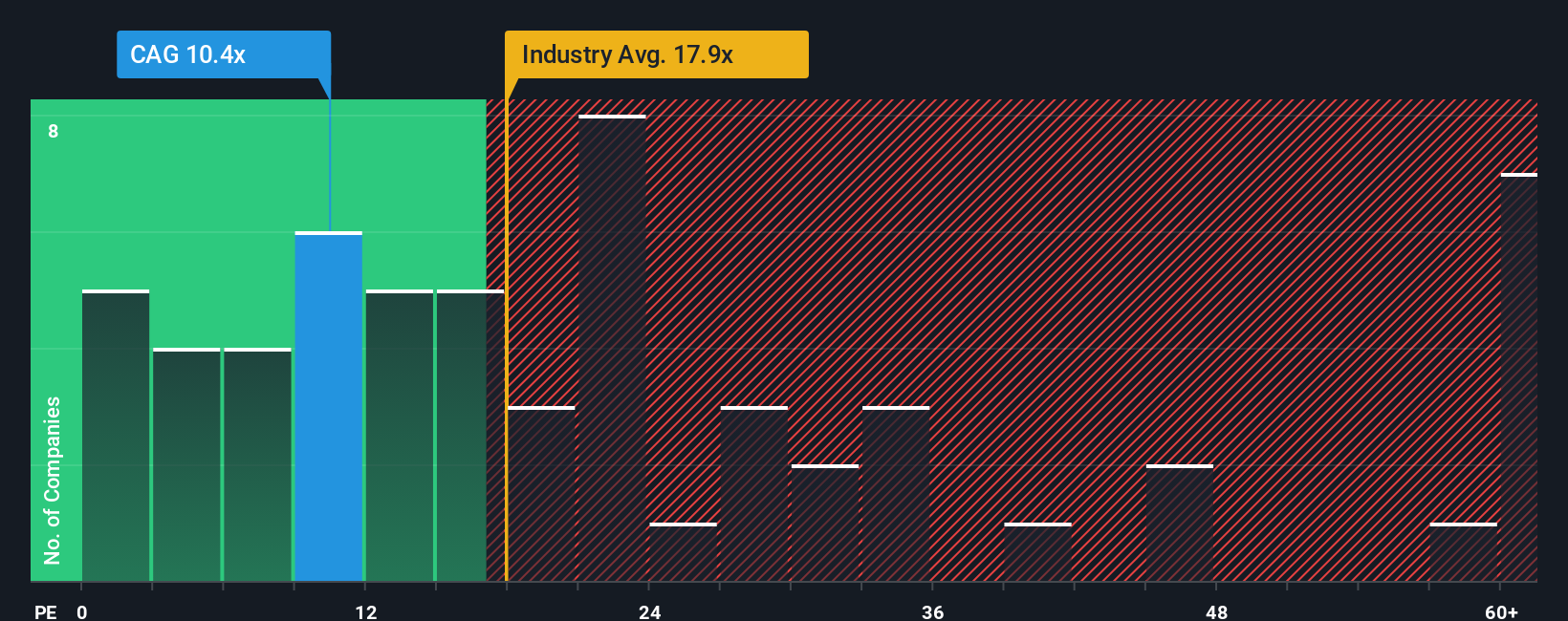

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Conagra Brands. It compares the company’s current share price to its earnings per share. A lower PE can indicate a stock is undervalued, while a higher one might reflect anticipated growth or lower perceived risk. When determining whether a PE ratio is “fair,” investors consider factors such as the company’s expected earnings growth, risk profile, and how these compare to the broader market and industry peers.

Currently, Conagra Brands trades at a PE ratio of 10.44x. For comparison, the average PE among its food industry peers is 15.96x, while the broader industry average is 17.87x. At first glance, this discount might lead investors to believe the stock is a clear bargain relative to competitors.

However, Simply Wall St’s proprietary “Fair Ratio” offers deeper insight. This fair PE ratio is calculated based on Conagra’s earnings growth, risk, profit margins, industry positioning, and size and is currently 17.07x. Unlike simple peer or industry comparisons, the Fair Ratio accounts for a comprehensive set of factors impacting what the PE should be for a company like Conagra, making it a much more tailored benchmark.

Comparing this Fair Ratio (17.07x) with the current PE (10.44x), Conagra Brands appears notably undervalued in the market. The company is trading well below the multiple investors would typically expect, given its fundamental outlook and characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Conagra Brands Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, yet powerful tool that lets you connect a company’s story—your beliefs about its prospects, challenges, and catalysts—to the hard numbers that drive fair value estimates, like future revenue, earnings, and profit margins.

Instead of relying solely on static ratios or broad market comparisons, Narratives help you translate your perspective on Conagra Brands into financial forecasts, showing how your assumptions stack up against current market prices. This approach bridges the gap between what’s happening in the real world and how much the stock should be worth. It is a process that feels intuitive rather than intimidating.

On Simply Wall St’s Community page, Narratives are easy to create and update, empowering millions of investors to capture their own views and see how their fair values compare with others’. Narratives aren’t static; they adjust as soon as new events, news, or earnings emerge, helping you stay on top of changes that really matter.

For example, one investor might believe Conagra’s strong supply chains and productivity gains will deliver future success and set a fair value at $26. Another, more cautious investor could focus on rising costs and weak demand, arriving at a fair value of $18. Narratives let you see, compare, and act confidently on these contrasting viewpoints.

Do you think there's more to the story for Conagra Brands? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAG

Conagra Brands

Operates as a consumer packaged goods food company primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives