- United States

- /

- Food

- /

- NYSE:CAG

Does Conagra Offer Opportunity After 32% Stock Drop and Recent Earnings Report?

Reviewed by Bailey Pemberton

If you’re considering what to do with Conagra Brands stock, you’re not alone. Investors are watching this food giant closely, weighing whether its recent price drop signals a new bargain or trouble ahead. Over the past year, Conagra’s shares have slipped significantly, down about 32% year-to-date and nearly 39% over five years. Even in just the past month, the stock fell almost 4%. These declines partially reflect changing investor attitudes toward consumer staples stocks as interest rates and market sentiment shift, putting pressure on companies like Conagra Brands. But does this mean Conagra is now undervalued and due for a rebound, or are there deeper issues at play?

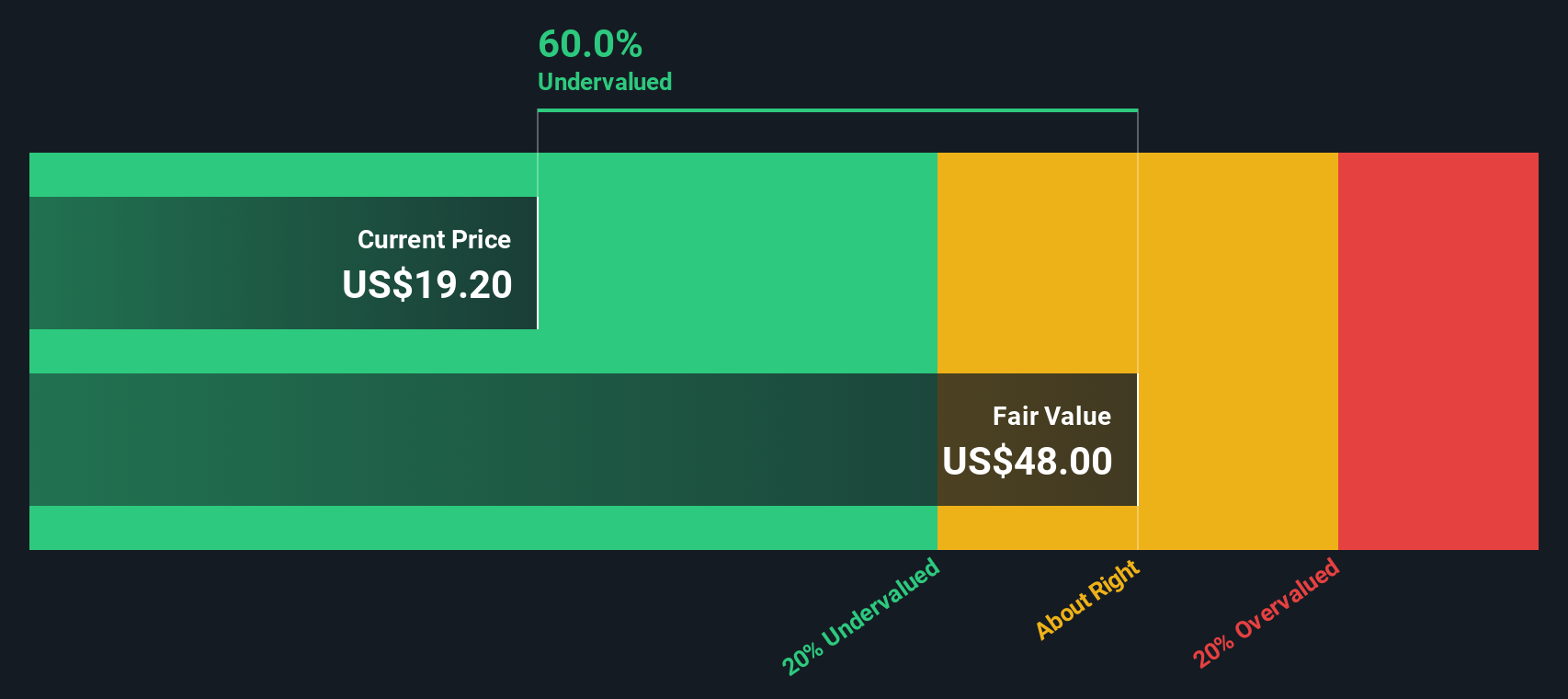

That is where valuation comes in. Analysts use a combination of checks to figure out if a stock is priced well compared to its fundamentals, and Conagra passes 5 out of 6 of these, earning it a strong value score of 5. That is the kind of signal that makes value-focused investors take a closer look, even as others may be wary after a period of weak performance.

Let’s dig into the main valuation methods experts use, each giving us a different perspective on whether Conagra is truly a bargain right now. Stick around to the end, though, because there is an even smarter way to look at company value that could help you see the bigger picture.

Why Conagra Brands is lagging behind its peers

Approach 1: Conagra Brands Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model takes the company’s expected future free cash flows, projects them out over several years, and then discounts those cash flows back to today’s value. This gives investors an estimate of what the company is truly worth right now, based on its ability to generate cash in the future.

For Conagra Brands, analysts estimate its last twelve months’ free cash flow at approximately $1.17 billion. Projections indicate this figure could grow steadily, with estimates for 2029 reaching about $1.29 billion. Beyond the next five years, these projections are extrapolated by Simply Wall St using modest growth rates and extend the company’s cash flow outlook to a full decade.

Based on these detailed projections, the DCF model calculates an intrinsic value of $78.13 per share. When compared to the current share price, this suggests the stock is trading at a significant 76.1% discount. In other words, Conagra Brands appears substantially undervalued, which could indicate considerable upside potential if these cash flow estimates are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Conagra Brands is undervalued by 76.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Conagra Brands Price vs Earnings

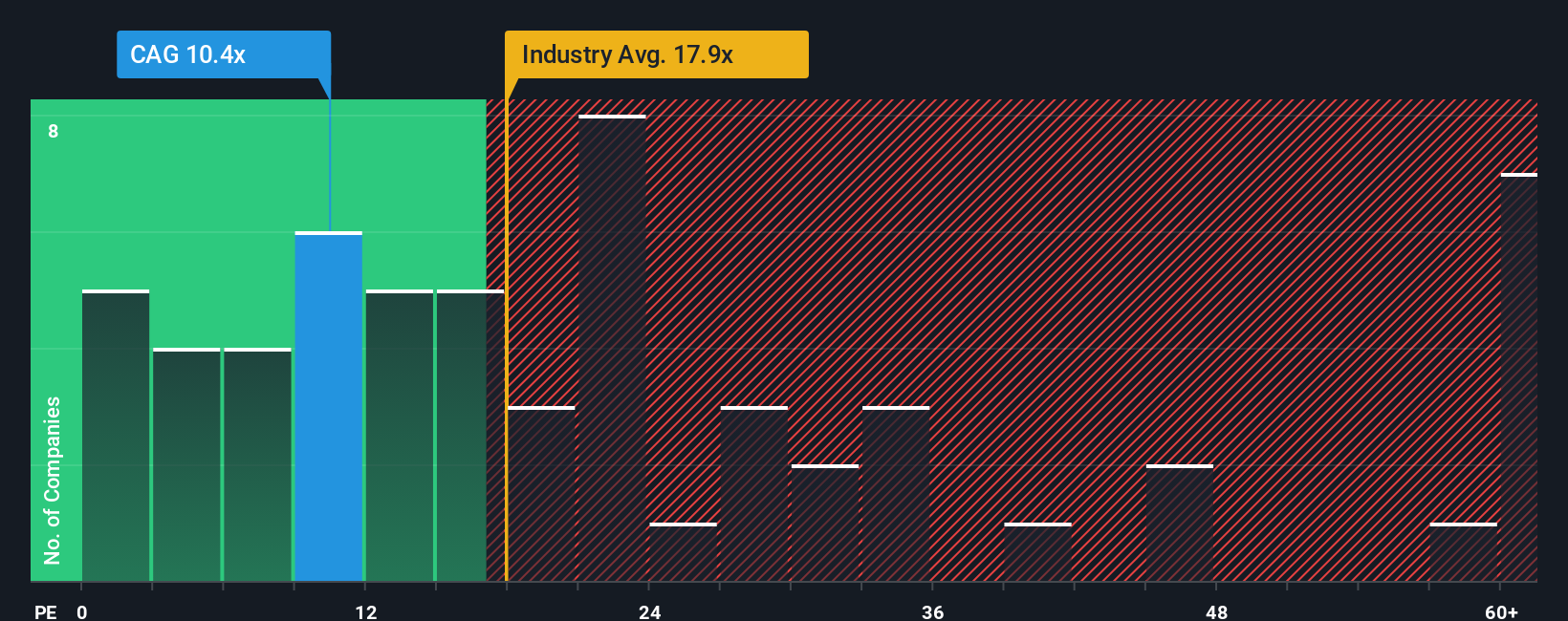

The Price-to-Earnings (PE) ratio is a favored valuation metric for established, profitable companies like Conagra Brands because it directly links the stock price to earnings power. A company with stable profits and a long history of generating cash flow gives investors a reliable base to assess value using the PE ratio.

What determines a “normal” or “fair” PE ratio? Growth expectations play a big part, as companies anticipated to grow earn higher multiples, while those facing more risk or slower outlooks trade lower. Industry norms and peer company valuations also help set expectations, but these may not fully account for a company’s unique growth opportunities or risk profile.

Right now, Conagra Brands trades at a PE ratio of 10.53x. That is noticeably lower than both the average of its food industry peers at 15.81x and the broader industry average of 17.73x. While this might catch the eye of value hunters, it leaves open the question of whether this discount is justified.

That is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio is more than just an average, as it folds in factors like Conagra’s earnings growth outlook, profit margins, size, industry, and company-specific risks. It is a tailored measure meant to reflect what is a genuinely fair price for this particular stock in today’s market. In this case, the Fair Ratio for Conagra Brands is 17.13x, well above its current multiple.

Since Conagra’s PE (10.53x) is substantially below its Fair Ratio (17.13x), the numbers suggest the stock is undervalued at present relative to its full earnings potential and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Conagra Brands Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply the story you tell about a company—your expectations about how it will perform, where it is headed, and what you think it is truly worth. Narratives link your personal perspective on the company to real financial forecasts and a fair value estimate, so you can back up your investment decisions with both data and context.

On Simply Wall St’s Community page, Narratives are a straightforward tool used by millions of investors to capture these stories and check whether the stock price matches their own fair value view. By comparing each Narrative’s fair value to the current price, you get a clear signal on whether Conagra Brands may be viewed as a buy, sell, or hold based on the story you believe in. Additionally, Narratives update automatically when fresh news or quarterly results are announced, which means your viewpoint is always based on the latest information.

For example, on Conagra Brands, bullish investors might see stabilized supply chains and strong demand as drivers for a fair value as high as $26.00 per share. More cautious investors might focus on margin risks and forecast as low as $18.00 per share. Narratives let you instantly spot and compare these differences so you can make an informed call.

Do you think there's more to the story for Conagra Brands? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAG

Conagra Brands

Operates as a consumer packaged goods food company primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives